Wonderful Ppp Loan Financial Statement Disclosure

Ad Find Financial Loan.

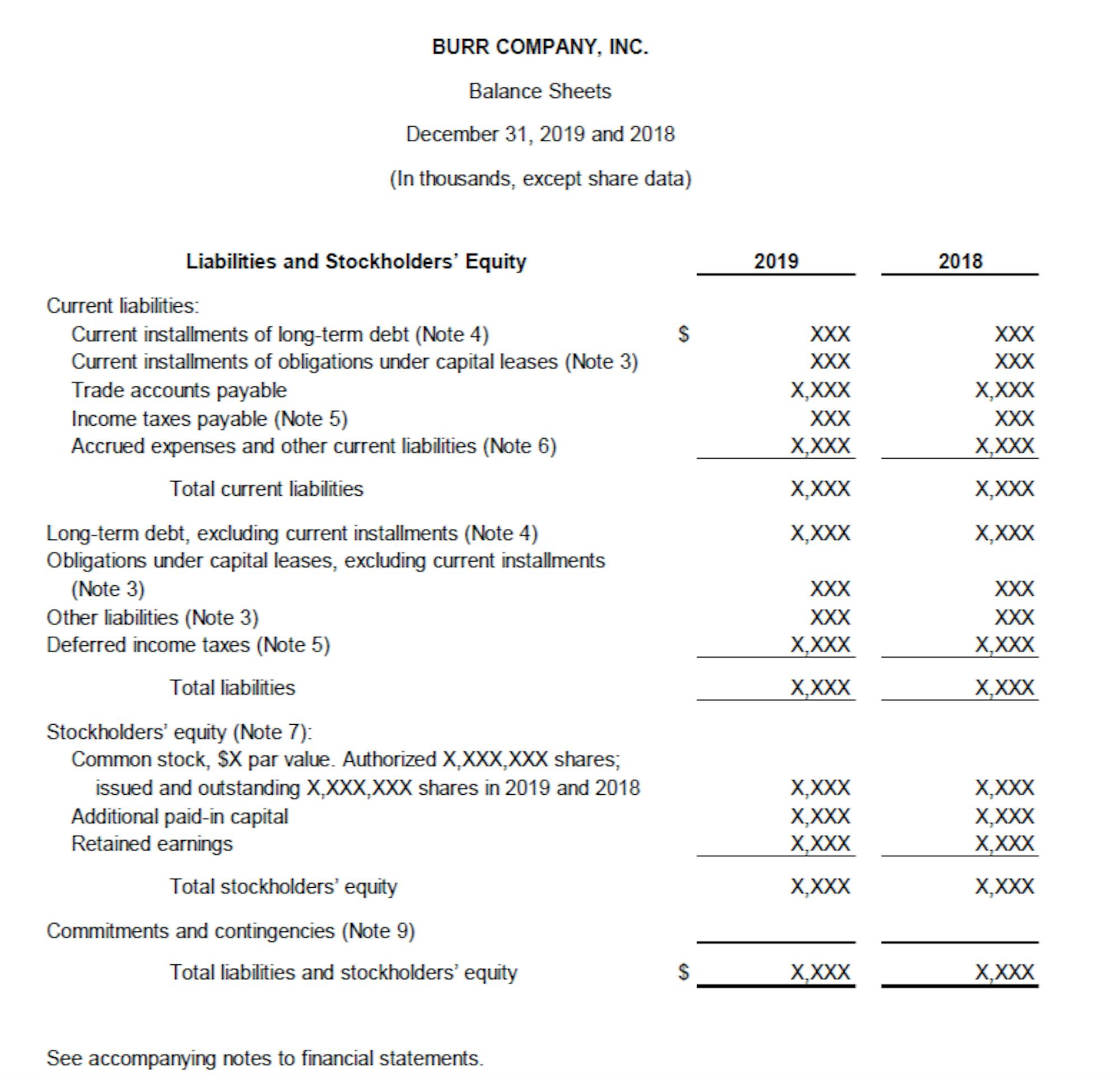

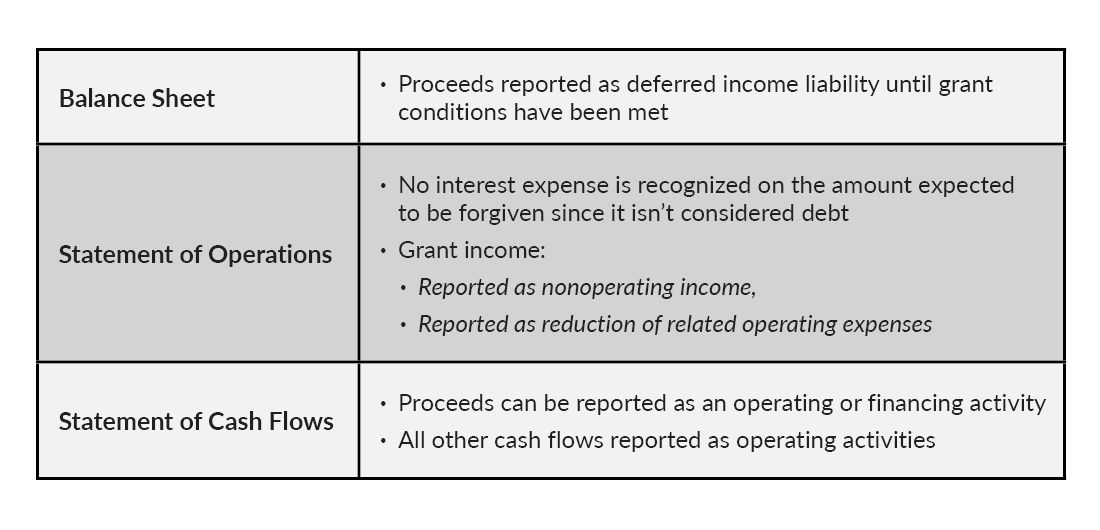

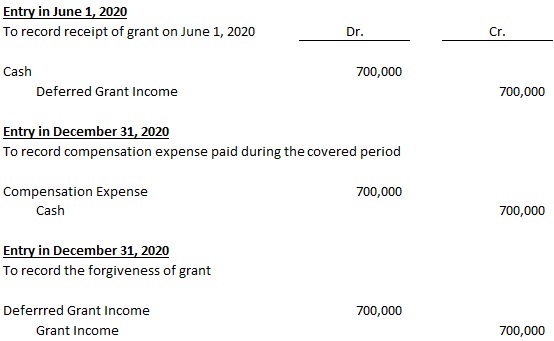

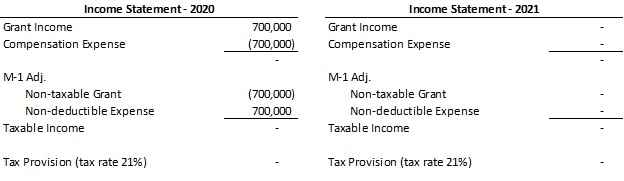

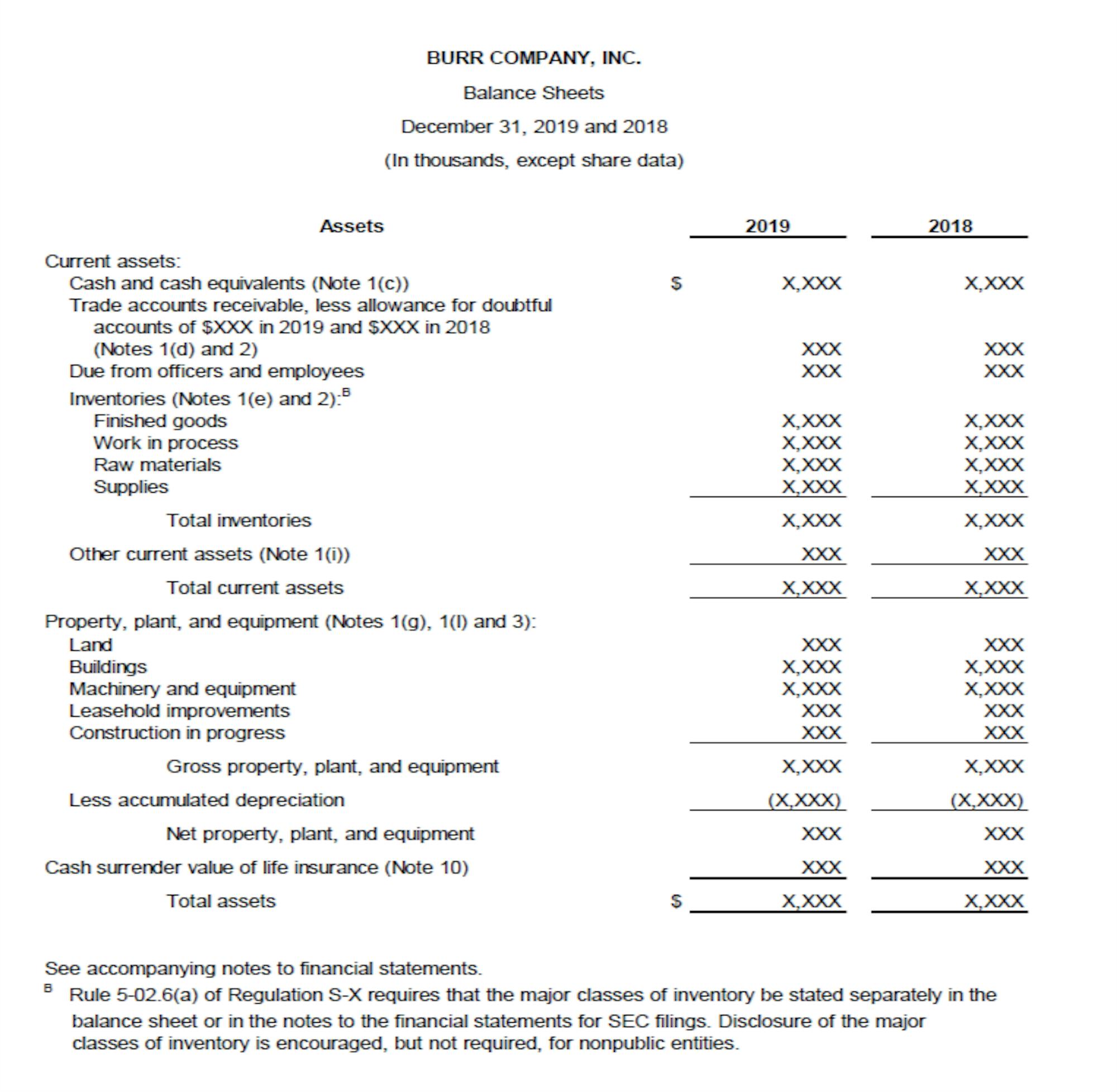

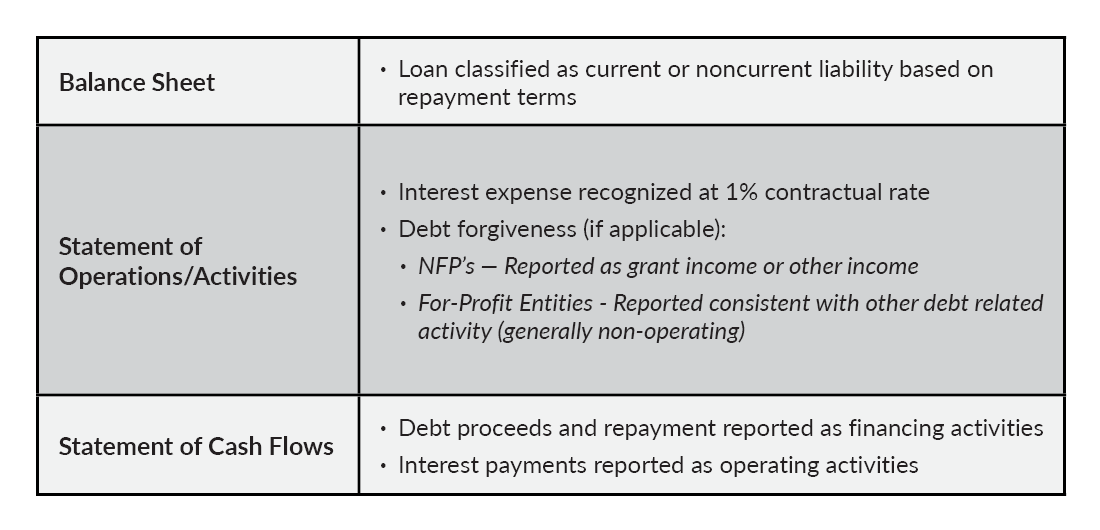

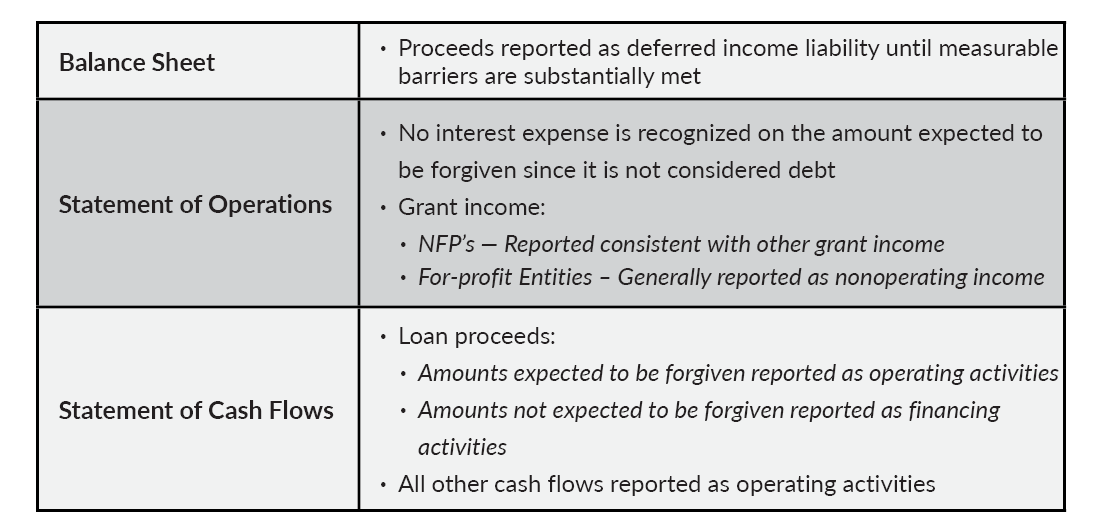

Ppp loan financial statement disclosure. Ad Find Financial Loan. GAAP for debt instruments. Reporting PPP Loans as Debt Under FASB ASC 470 the loan proceeds are recorded as debt on the Balance Sheet and are broken out between the current and long-term portions on a classified statement.

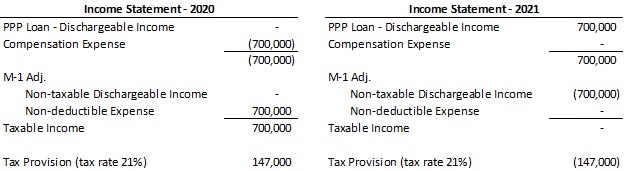

In the aggregate amount of 10000000 pursuant to the Paycheck Protection Program the PPP under Division A Title I of the CARES Act which was. Ad Find Financial loan. In addition to the extent a PPP loan remains outstanding as of a financial statement reporting period entities should consider disclosing uncertainties related to eligibility tax deductibility and complexity surrounding the PPP loan forgiveness process.

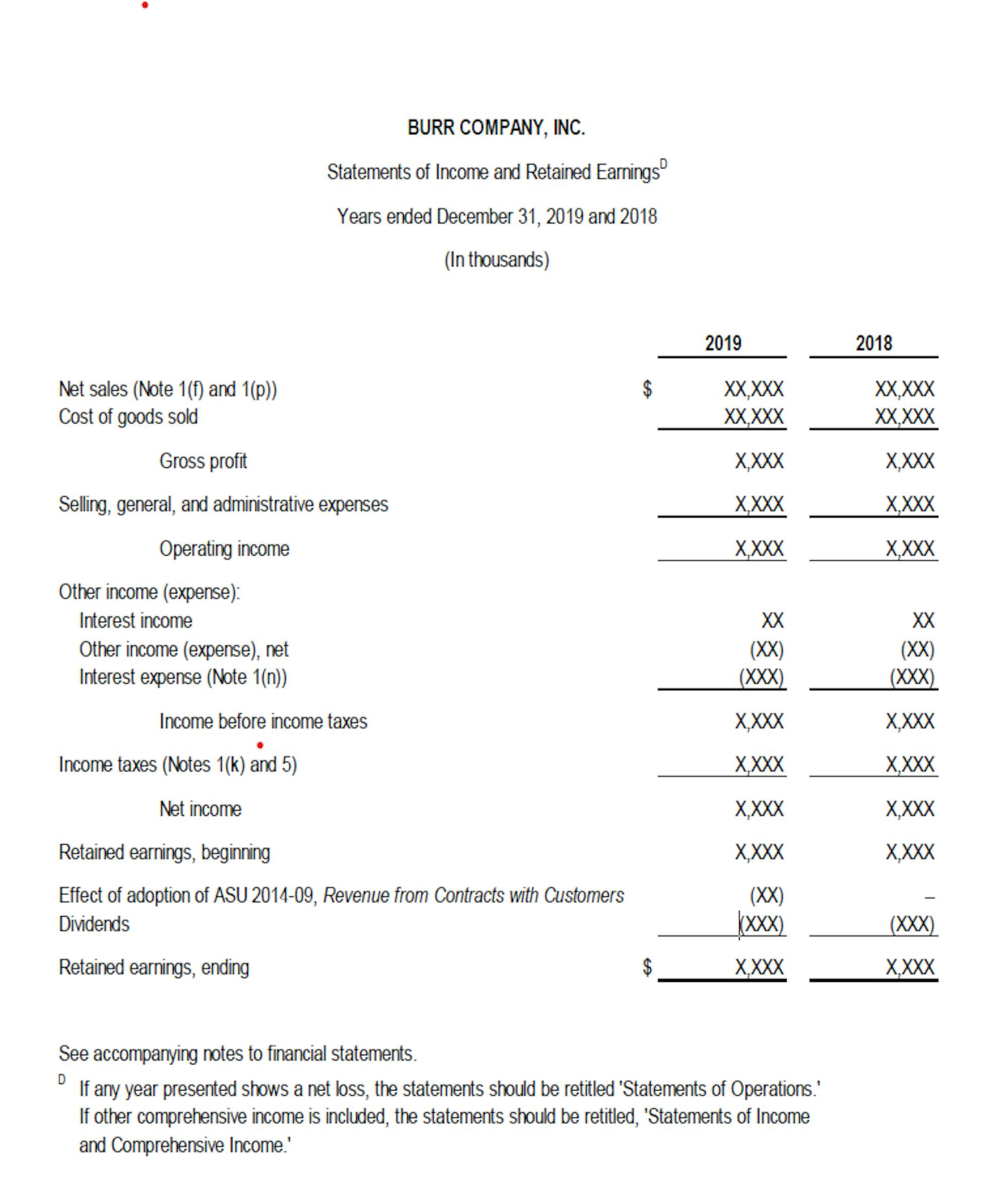

If forgiveness is received before issuance of the financial statements but after the reporting period end the loan still must be presented as a financial liability but the entire balance may be classified as noncurrent. Interest is accrued on the loan at the effective interest rate over the term of the loan. On the quarterly and annual statements Note 11 is the appropriate place to disclose a PPP loan.

Financial Statements PPP loan proceeds should be recorded on the balance sheet for business entities or the statement of financial position for nonprofit entities as a liability either current or long-term based on maturity. Whatever you are looking for use our site and get relevant results every time. Ad Find Financial Loan.

Disclosures Regardless of the accounting approach followed by a borrower if the PPP loan is material to the financial statements the borrower should disclose in the footnotes how the PPP loan was accounted for and where the related amounts are presented in the financial statements including the statement of cash flows. Financial Statement Disclosures Disclosures under ASC 470 will be similar to traditional debt disclosures. The PPP loan also should be included in the organizations debt maturity disclosure see ASC 470-10-50-1.

Under ASC 450-30 there are no specific disclosure requirements. Its important to note that material PPP loans should adequately disclose all key terms of the loan in the notes to the financial statements. Financial Statement Disclosures The entity should consider the disclosure requirements in US.

/balance_sheet-5bfc2fc1c9e77c005877d00d.jpg)