Glory Preparation Of Financial Statements Questions And Answers

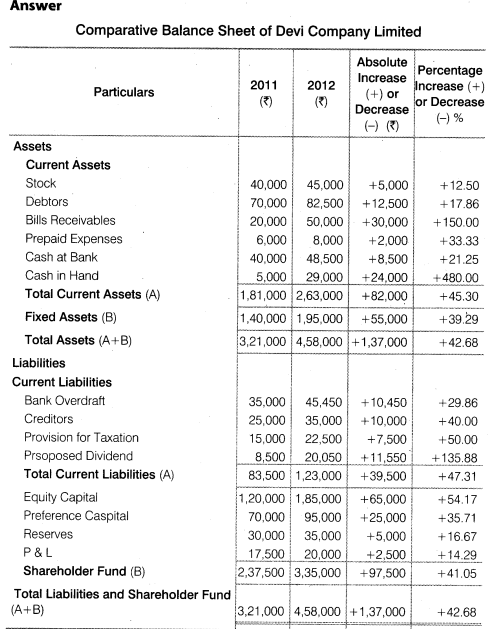

B Prepare a balance sheet as at 31 December 2014.

Preparation of financial statements questions and answers. Finance costs Kmillion 8 x 3690million 295 Less finance costs paid 200 Finance costs accrued 095 Total liability to statement of financial position 3690 095 K3785m The finance cost of the convertible loan note is based on its effective rate of 8 applied to carrying amount of the loan of K3690million on 1 October 2013 which amounts to K295million. From the following balances taken from the books of Simmi and Vimmi Ltd. Depreciation Machinery by 10 and Amortization of Patents by 20.

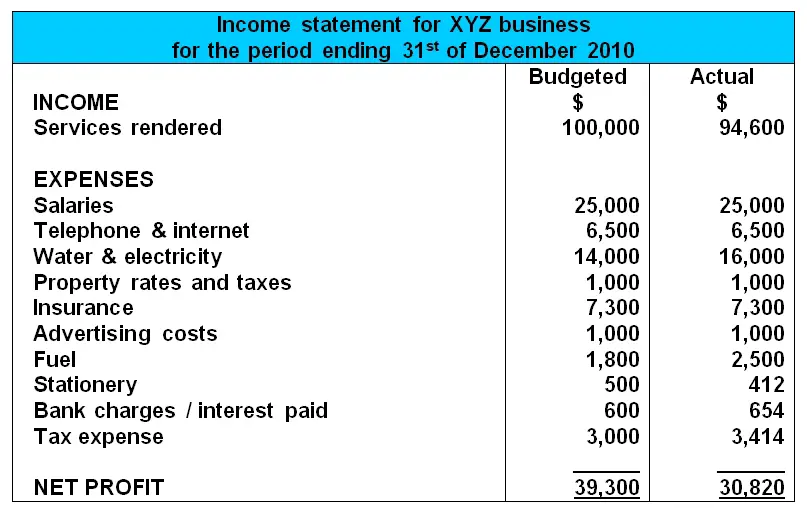

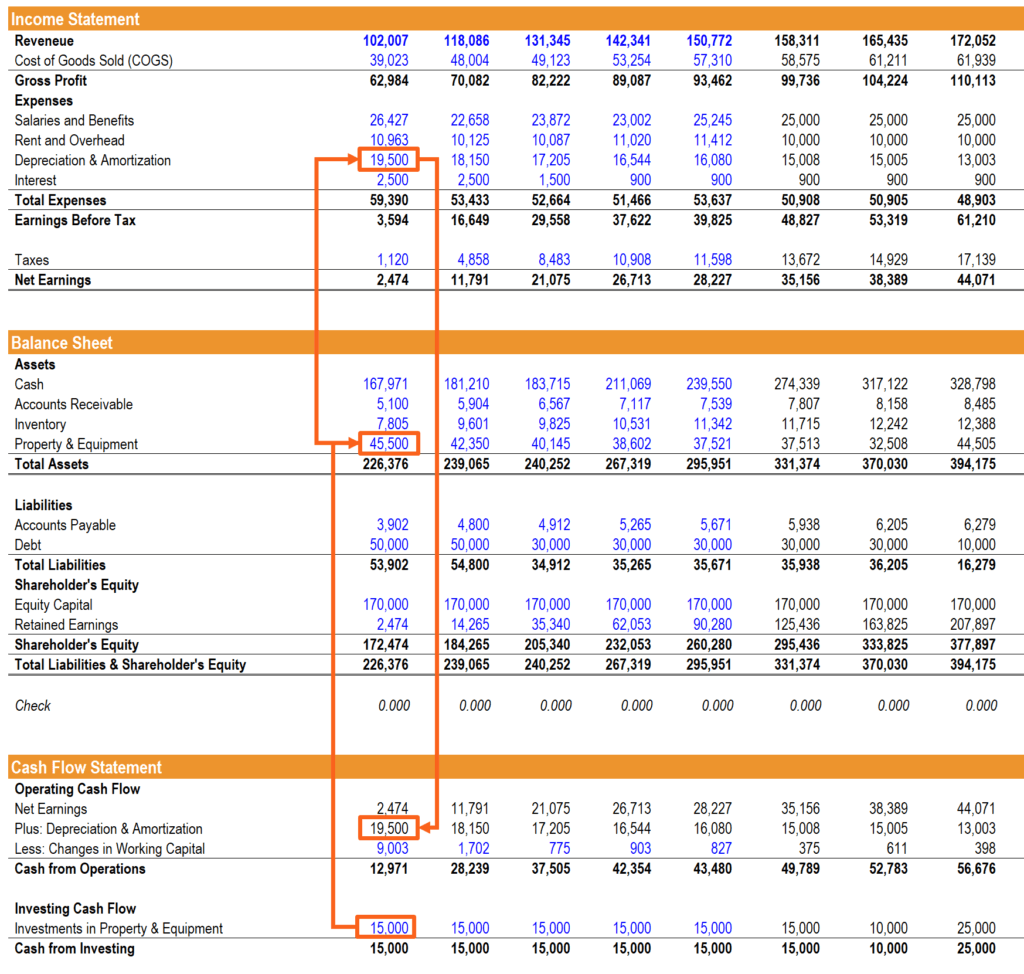

Statement of retained earnings. Use a structured approach to answering each question. Prepare the financial statements for ABC Corporation.

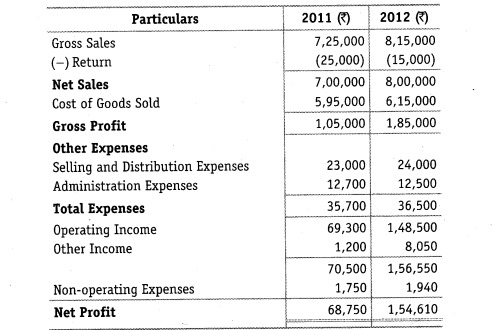

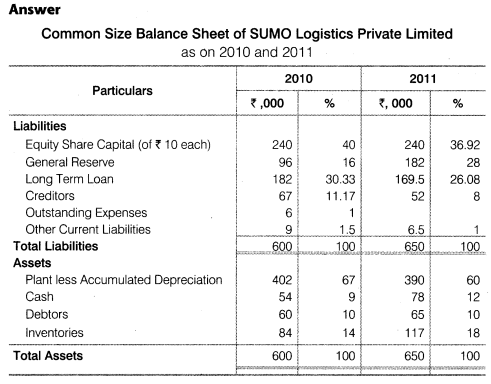

Prepare Trading and Profit and Loss Account for the year ended 31st March 2016 and Balance Sheet as at that date after taking into account the following. FINANCIAL STATEMENTS WITH ADJUSTMENTS You have learnt in the previous lesson how to prepare Trading Ac Profit Loss Ac and Balance Sheet. 23 Financial Statements Questions and Answers.

Take a couple of seconds to plan your answer and repeat the question back to the interviewer out loud you buy some time by repeating part of the question back at the start of your answer. Are the assets which get generated during the course of operations and are likely to be converted in the form of cash or getting utilized during the normal operational cycle of the business within a short span of time of one year. For the year ending March 31.

There is no definitive answer the question is meant to assess whether the candidate can apply the knowledge they have gained to the case study. Explain share capital reserves and surpluses. Financial Statements I Numerical Questions Solutions 1.

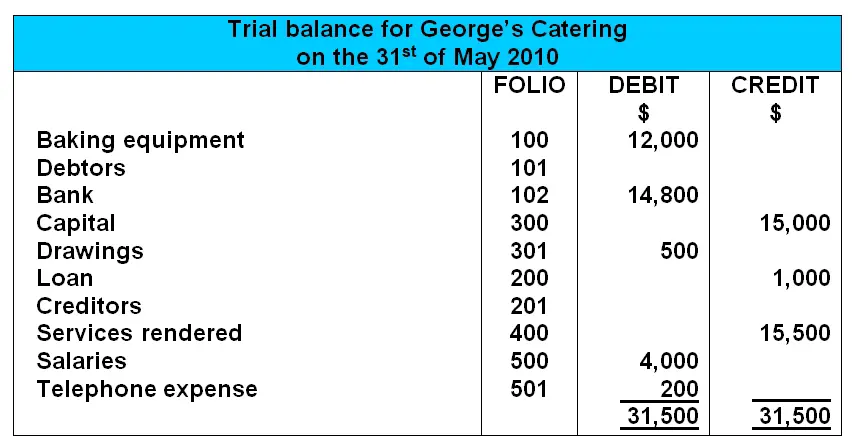

Question 2 tests understanding of the conceptual framework underpinning financial statement. For the year ended 31 December 2014 b Balance Sheet as at 31 December 2014. Prepare Adjustment Entries Adjusted Trial Balance and three Informal Financial Statements excluding cash flow statement.