First Class Prepaid Advertising On Balance Sheet

Prepaid expenses only turn into expenses when you actually use them.

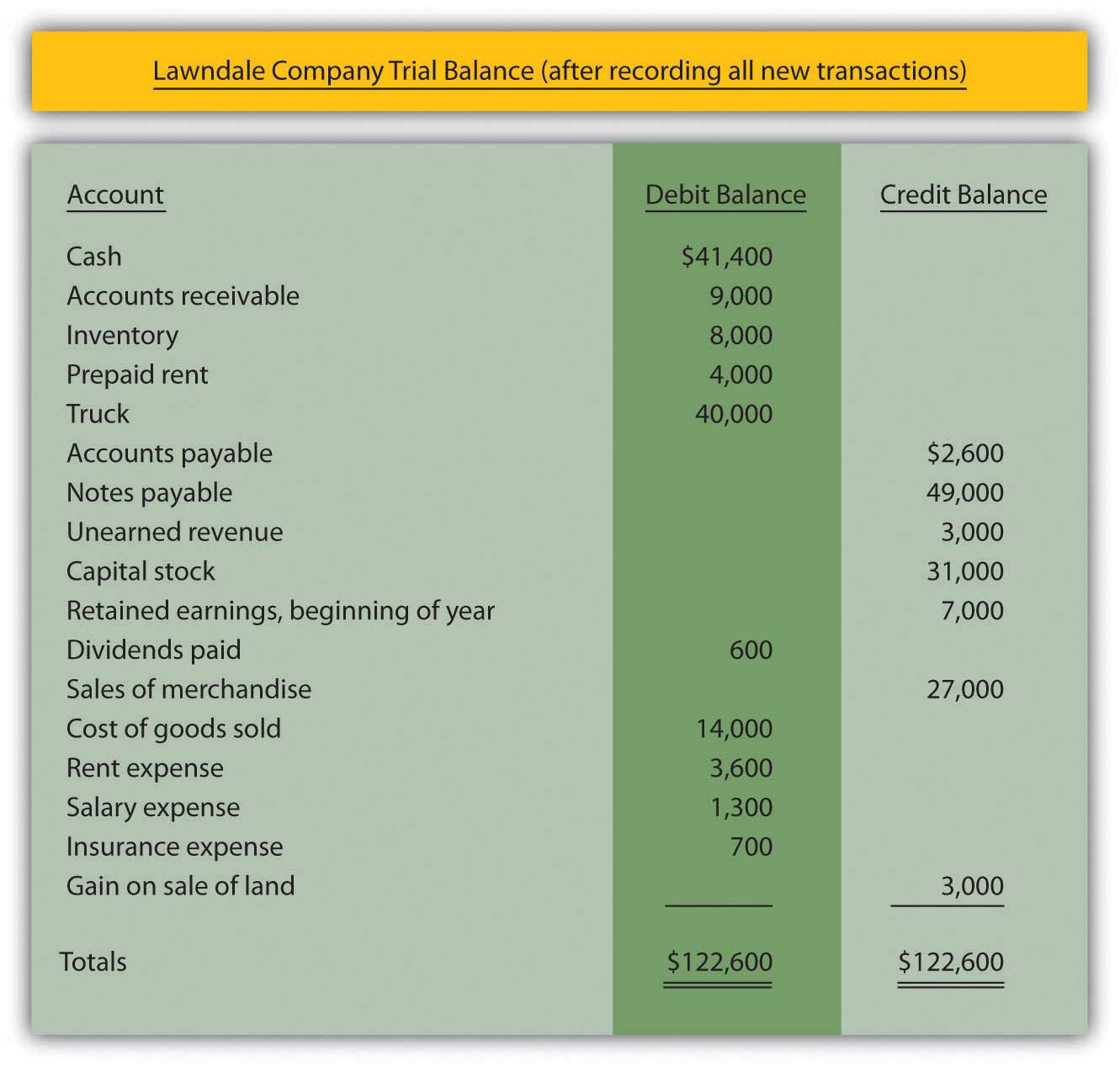

Prepaid advertising on balance sheet. Other current assets are cash and equivalents accounts receivable notes receivable and inventory. Prepaid Advertising has a debit balance in the Trial Balance section of the worksheet of 1600 and a credit entry of 550 in the. As you use the item decrease the value of the asset.

A prepayment of the cost of ads that will air in the future should be recorded in a current asset account such as Prepaid Advertising. The value of the asset is then replaced with an actual expense recorded on the income statement. Advertisements various advertising campaigns.

As these costs are consumed such as through the running of television or Internet ads the applicable portion of this asset is recognized as advertising expense. All these expenses can easily be anticipated thanks to their arrangement in a centralized balance sheet table and shared by the relevant parties in the company. Deferred expenses also called deferred charges fall in the long-term asset.

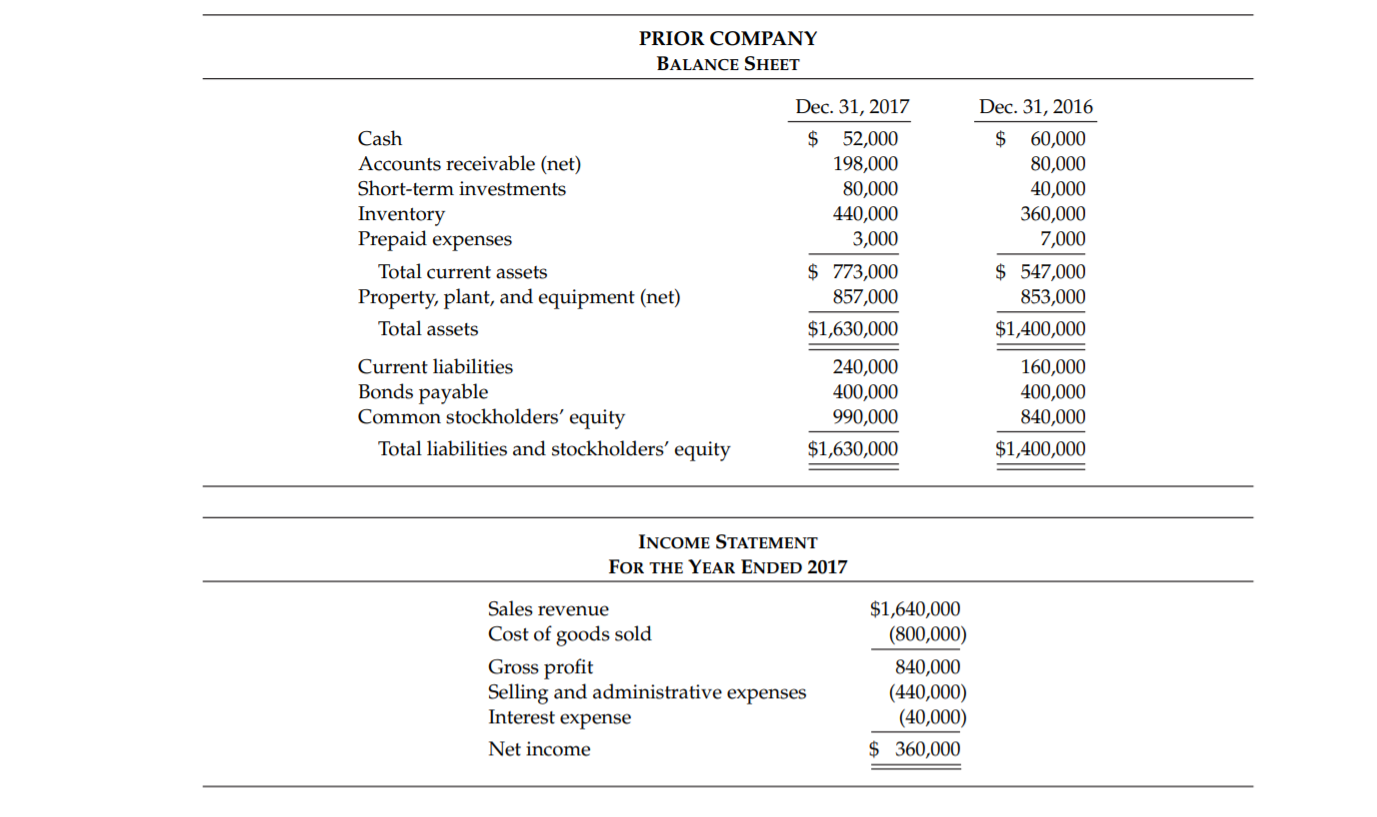

Prepare a balance sheet. The expense would show up on the income statement while the decrease in prepaid. Subscriptions software internet.

For Teachers for Schools for Working Scholars for. Prepaid advertising representing payment for the next quarter would be reported on the balance sheet as an asset. Try to maintain a balance sheet.

Government Prepaid expense list involves many duties and responsibilities to invest. The journal entry for the prepayment of advertising would involve a credit to cash as cash is paid out and a debit to the prepaid advertising account. Example of Advertising as an Asset and as an Expense.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)