Neat Requirement To Prepare Consolidated Accounts

You are encouraged to download these guides for your own.

Requirement to prepare consolidated accounts. Companies Act requirement to prepare consolidated financial statements. Only and should not be used as a definitive guide since individual circumstances may vary. In addition to preparing their own Financial statements holding undertakings are required to prepare consolidated group financial statements and to lay them before the AGM at the same time as their own annual financial statements.

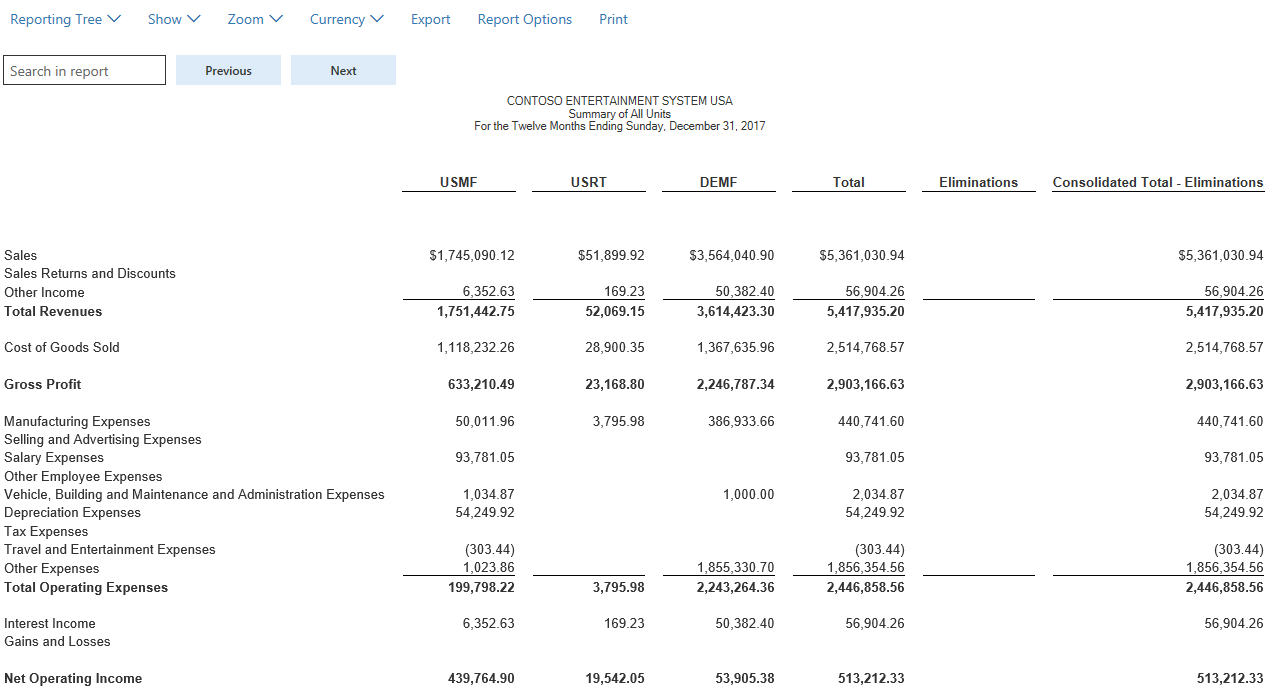

Consolidation accounting is the process of combining the financial results of several subsidiary companies into the combined financial results of the parent company. It is an introduction. The requirements regarding consolidated financial statements business combinations and goodwill are set out as part of FRS 102.

These financial statements must also comply with the prescribed Accounting Standards and give a true and fair view. Whether H Ltd. 3 This Standard does not deal with the accounting requirements for business combinations and their effect on consolidation including goodwill arising on a business combination see AASB 3.

Company A and its subsidiaries are small individually however as a group are medium and therefore require consolidation and an audit. Section 129 3 of the Companies Act 2013 provides that where a company has one or more subsidiaries it shall prepare a consolidated financial statement of the company and of all the subsidiaries. Requirement for UK company to prepare group accounts if it has a larger parent overseas We have a group situation where there is a UK entity Company A with a chain of parents subsidiaries.

Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. Previously the Securities and Exchange Board of India SEBI required only listed Companies to prepare. Whether H Ltd.

ACCA UK produces Guides To which are designed to be passed to clients and keep them informed on key issues. The 2013 Act mandates preparation of consolidated financial statements CFS by all Companies including unlisted Companies having one or more subsidiaries joint ventures or associates. FRS 102 is regularly updated and amended by the Financial Reporting Council FRC.