Impressive Define Classified Balance Sheet

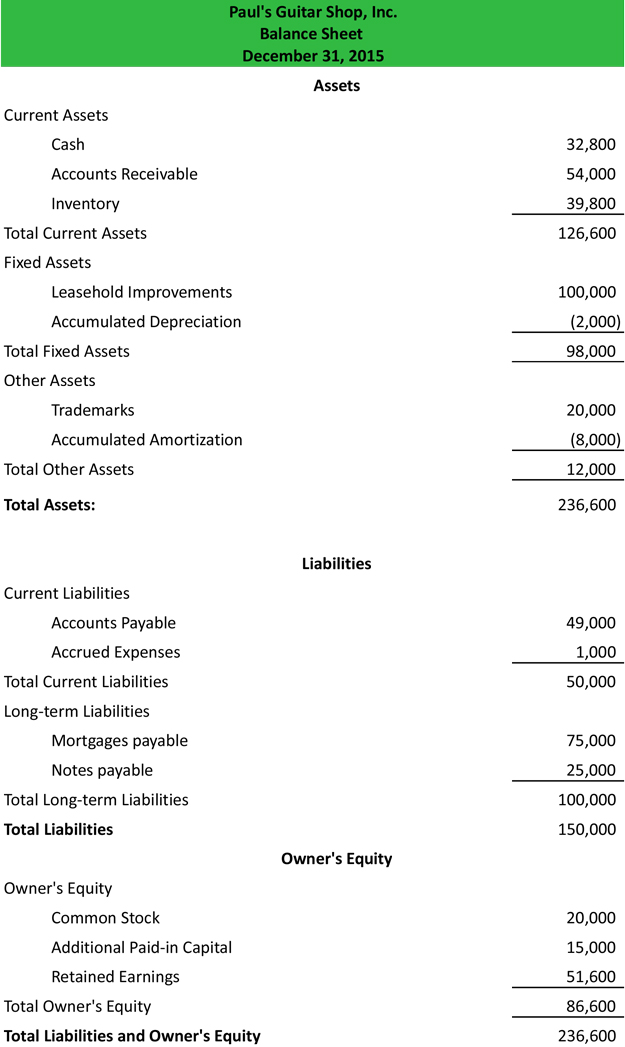

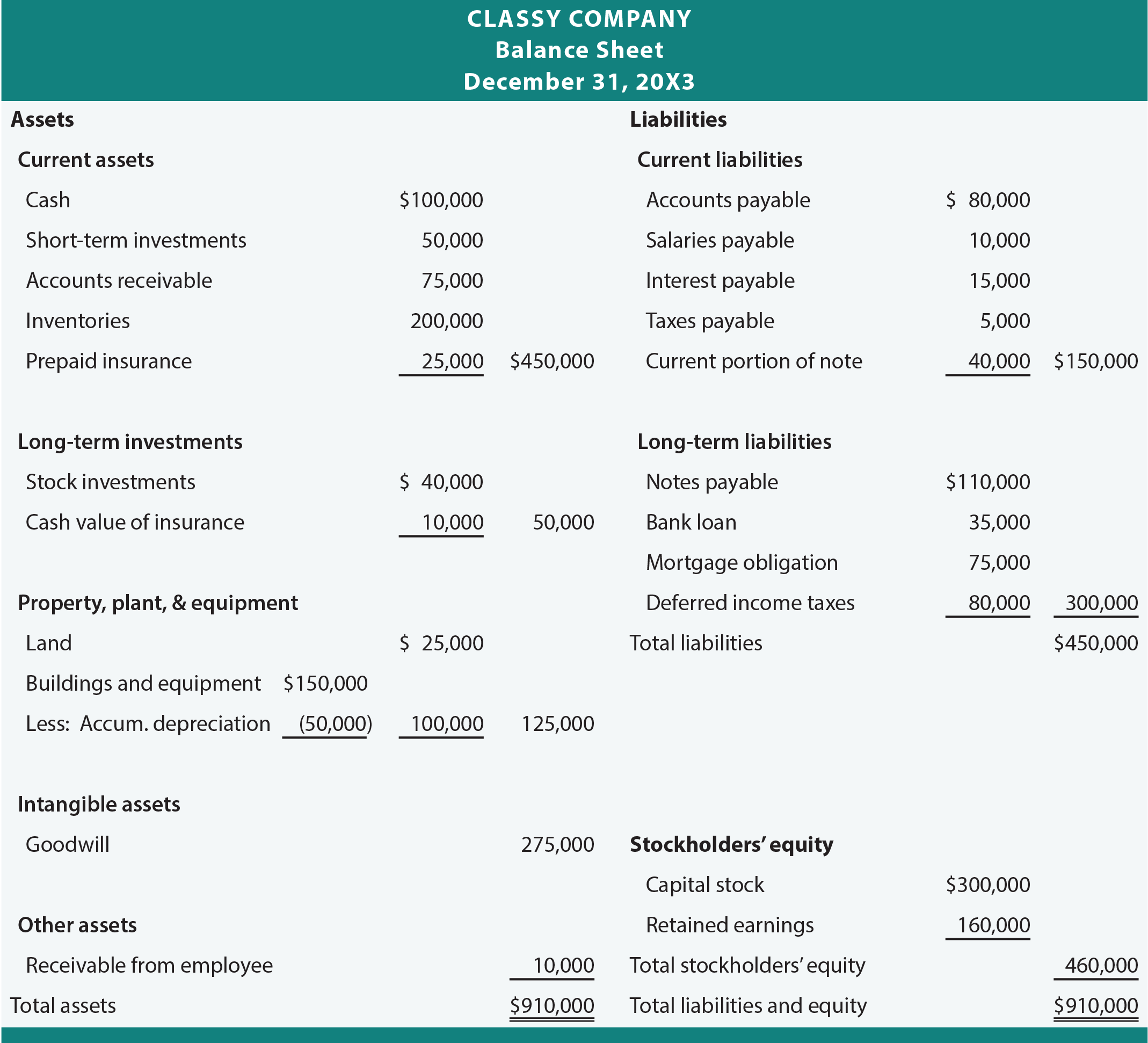

In other words it breaks down each of the balance sheet accounts into smaller categories to create a more useful and meaningful report.

Define classified balance sheet. It breaks each account into smaller sub-categories to provide more value for the user of. A balance sheet is a financial statement that reports a companys assets liabilities and shareholders equity. For example all current assets such as cash and accounts receivable show up in one grouping.

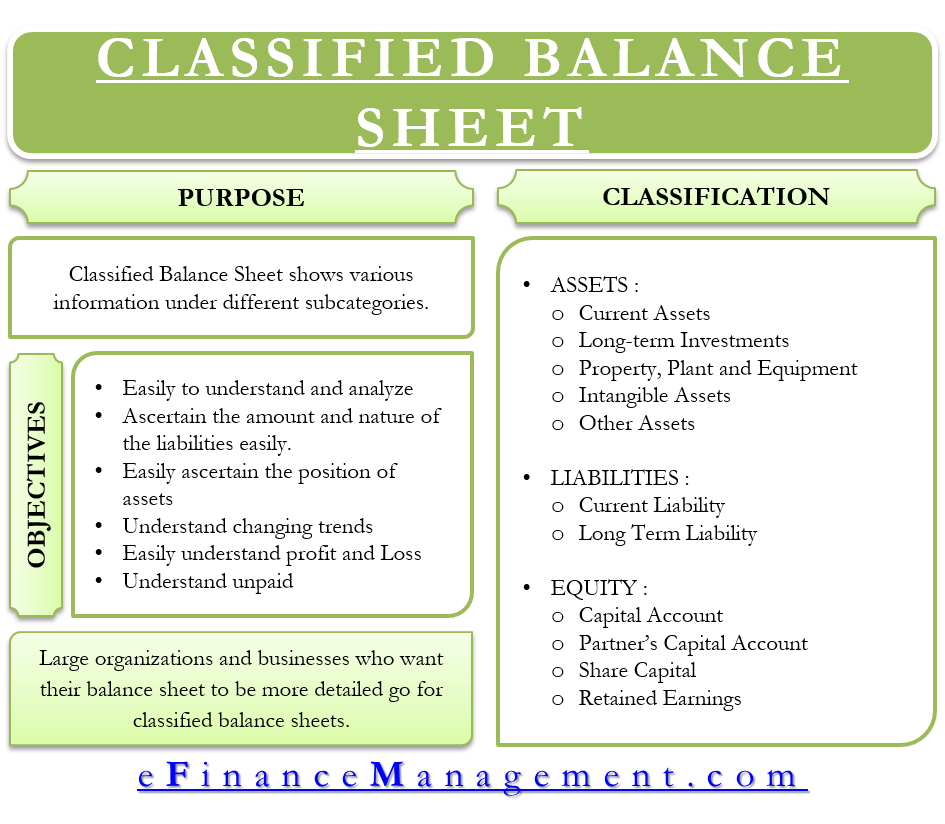

A classified balance sheet is a financial statement with classifications like current assets and liabilities long-term liabilities and other things. For example most balance sheets use the following asset classifications. A balance sheet that includes these subtotals is called a classified balance sheet and is the most common form of presentation.

The balance sheet is one of the three. A classified balance sheet is a financial statement that reports asset liability and equity accounts in meaningful subcategories for readers ease of use. What is a Classified Balance Sheet.

Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a companys assets that are cash or can be converted into cash immediately. Property plant and equipment. When to Use an Unclassified Balance Sheet.

A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts. A classified balance sheet groups like accounts together. A classified balance sheet is one that arranges the balance sheet accounts into a format that is useful for the readers.

This presentation is needed in order to derive liquidity ratios such as the current ratio that depend on the presentation of current asset and current liability subtotals. What is a classified balance sheet. To learn more see Explanation of Balance Sheet.