Recommendation Cecl Credit Loss

Current Expected Credit Loss CECL.

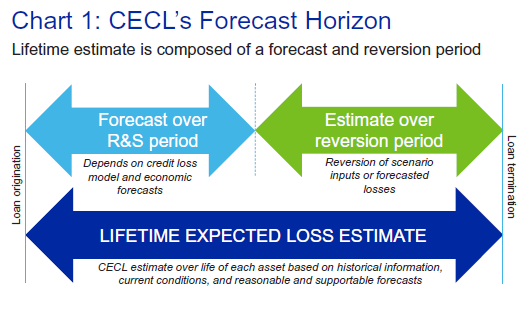

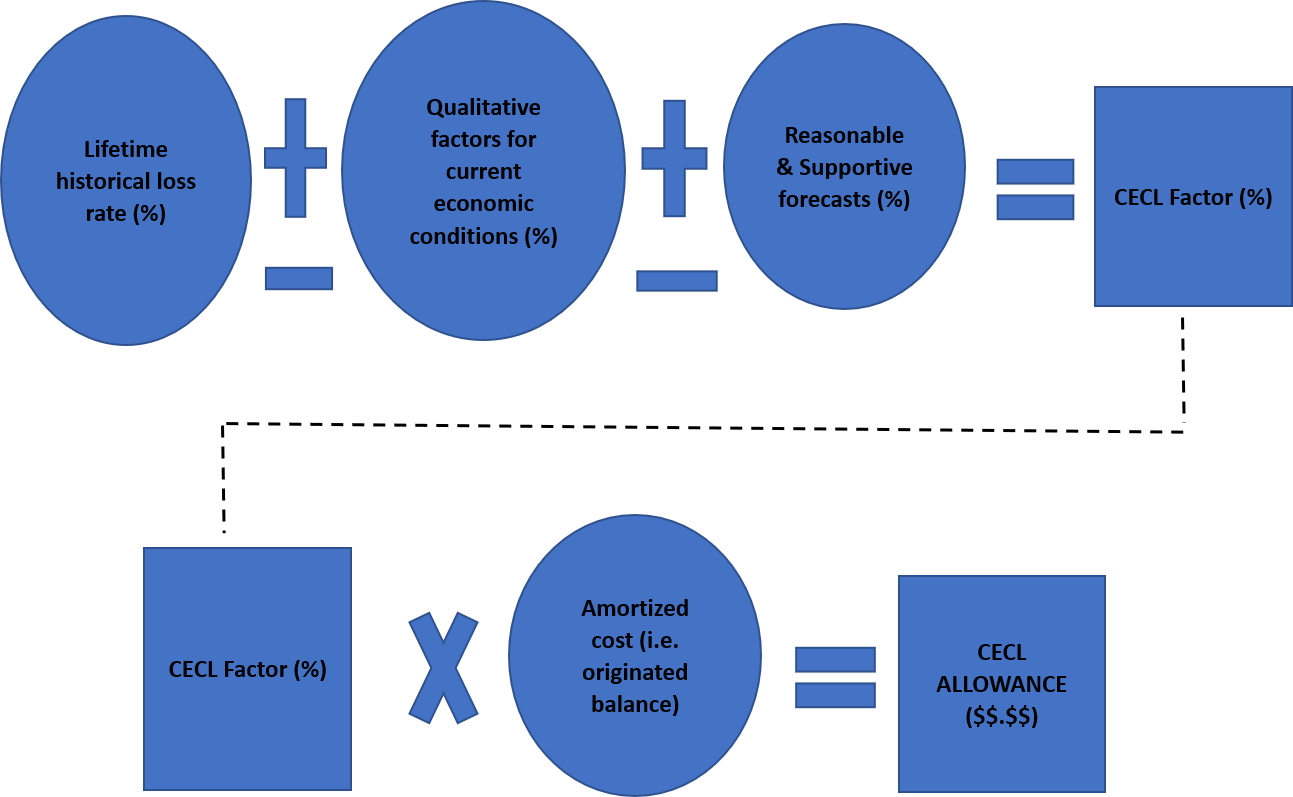

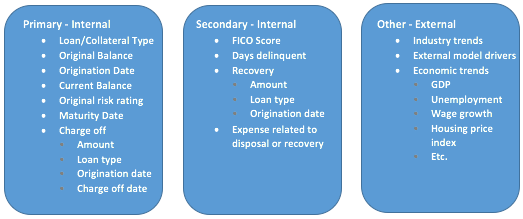

Cecl credit loss. The new CECL accounting standard requires institutions to incorporate forward-looking information in their estimate of expected lifetime losses. The new standard is expected to result in greater transparency of expected losses at an earlier date during the life of a loan. Join CECL experts as they discuss ways in which this requirement can be achieved by community banks and credit unions.

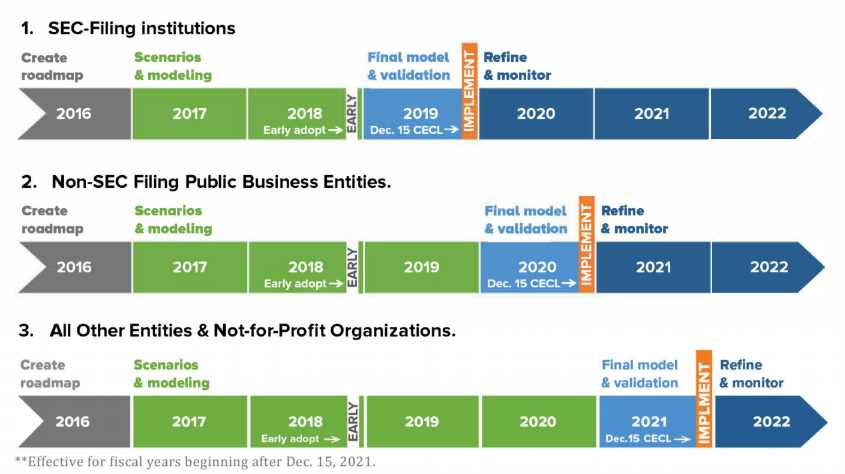

CECL Workshops Learn about upcoming CECL workshops. Deloittes CECL guidance and insights can help you prepare. 2016-13 Measurement of Credit Losses on Financial Instruments which introduces the current expected credit losses methodology CECL for estimating allowances for credit losses.

Because the CECL model does not have a minimum threshold for recognition of credit losses entities will need to measure expected credit losses on in-scope assets even if there is a low risk of loss investment-grade held-to-maturity debt securities for example. Early recognition of expected losses might not only help investors but might also create a more stable banking system. The CECL model would replace the multiple impairment models for different assets such as loans receivables purchased credit impaired loans and hold-to-maturity ebt securities that currently exist in US.

This video is a very brief introduction to FASBs Current Expected Credit Loss accounting standard also known as CECL. A Comprehensive Look at the CECL Model 6. The current expected credit loss CECL standard is the most impactful accounting change in years.

Previously companies could calculate their bad debt reserve based on years past. 444 Estimating Credit Losses by Using Methods Other Than a DCF Method 44 4441 Accrued Interest 46 445 Weighted-Average Remaining Maturity Method 47 446 Practical Expedients Related to Measuring Expected Credit Losses 51 4461 Collateral-Dependent Financial Assets 51 4462 Collateral Maintenance Provisions 56. In June 2016 the FASB issued ASU No.

The standard is effective for most SEC filers in fiscal years and interim periods beginning after December 15 2019 and for all others it takes effect in fiscal years beginning after December 15 2022. Language would be added as of December 31 2019 indicating this guidance on Schedule A1d item 54 Allowance. This course includes references to accounting standard codification ASC and provides insights into implementation challenges.