Formidable Financial Ratios For Pharmaceutical Industry

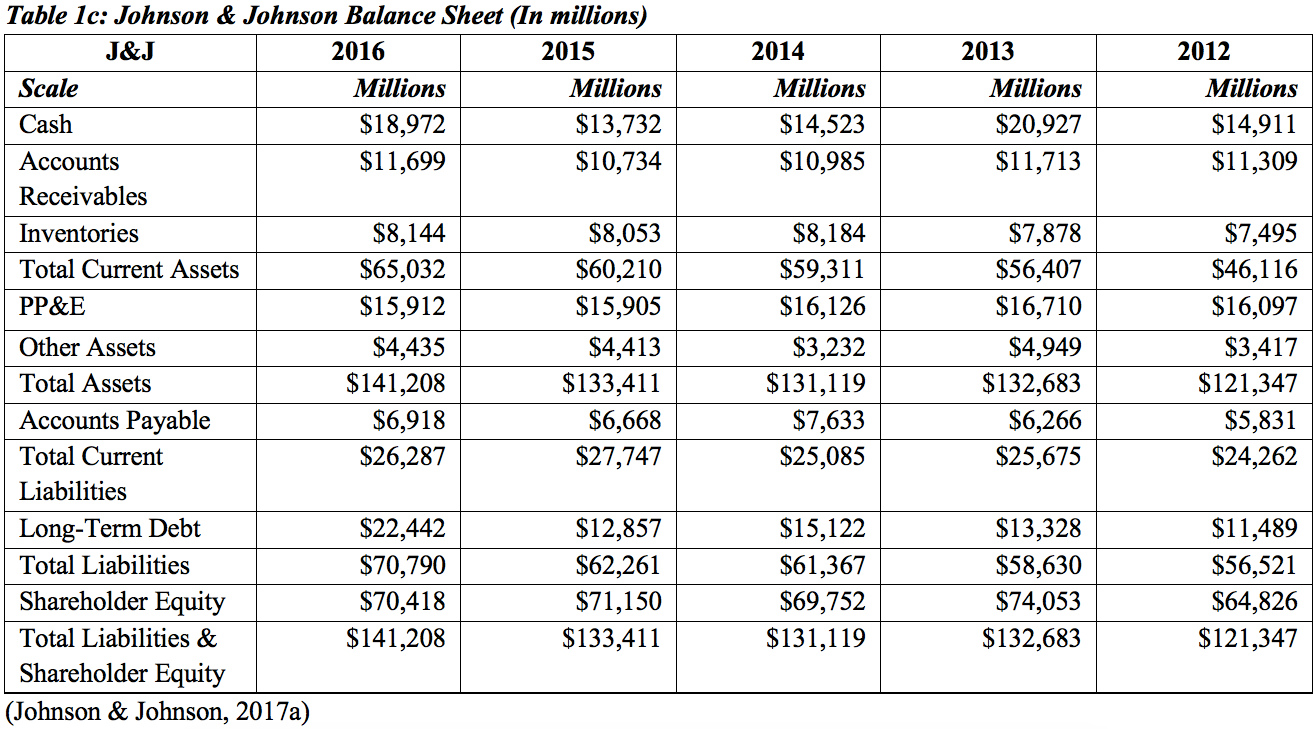

Asset Management Asset Quality b.

Financial ratios for pharmaceutical industry. Profitability Investment Return. Among the different method Ill use the ratio method to analyze financial statements. The EVEBITDA NTM ratio of Australian Pharmaceutical Industries Ltd is significantly lower than the average of its sector Drug Retailers.

Per Share Ratios. Efficiency Productivity Capital Strength d. Key Financial Ratios of Sun Pharmaceutical Industries in Rs.

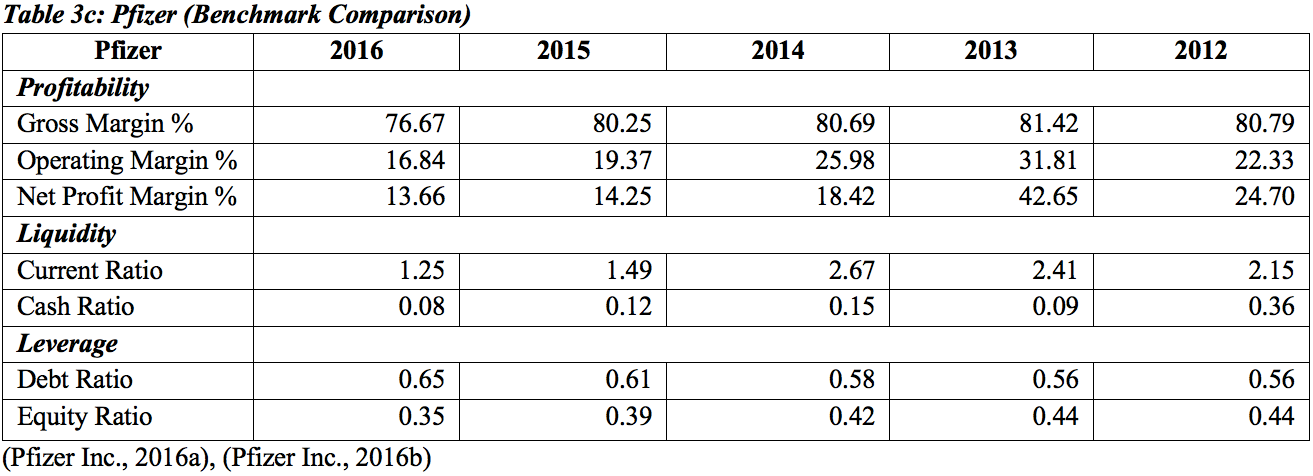

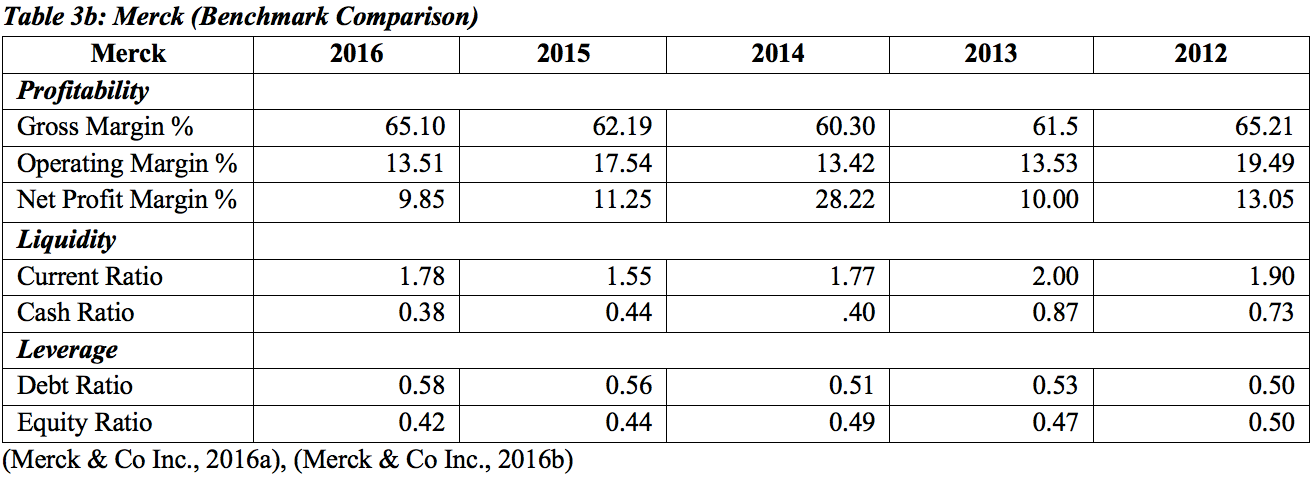

Liquidity Leverage e. Ad Develop financial skills to unlock critical insights into performance. Financial benchmarking section of these reports provides an analysis of industry profit and expenses as a percentage of revenue by major category eg purchases wages depreciation marketing rent utilities other costs and earnings before interest and taxes for the most recent year and line graphs indicating trends for each category over the past five years.

Return on Research Capital Ratio. The following ratio will be calculated. Ad Unlimited access to Financial Services market reports on 180 countries.

Instant industry overview Market sizing forecast key players trends. HBS Online offers a unique and highly engaging way to learn vital business concepts. Ratio to measure specific financial or financial characteristics of business.

The average value of. Novo Nordisk heads the list with a sales to assets ratio of 1. Basic EPS Rs 892.

/GettyImages-941395072-ff92e929f7494d9286d50006505262cf.jpg)