Outrageous Sony Financial Ratios

June 23 2021 Sony Corporation Files Annual Report on Form 20-F Filing PDF 506KB June 22 2021 Position and Policy Regarding Lowering Minimum Value of Investment Units.

Sony financial ratios. Is significantly higher than its historical 5-year average. Is slightly lower than the average of its sector Consumer Electronics. Sony annual financial activities - other for 2021 was 0605B a 674 decline from 2020.

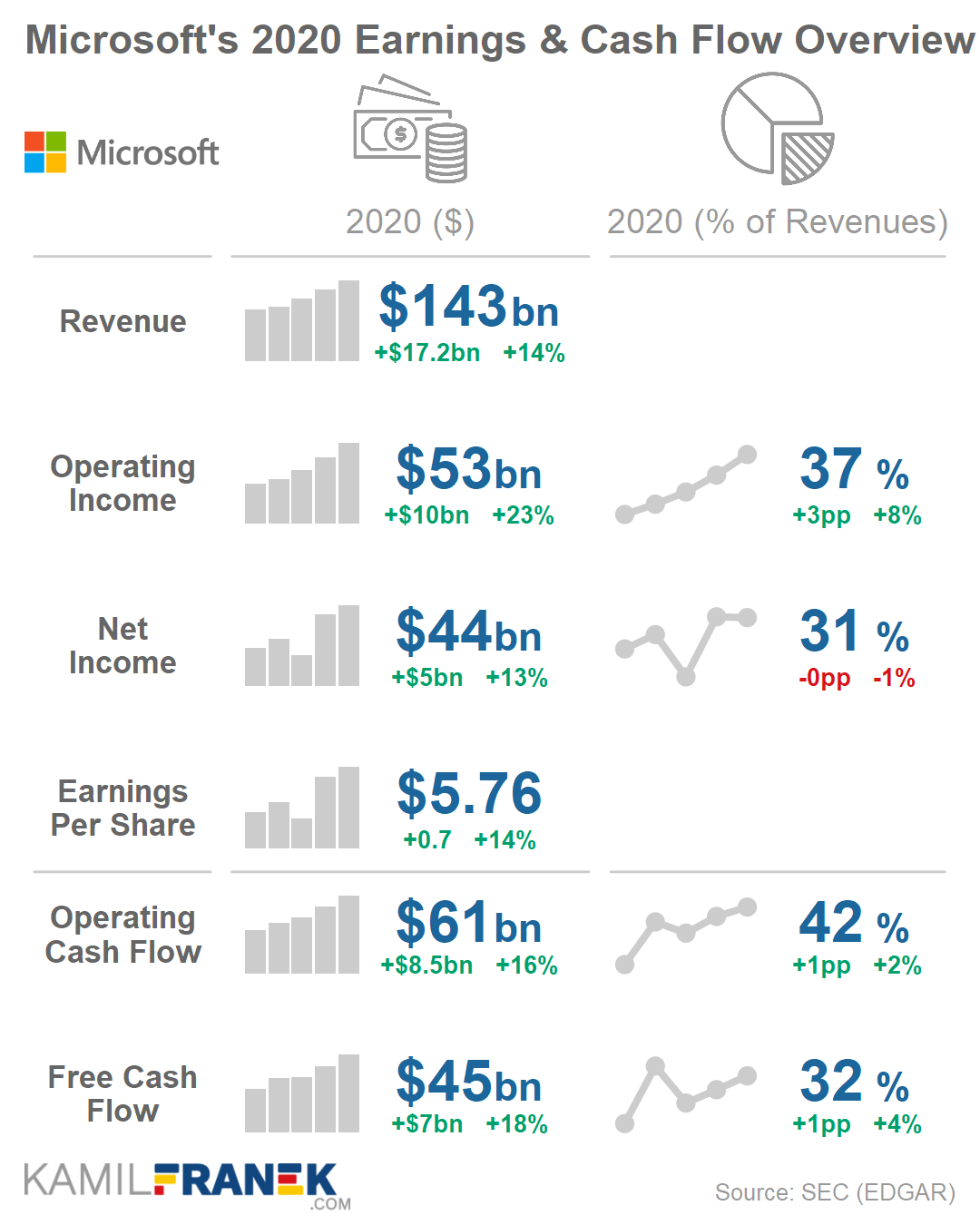

5-year and 10-year growth rates are calculated with least-square regressionbased on the 6-year. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Sony Group Corps latest. PE Ratio including extraordinary items -.

Liquidity Ratios Net Working Capital to Total Assets. View below Sony key financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on the latest financial reports. Sony has a lower than ideal ratio and the current ratio below even 1 means that the company does not have sufficient current assets to pay off its current liabilities.

Book Value Growth 570. Get Sony Entertainment latest Key Financial Ratios Financial Statements and Sony Entertainment detailed profit and loss accounts. Effectiveness of Sonys internal control over financial reporting as of March 31 2019 except for the recording of the fair value of the intangibles and residual goodwill.

Enterprise Value to EBITDA 733. The EVEBITDA NTM ratio of Sony Corp. Also high current ratio of Samsung means that it has a higher amount tied.

22 rows PB Ratio. GameStop Corporation Common Stock. The EVEBITDA NTM ratio of Sony Corp.