Beautiful Healthy Financial Ratios

They help to provide a basic overview of the business financial health.

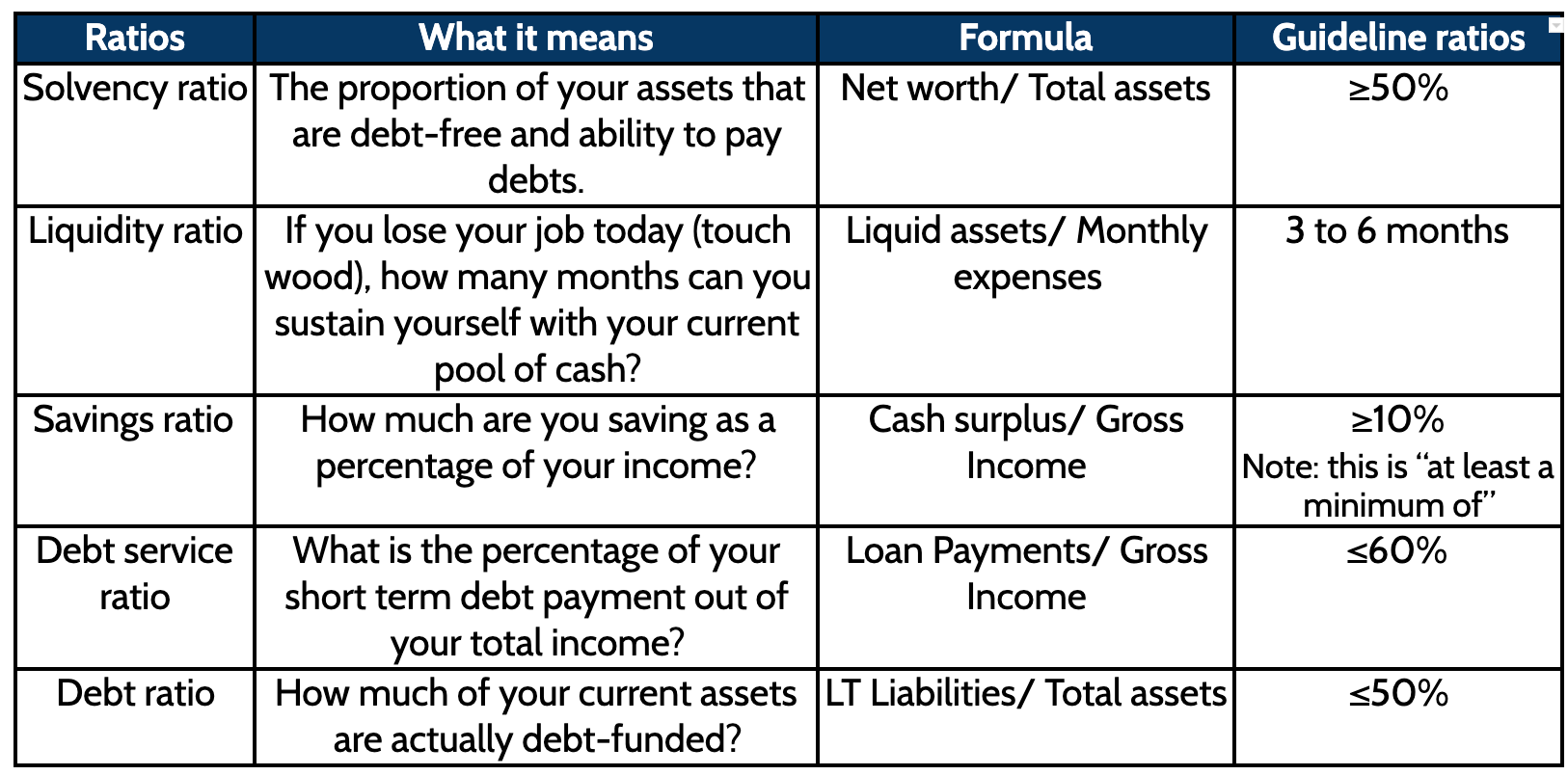

Healthy financial ratios. It also shows how you can generate money to meet some of your short-term financial commitments. But bankers investors and buyers want to know them because theyre the best indicators of your companys health. A company enjoying good financial health should obtain a ratio around 2 to 1.

Liabilities to Assets Ratio. Your Profitability Ratio Is on the Healthy Side There are a handful of profitability ratios that measure the return on your sales and investments. Traditionally this is outside of any other income sources such as social security work from part-time jobs etc.

The lower your debt-to-income ratio the better. Then the current ratio is 84727200 1181. The quick ratio is a good indicator of a companys ability to effectively cover its day-to-day operating expenses.

Liabilities to Assets Ratio Total Liabilities Total Assets. Financial ratios are used by businesses and analysts to determine how a company is financed. Most lenders will look for ratios below 36 so if yours is higher you may need to prioritize clearing debt faster in 2021.

For example to live on 40000 a year youd need 1 million. For example if your total debt per month is 1500 and your income is 3000 this calculation gives you a 05 or 50 debt-to-income ratio. You should have a quick ratio of 10 or more to be able to meet your financial obligations.

Part of our goal in rating the financial performance of charities is to help donors assess the financial capacity and sustainability of a. Investment Ratio Investment Assets Net Worth Investment ratio measures how much of your net worth is in investments. Financial ratios help you make sense of the numbers presented in financial statements and are powerful tools for determining the overall financial health of your company.