Formidable Assets And Liabilities Explained

Examples of assets are buildings equipment inventory and cash.

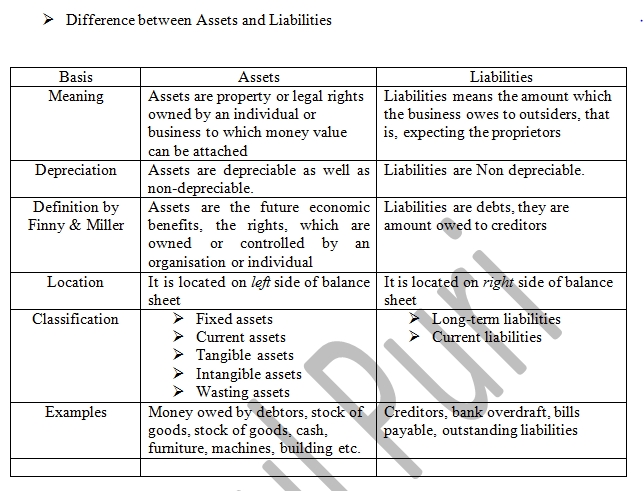

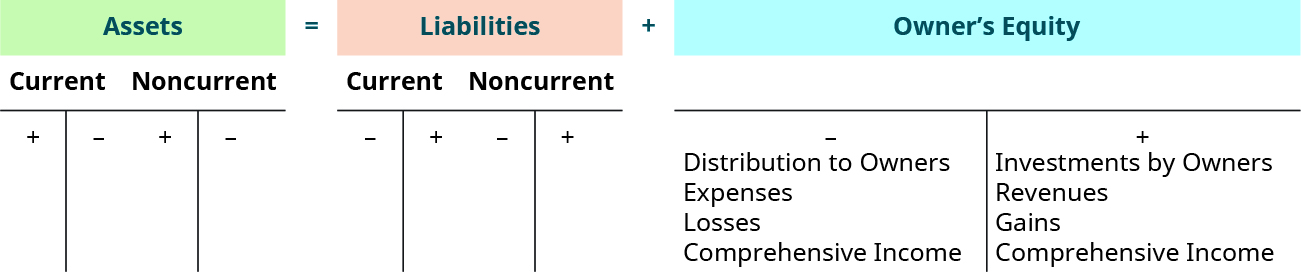

Assets and liabilities explained. Assets are such items that economically benefit a company. Once you understand how the terms assets and liabilities are used in business you can use that knowledge to your benefit in. Assets and liabilities are two sides of the same coin known as financial accounting.

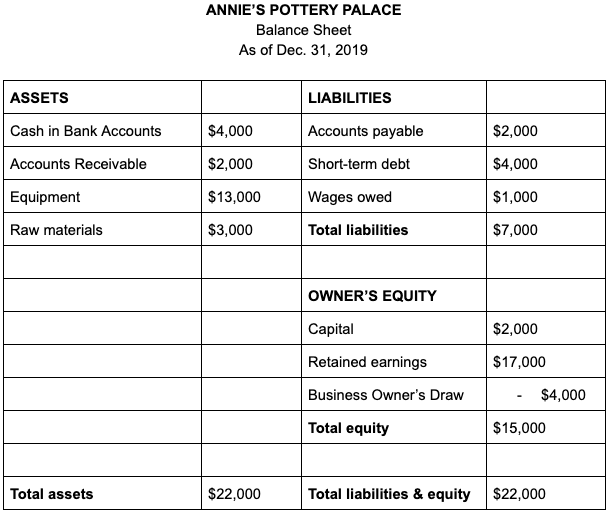

In other words it is a snapshot or statement of financial position on a specific date. Liabilities What does it mean. Lets revisit the Rich Dad simple definition of an asset and a liability.

In simple words Liability. No business can continue to survive without the creation of assets. Liabilities include items like monthly lease payments on real estate and bills owed to keep the lights turned on and the water running.

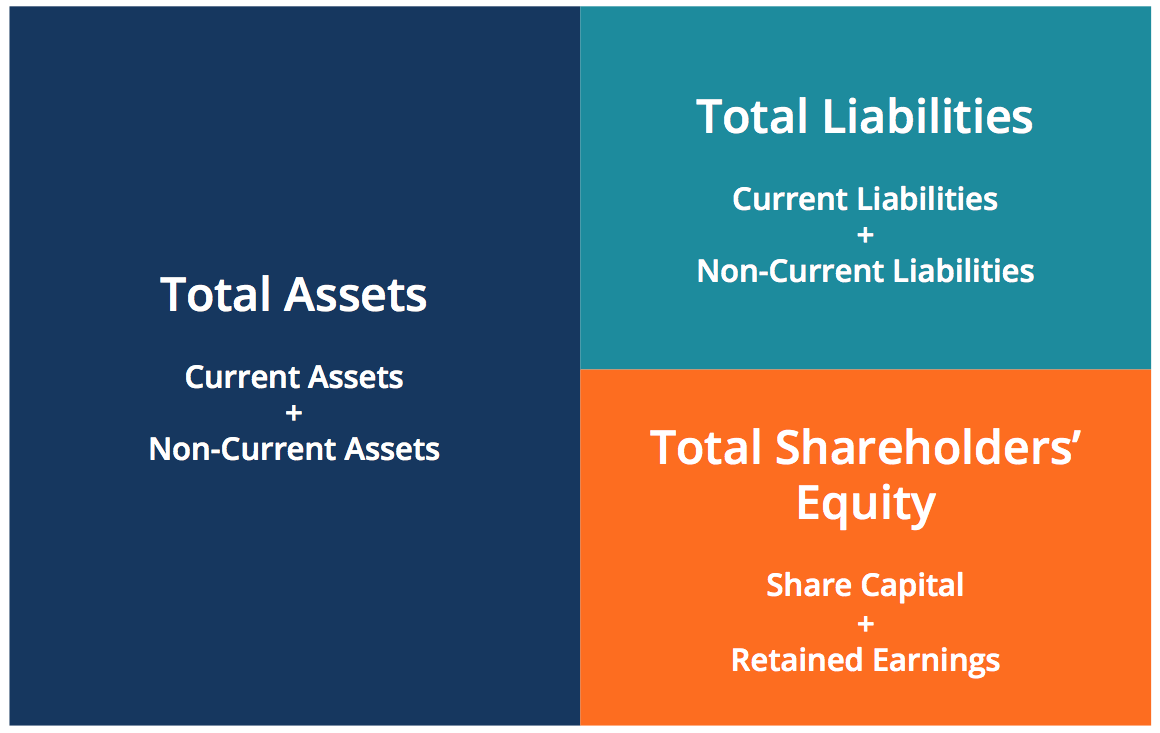

Assets and liabilities are two major aspects of a business and a measure of its long-term viability. What are Assets and Liabilities. In this article we explain the meaning of assets and liabilities give examples of each and share how companies use these figures on a balance sheet to calculate the total value or equity of a business.

An asset is something that puts money in your pocket and a liability is something that takes money out of your pocket. The assets that are needed impact their return-on-capital calculations. They are the opposite of assets.

However equity can be classified into different components. The words asset and liability are two very common words in accountingbookkeeping. The amount of equity therefore depends on the measurement of assets and liabilities.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)