Out Of This World Calculate Leverage Ratio From Balance Sheet

If the ratio you get after calculating your debt-to-capital ratio is more than 1 this means your companys debt exceeds its capital.

Calculate leverage ratio from balance sheet. The leverage ratio defines exposures the denominator as the total of a banks. Financial ratios are the most well-known and widely used of financial analysis tools. 14 rows Calculate Balance Sheet Ratios With the balance sheet and income statement.

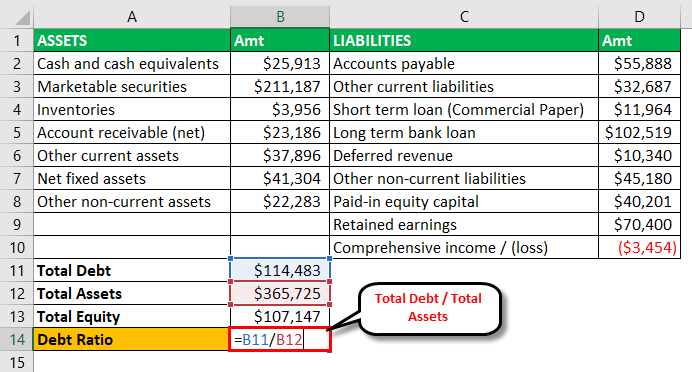

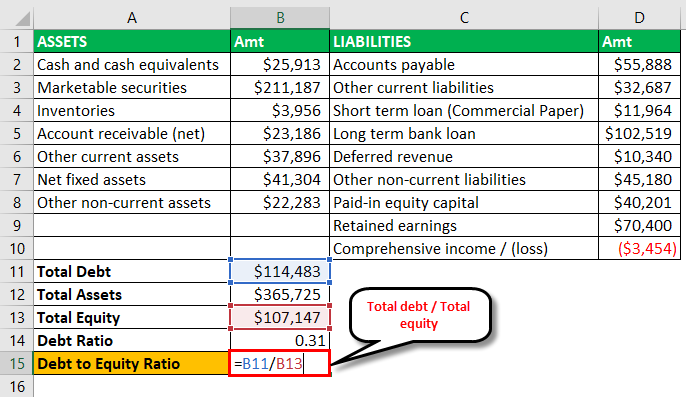

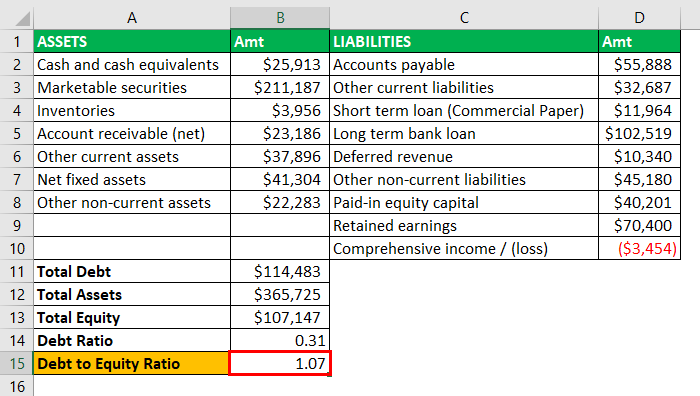

Debt to Equity Ratio in Practice. On-balance sheet assets including on-balance sheet collateral for derivatives and securities finance transactions not included in items ii-iii below. Debt-to-Assets Ratio Total Debt Total Assets Debt-to-Equity Ratio Total Debt Total Equity Debt-to-Capital Ratio Today Debt Total Debt Total Equity.

Derivative exposures comprising underlying derivative contracts and counterparty credit risk CCR. Coverage ratios focus instead on the income statement and cash flows and measure a companys ability to cover its debt-related payments. Below are 5 of the most commonly used leverage ratios.

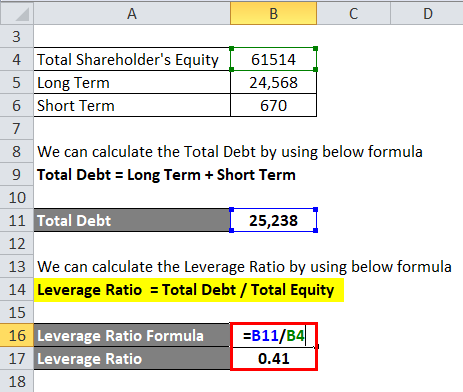

Consumer leverage ratio Total household debt Disposable personal income textConsumer leverage ratio fractextTotal household debttextDisposable personal income Consumer. Balance Sheet Leverage Ratio means i the aggregate amount of Indebtedness of the Borrower including but not limited to the aggregate amount of outstanding Letters of Credit minus any and all Indebtedness of the Borrower subordinate to the Obligations if any divided by ii the Borrowers Tangible Capital Funds all calculated on a consolidated basis. The information in your Balance Sheet and Income Statement can be used to calculate financial ratios.

Operating leverage ratio measures the ratio of a business contribution margin to its net operating income. Debt to Equity Ratio Total Debt Shareholders Equity. If as per the balance sheet Balance Sheet The balance sheet is one.

Divide the companys debt by its equity. The result is the leverage ratio. Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity.

:max_bytes(150000):strip_icc()/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)