Nice Accounts Receivable Turnover Analysis Sample Balance Sheet With Intangible Assets

Annual balance sheet by MarketWatch.

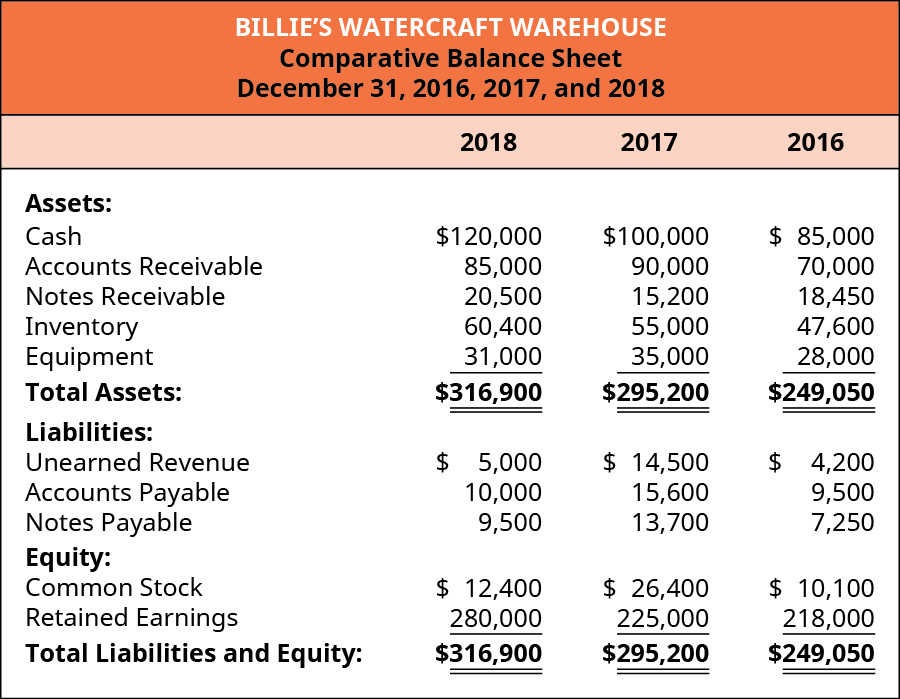

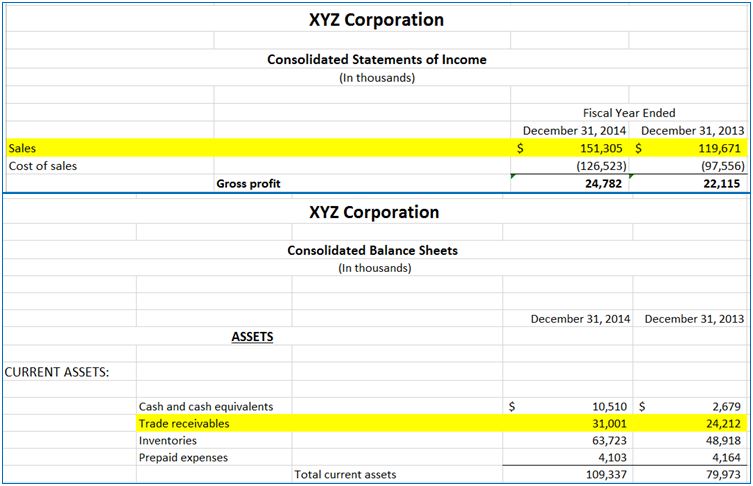

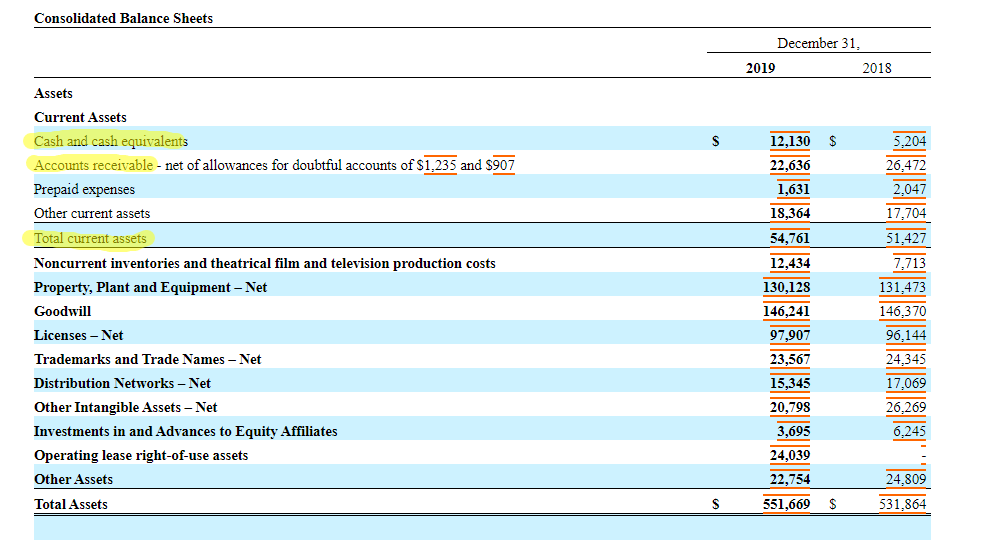

Accounts receivable turnover analysis sample balance sheet with intangible assets. View all FB assets cash debt liabilities shareholder equity and investments. 2020 2019 2018 2017 2016 5-year trend. B while C is also a form of vertical analysis Statement C is false because Prepaid Expenses decreased from 2013 to.

Balance Sheet - Two-Year Comparison Assets Cash Equivalents Trade Accounts Receivable Inventory Other Current Assets Total Current Assets Long-Term Investments. ST Debt Current Portion LT Debt. Balance sheet projections exercise.

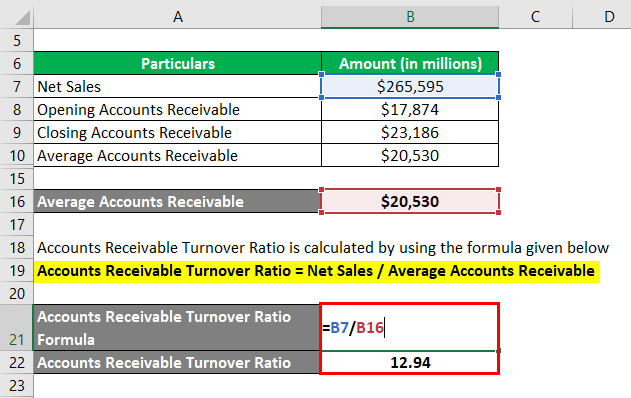

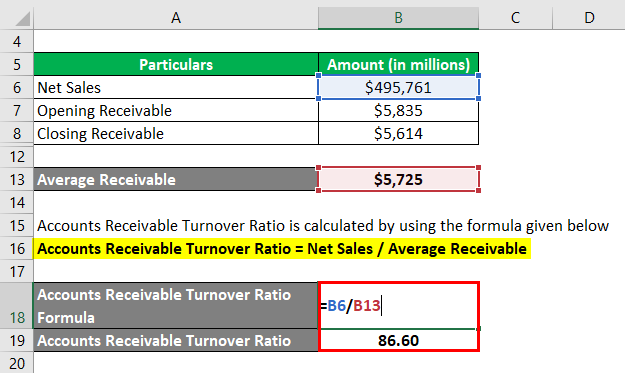

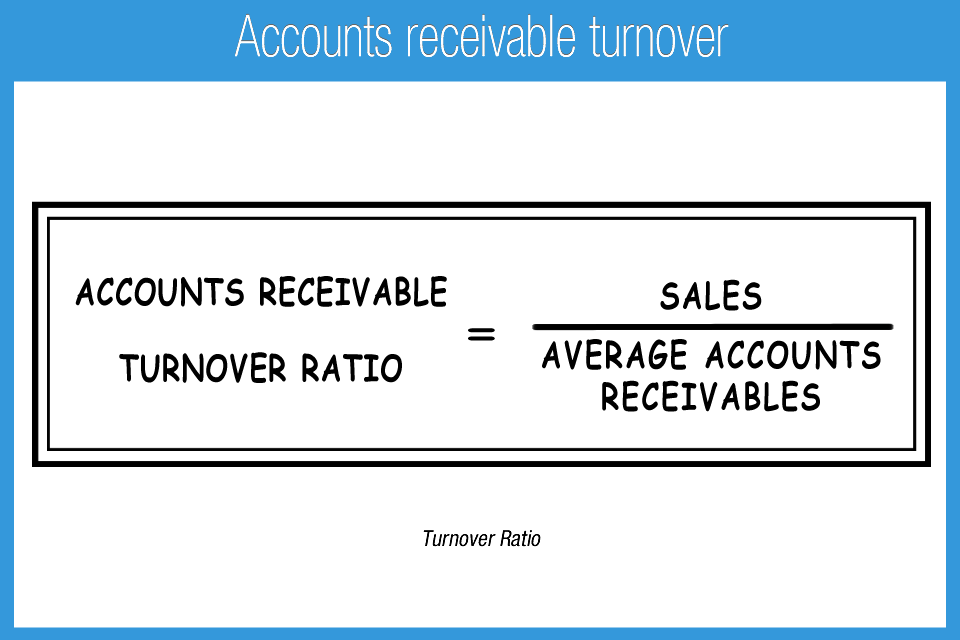

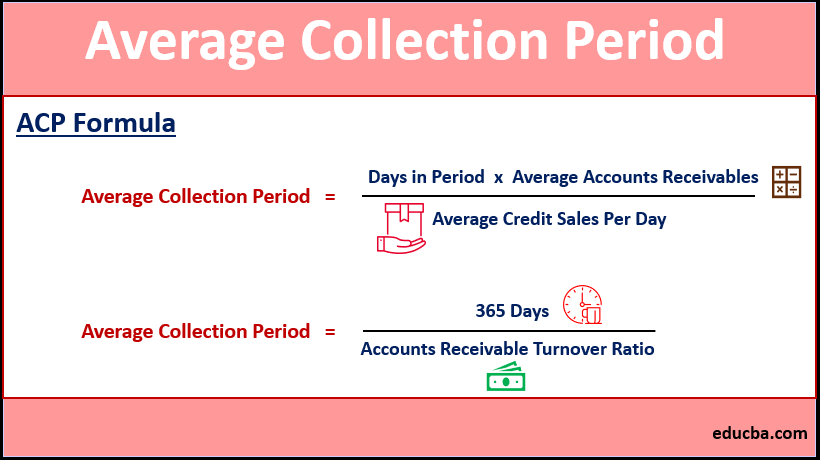

A balance sheet helps in the financial analysis because most of the financial ratios are calculated based on the balance sheet. Standard analyses focus on the sizes sources and aging of accounts as well as the extent to which the accounts receivables are actively managed and diversified. Accounts Receivable Turnover Days Sales in Receivables Inventory Turnover.

All of the above Answer. Get the PDF book here. It refers to the amount external customers have to pay to the company.

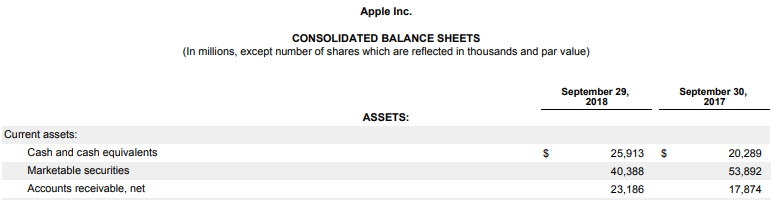

To calculate asset turnover take the total revenue and divide it by the average assets for the period studied. Imagine that we are tasked with building a 3-statement statement model for Apple. The credit sales are converted into customers accounts that are accounts receivable.

17 increase in Prepaid Expenses. Even an aspiring chartered accountant or those reaching for the CPA Australia can benefit. Cash as 950 of total assets.