Formidable Adjusted Income Statement Sole Trader Balance Sheet Format

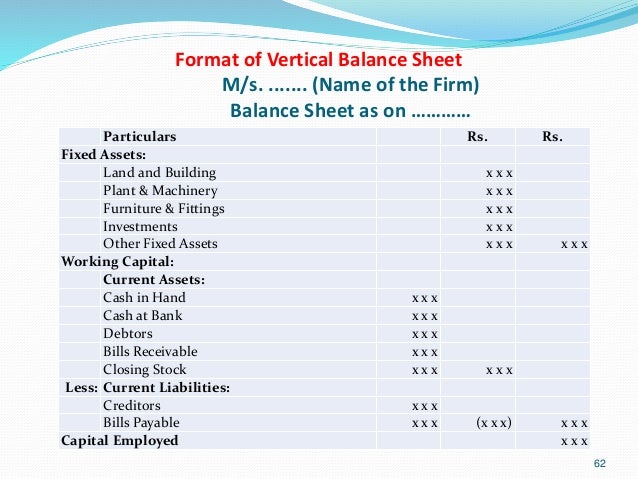

It lists all of your businesss assets and liabilities.

Adjusted income statement sole trader balance sheet format. The Balance Sheet is just a rearrangement of this important equation. Expenses are recognized when incurred regardless of when paid. The income statement of a sole proprietorship will not report any salary expense for the sole proprietor who works in the business.

The final accounts or financial statements of a sole trader comprise. The balance sheet provides a picture of the financial health of a business at a given moment in time. Balance sheet also known as the statement of financial position is a financial statement that shows the assets liabilities and owners equity of a business at a particular dateThe main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

The most common expenses are preprinted to save you time. While the balance sheet can be prepared at any time it is mostly prepared at the end of. Stock value if any in the balance sheet should be same as closing stock reflected in profit and loss statement PL.

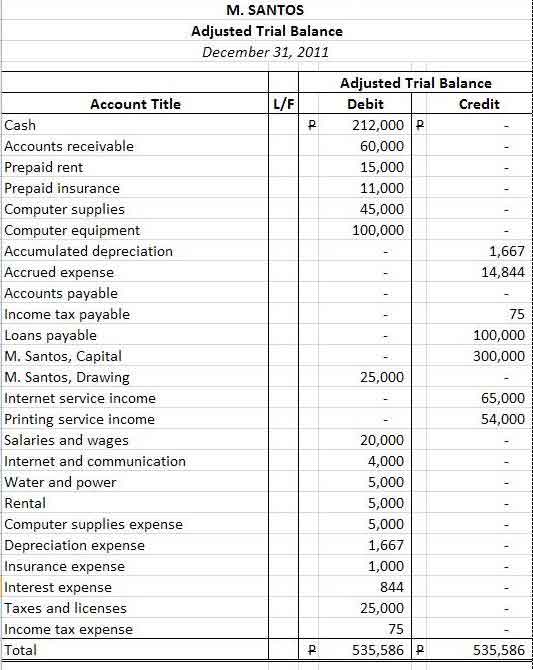

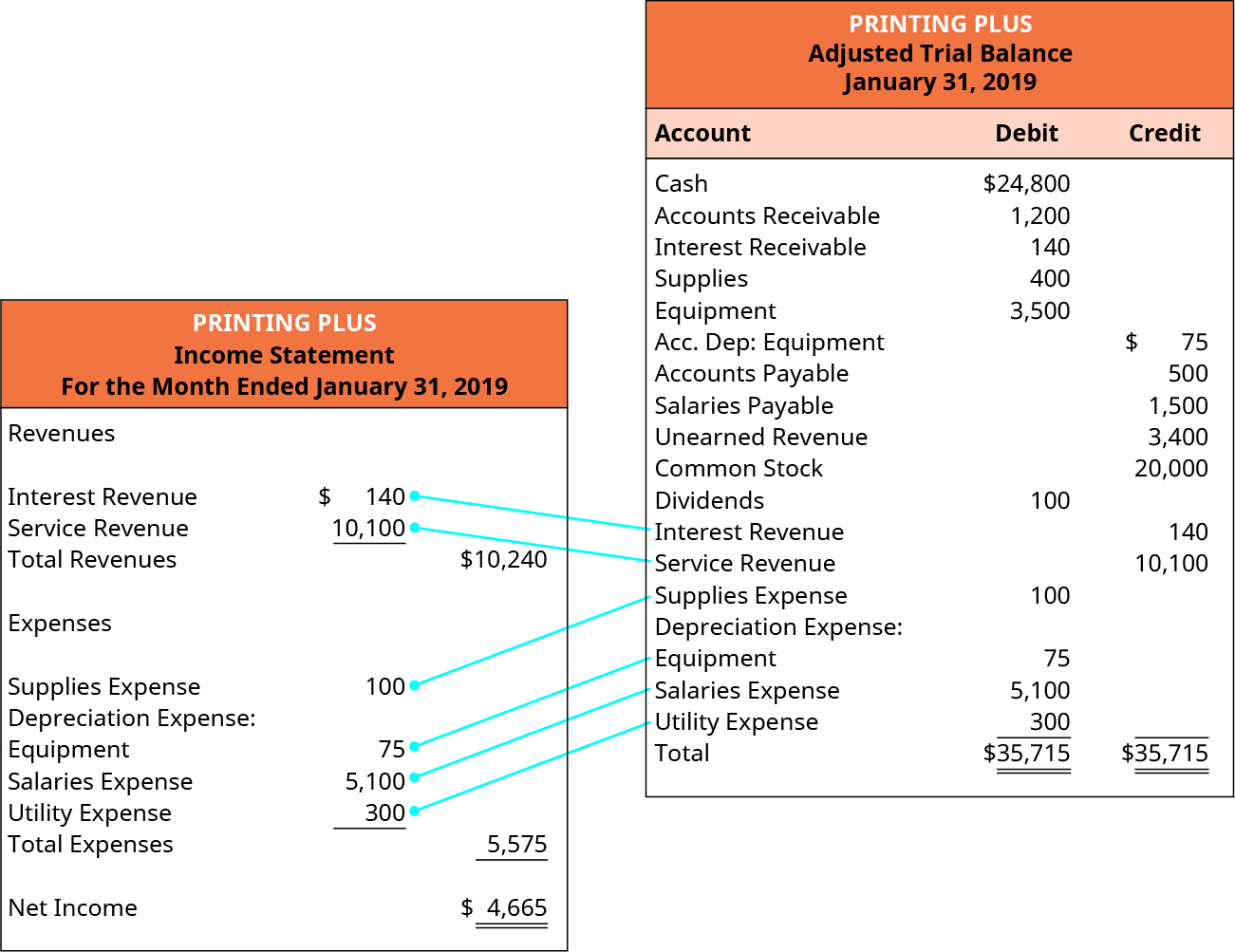

The income statement complies with the accrual basis of accounting. Format Of Sole Trader S Balance Sheet. This statement is a condensed version of the more detailed income statement presented in Illustration 4-2.

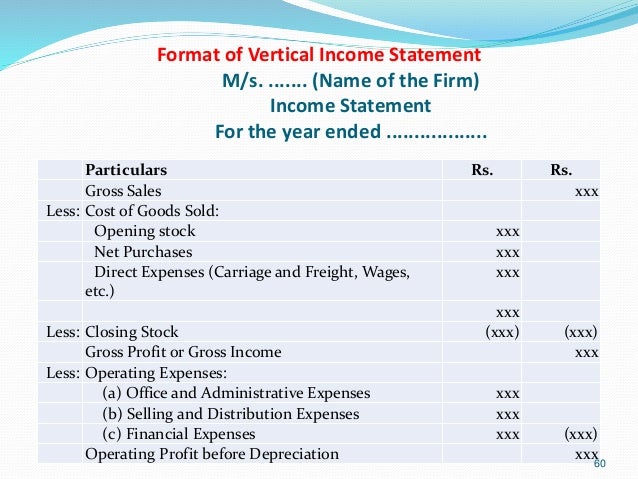

Prepare the statement of cos t of goods manufactured. Simply drop in your amounts on the lines provided. A trading and profit and loss account which shows the profit or loss of the business a balance sheet which shows the assets and liabilities of the business together with the owners capital These final accounts can be produced more often than once a year in order to.

It is more rep-. Income statement example here is a sample income statement of a service type sole proprietorship business. Y E A R E N D A D J U S T M E N T S.