Unbelievable Directors Current Account In Balance Sheet

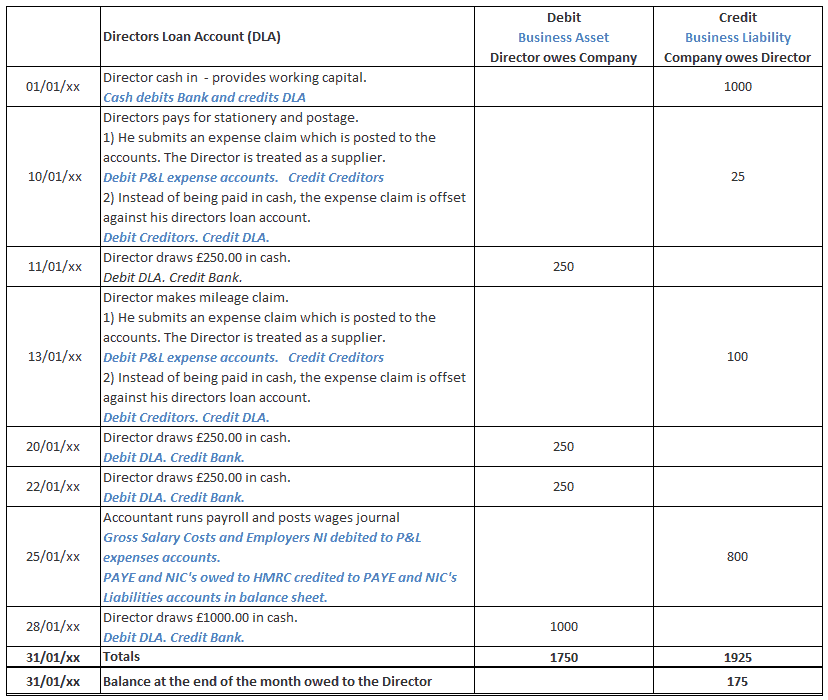

If you owe the company money the current account would show as an Asset in the Balance Sheet.

Directors current account in balance sheet. The amount owed to or from the director. Its the same thing. Go to Reports All Reports Balance Sheet find the account.

If the company owes you money the account will be in credit. On the right side the balance sheet outlines the companys liabilities Types of Liabilities There are three primary types of liabilities. This should be recorded accordingly as an asset or a liability in the balance sheet of your companys annual accounts.

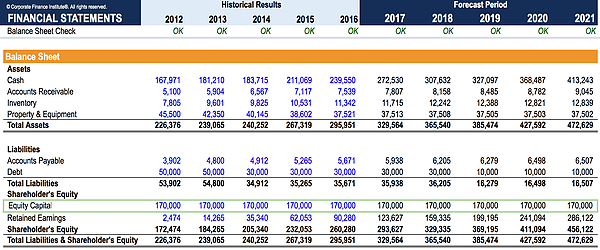

This document outlines the major accounts listed in the Balance Sheet and the effect of transactions on each account. Amount due could be for loans made from the director to the company or due to the director for services rendered. The order in which the current liabilities will appear on the balance sheet can vary.

Accounts payable short-term loans payable and the current portion of long-term debt. Depending on the borrowing repayment activity in your directors loan account at the end of your companys financial year either you will owe the company money or the company will owe you money. The loan should be recorded as an increase in the balance on the relevant bank account and as a new directors loan liability on the Balance Sheet report.

The shareholder current account is essentially a loan from a shareholder. To check the balance of a Shareholder or Directors Loan Account in Wave there are a few ways. When the director pays you the amount back or a proportion create a bank deposit.

The document aims to provide a better understanding of the purpose and the makeup of accounts presented in a schools Balance Sheet. Firstly if a balance remains outstanding on their loan account at the companys year end this can lead to an income tax charge on the company. You may also hear it being referred to as a Directors Current Account or a DLA.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)