Stunning Goldman Sachs Strong Balance Sheet Portfolio

The US bank has said it hoped to shrink its equity investments portfolio by almost 20 per cent turning instead.

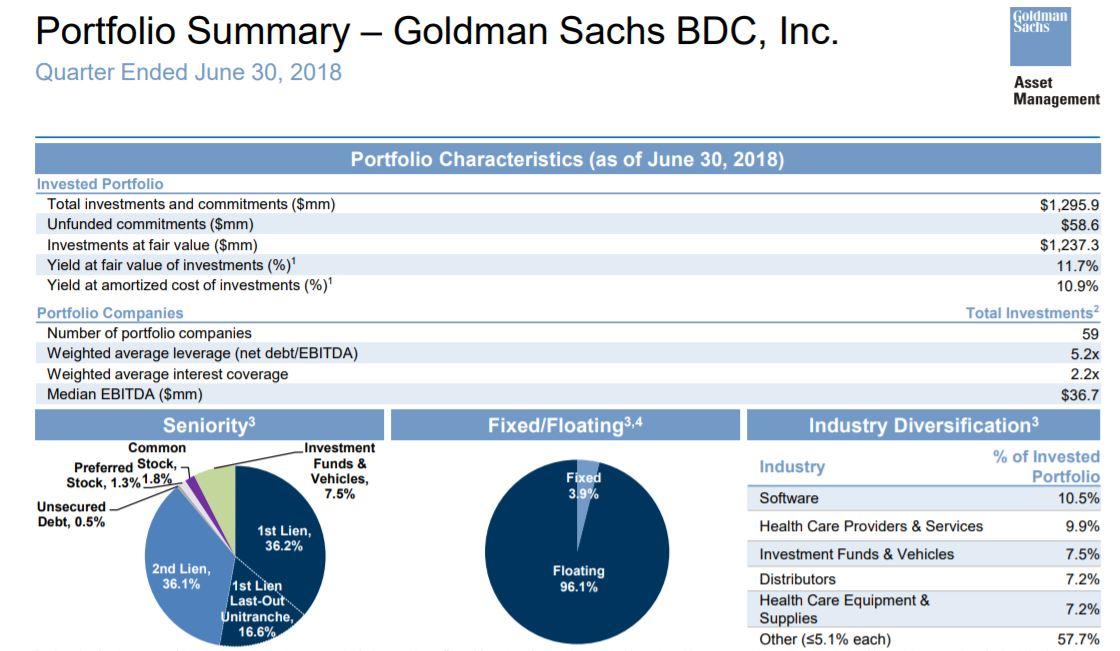

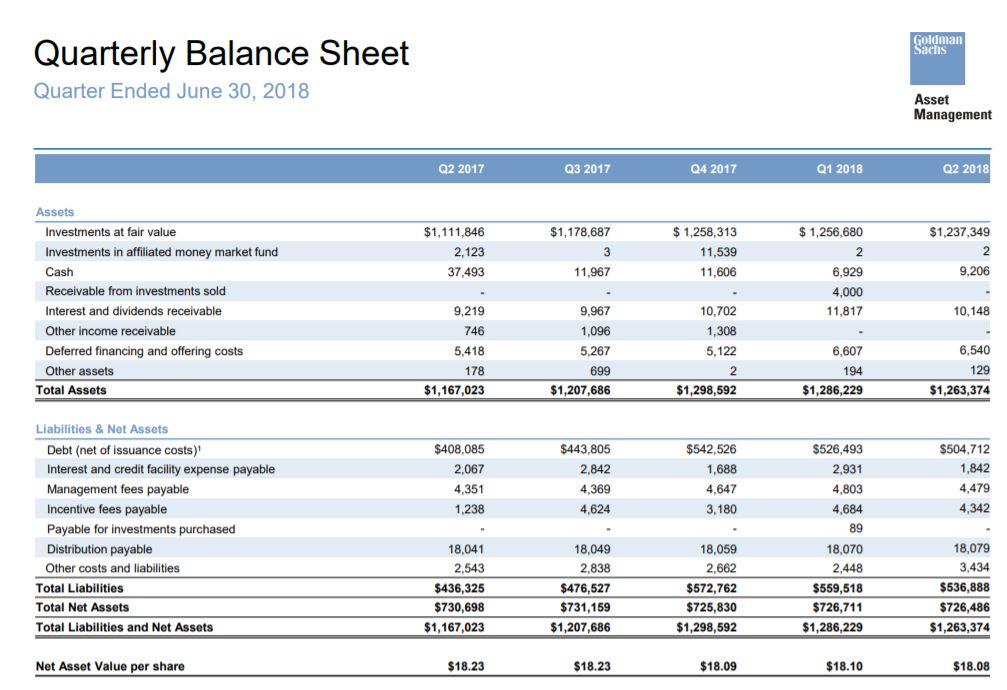

Goldman sachs strong balance sheet portfolio. Strong Balance Sheet Liquidity Position. Get the annual and quarterly balance sheet of Goldman Sachs Group Inc. Goldman at its investor day last year outlined a plan to reduce the size of the equity investments portfolio from 22bn to 18bn in the next five years.

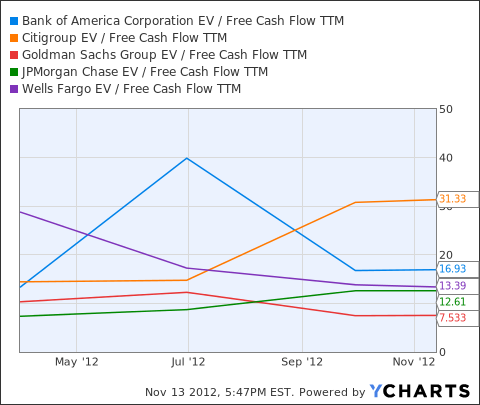

Assumptions for purposes of making comparisons. The portfolios are named. Goldman Sachs raked in record revenue from asset management in the last quarter thanks to a business that invests the Wall Street banks own capital.

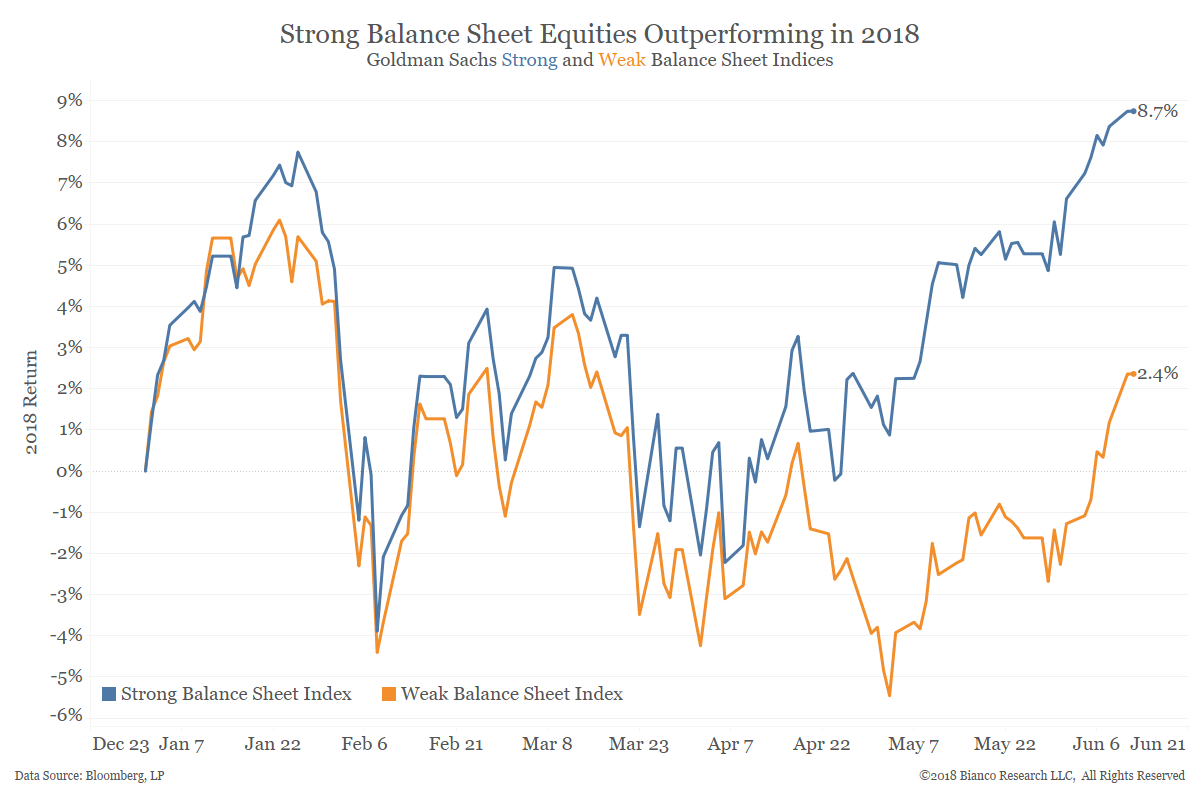

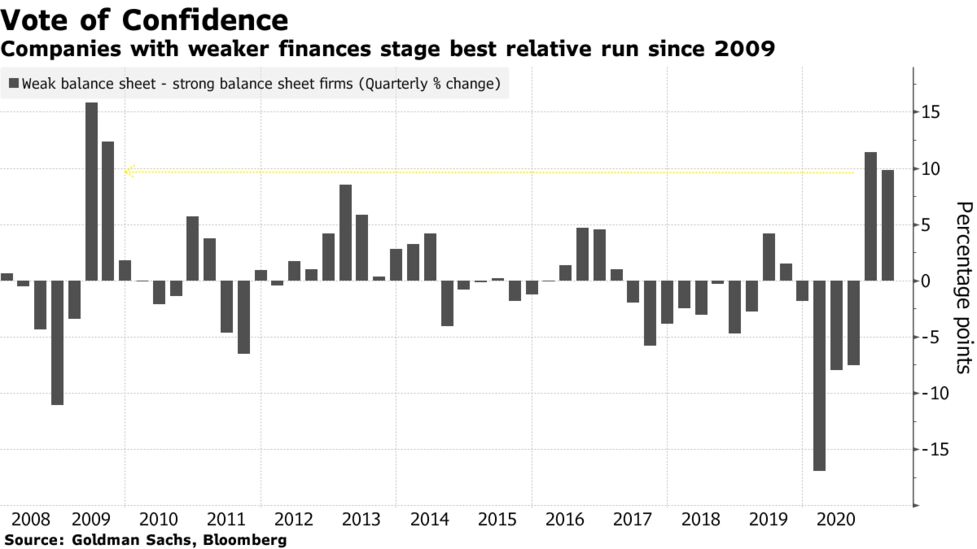

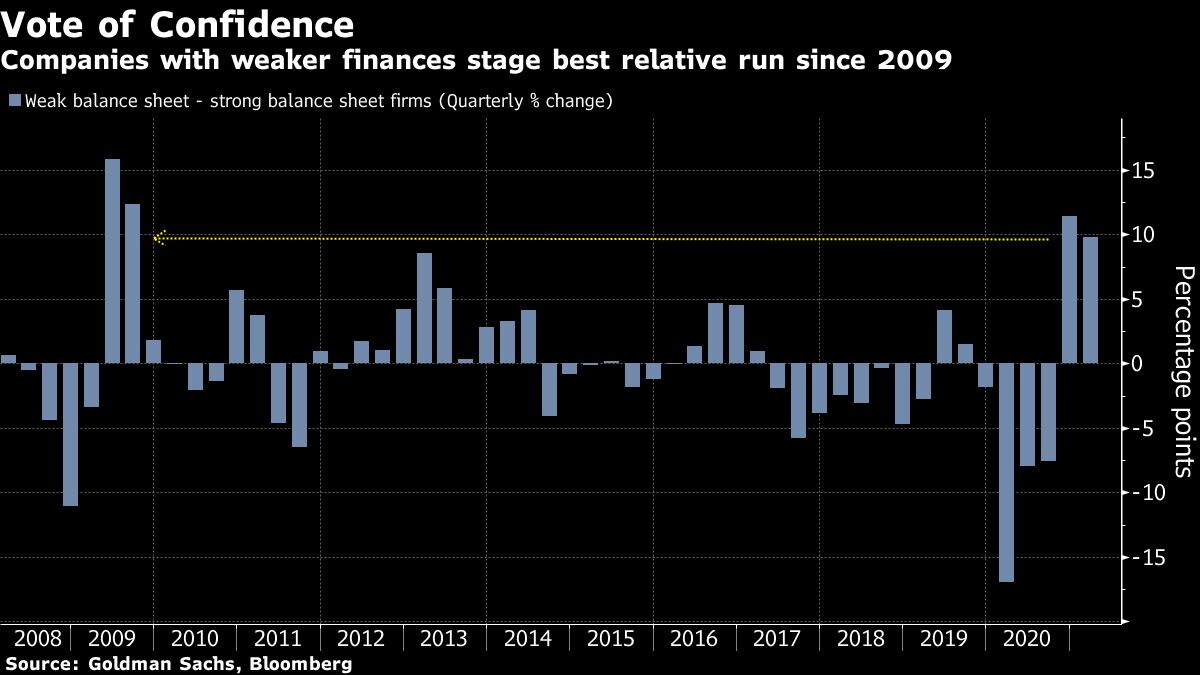

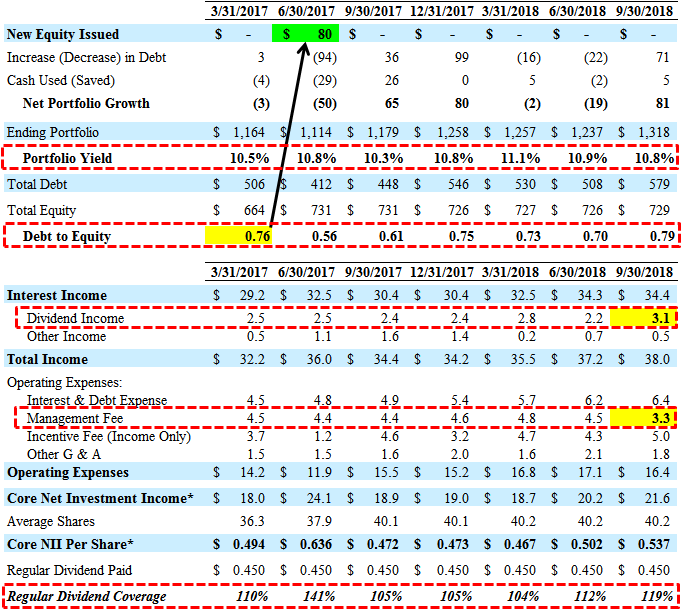

Goldman created a strong balance sheet stock portfolio for turbulent times. So far this strategy has done very well for investors. Peer population represents key competitors tracked internally by product classification and portfolio management style Slide 3.

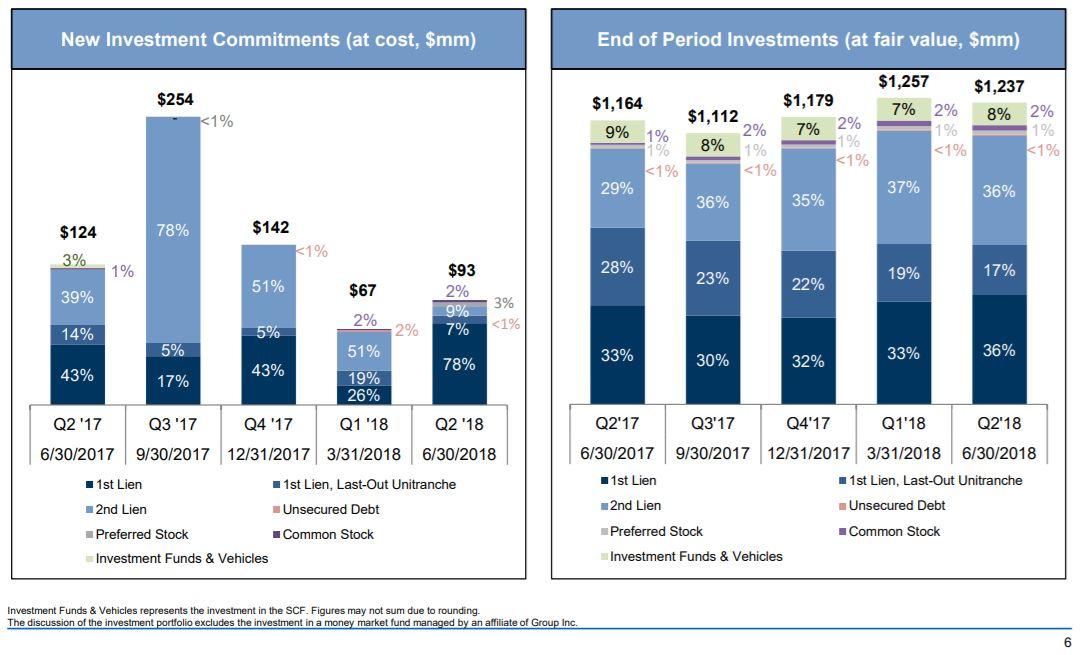

We will continue to invest through the balance sheet and partner capital. But rather than expand it Goldman is seeking to make the business smaller. Add toRemove from a Portfolio Add to Portfolio.

Goldman Sachs infusion of both capital and expertise into SMFGs restructuring efforts helped SMFG begin to rehabilitate its balance sheet and return to profitability. We will continue to invest through the balance sheet and capital of the partners. Non-fee earning assets of 130bn includes Goldman Sachs balance sheet investments employee funds leverage cost vs.

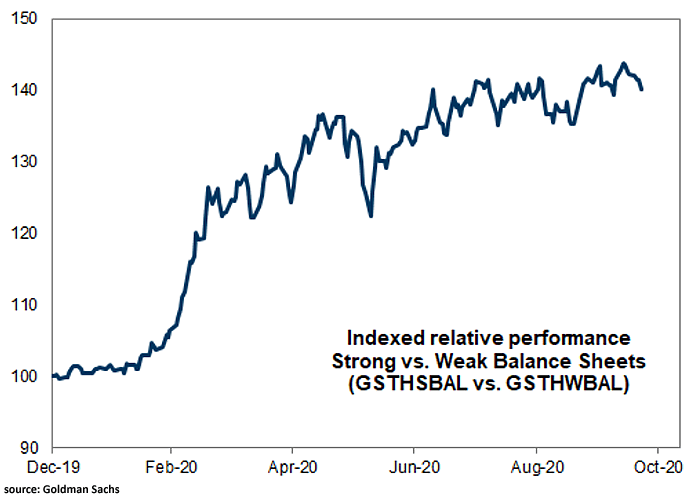

Stocks with strong balance sheets according to Goldman include tech stocks like Facebook Alphabet and Netflix but also Costco and Colgate-Palmolive. Goldman Sachs basket of 50 strong balance sheet stocks outperformed weak balance sheet stocks by. 2020 has been a wild year for the market and investors seeking safety have been flocking to stocks with strong balance sheets.