Casual Ratio Analysis Comparison Between Two Companies

Because their investment in fixed asset is more as compare to angroProduction is also increase due to more investment.

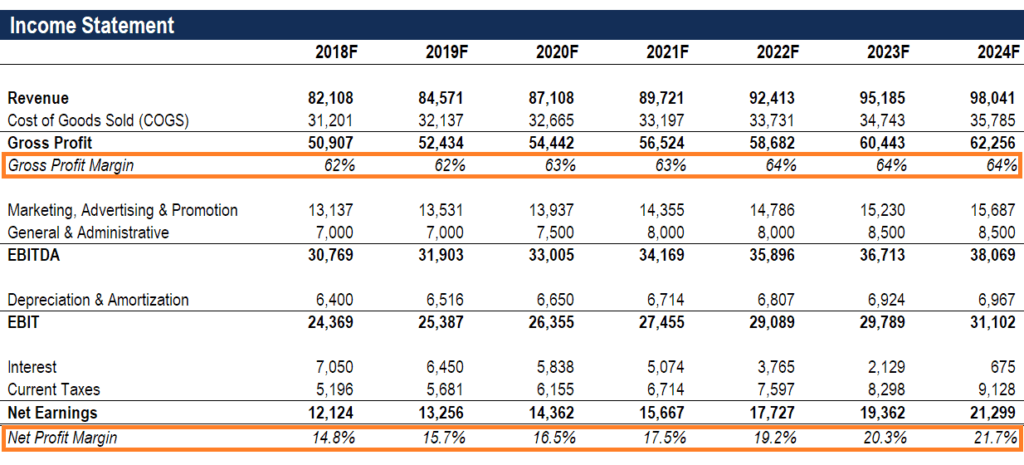

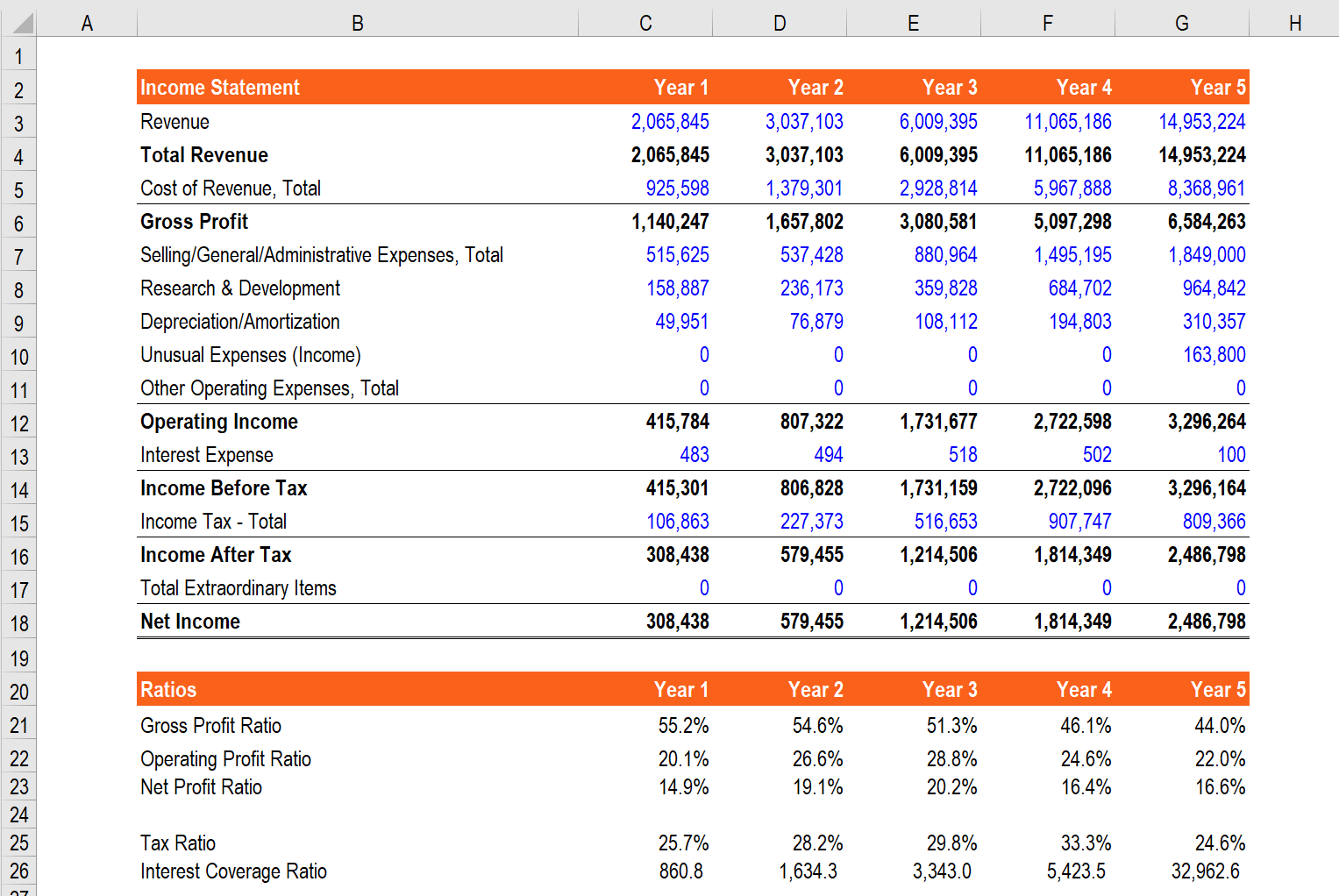

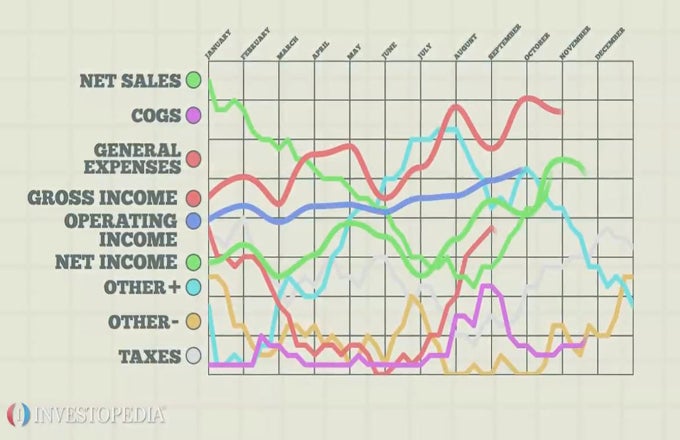

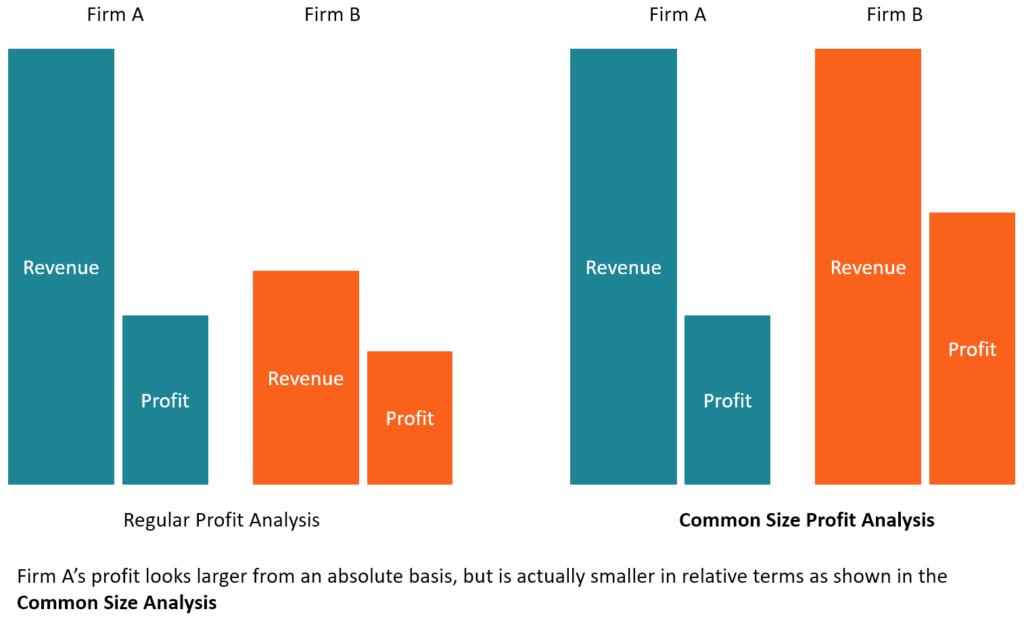

Ratio analysis comparison between two companies. ANALYSIS OF INCOME STATEMENT OF NESTLE AND ENGRO We have made analysis between engro and nestle companies here we analyze that sales of nestle 64824 364 is more as compare to engro29859226. Liquidity ratio is conveying the ability to repay. Ratio analysis is used to evaluate relationships among financial statement items.

Financial ratio analysis helps us to understand how profitable a business is if it has enough money to pay debts and we can even tell whether its shareholders could be happy or not. Although it may be somewhat unfamiliar to you financial ratio analysis is neither sophisticated nor complicated. Ratio analysis simplifies the process of comparing the financial statements of.

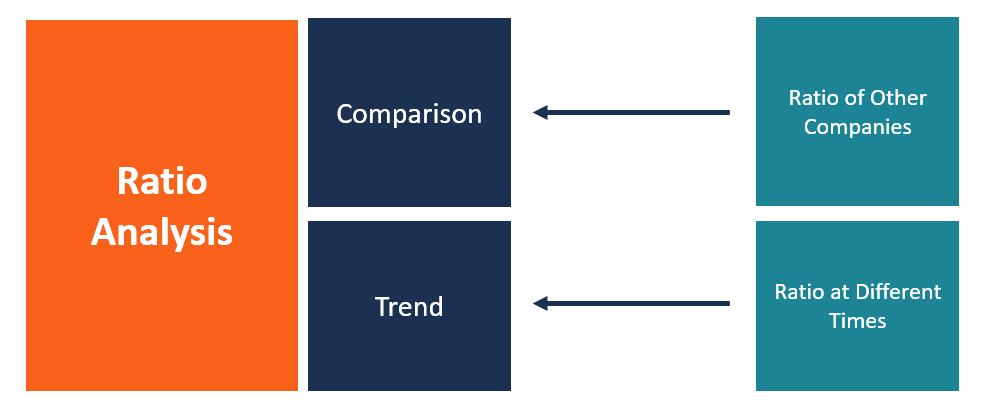

Ratios help link the three financial statements together and offer figures that are comparable between companies and across industries and sectors. The mathematical calculation was establish for ratio analysis between two companies from 2007-2008It is most important factors for performance evaluation. Objectives of Ratio Analysis Standardize financial information for comparisons Evaluate current operations Compare performance with past performance Compare performance against other firms or industry standards Study the efficiency.

As what we can see above is that WONG ENGINEERING CORPORATION BERHAD WECB has better network and better income compared to TIME ENGINEERING BERHAD TEB. Acid test ratio The quick ratio also behalf like the current ratio. Financial statement ratio analysis focuses on three key aspects of a.

Ratio analysis can mark how. Between a single company and its industry average. 1096 7296 015 Return on Equity ROE One of the most important profitability metrics is return on equity.

A ratio you will remember from grammar school is the relationship between two numbers. Both of these companies are in the engineering field. The ratios are used to identify trends over time for one company or to compare two or more companies at one point in time.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)