Wonderful Line Of Credit Disclosure In Financial Statements

15 rows IFRS 7 requires disclosure of information about the significance of financial instruments to an entity and the nature and extent of risks arising from those financial instruments both in qualitative and quantitative terms.

Line of credit disclosure in financial statements. The Company is in compliance with certain financial covenants imposed by the line of credit agreement. Ad Find Credit Report Online Free. Ad Find Credit Report Online Free.

It is secured by all Company assets and personal guarantees by the stockholders of the Company. Ad Find Credit Reports Online. The only other activity that should affect the line of credit GL account will be the.

Line-of-Credit Reporting on Financial Statements A line of credit is a revolving loan. The line bears interest at prime plus 1 per annum. In the example 5000 is receipted into the bank account and is also setup as a liability.

Securities and Exchange Commission SEC including financial statement requirements in Article 9 of Regulation S-X. These disclosures should be sufficient for a user to understand the effect of credit. Now that you have drawn money from the line the liability must be present on your Balance Sheet.

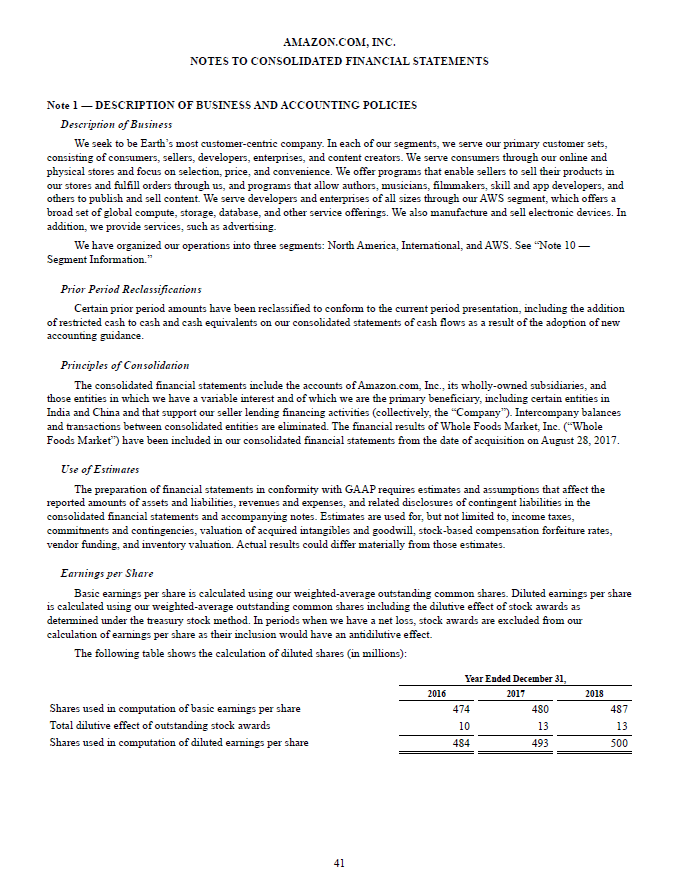

Ad Find Credit Reports Online. The line of credit expires in June 20x5 and it is managements intention to renew the facility. The preparation of the Companys financial Use of Estimates statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates that affectthe reportedamountsof assetsliabilitiessales and expenses and related disclosures of contingent assets and liabilities.

Specific disclosures are required in relation to transferred financial assets and a number of other matters. If the company borrows 4 million then pays it off it can borrow against the line of credit again instead of taking out another loan. Revenue from Contracts with Customers to which IFRS 9s impairment model is applied.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)