Beautiful Work Provision For Doubtful Debts Ifrs

This article sets out the accounting treatment for the impairment of trade receivablesdebtors.

Provision for doubtful debts ifrs. A provision is a liability of uncertain timing or amount. Provision for doubtful debts seems to be suffering from the same predicament beacuse strictly speaking the estimate for doubtful debts is not an obligation to an external party as per IAS 37 definition of a provision. The liability may be a legal obligation or a constructive obligation.

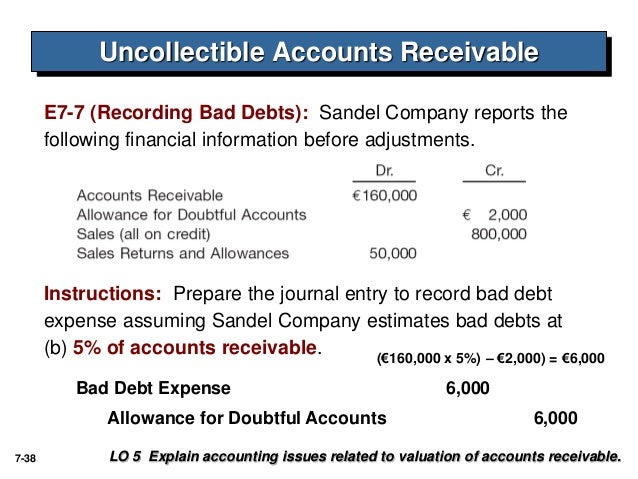

General provision for doubtful debts I heard that general provisions for doubtful debtors based on debtor age analysis is not allowed under IFRS. The entry to record the allowance would be. Prudence requires that an allowance be created to recognize the potential loss arising from the possibility of incurring bad debts.

As per IFRS 9 183604 woul be provided for as bad debts. The key principle established by the Standard is that a provision should be recognised only when there is a liability ie. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position.

Carrying amount 100 30 70. IAS 37 defines and specifies the accounting for and disclosure of provisions contingent liabilities and contingent assets. Tax base of receivables 100.

A present obligation resulting from past events. This account is used to reduce the carrying amount of trade receivables in the Statement of Financial Position if there is doubt regarding its collectability. The Standard thus aims to ensure that only genuine obligations are dealt with in the financial statements planned future expenditure even where authorised by the board of directors or equivalent governing body is.

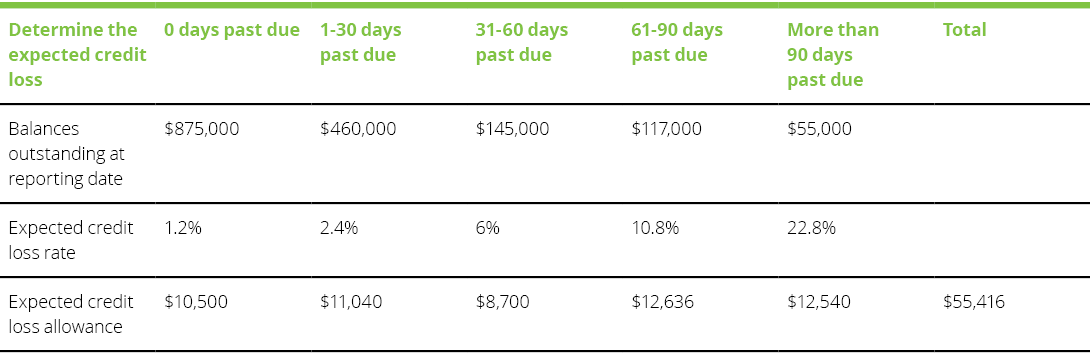

IFRS 9 Financial Instruments introduced changes to the calculation of bad debt provisions on trade receivables. As per IFRS 9 the Bad debts Provision would be calculated as follows. Such receivables are known as doubtful debts.