Best One Time Expenses Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

With Odoo Expenses youll always have a clear overview of your teams expenses.

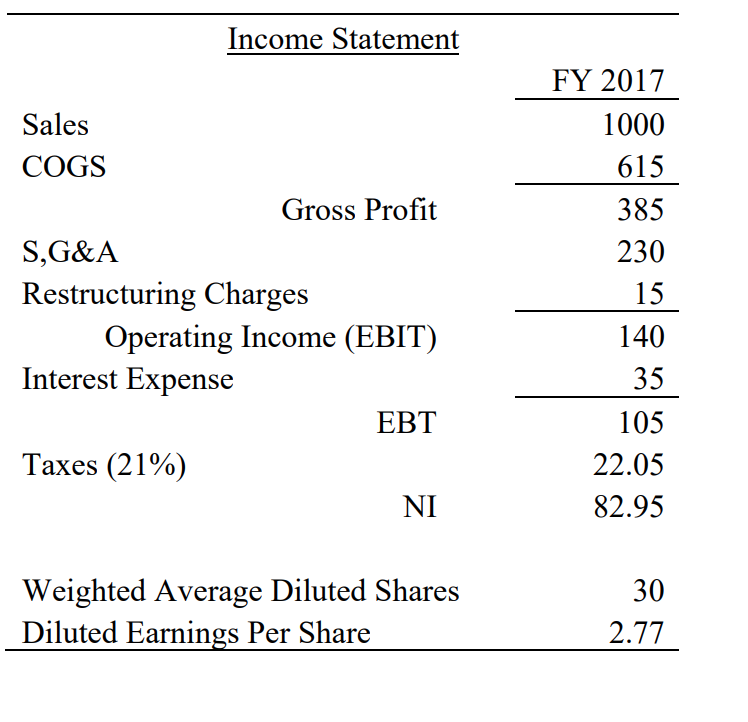

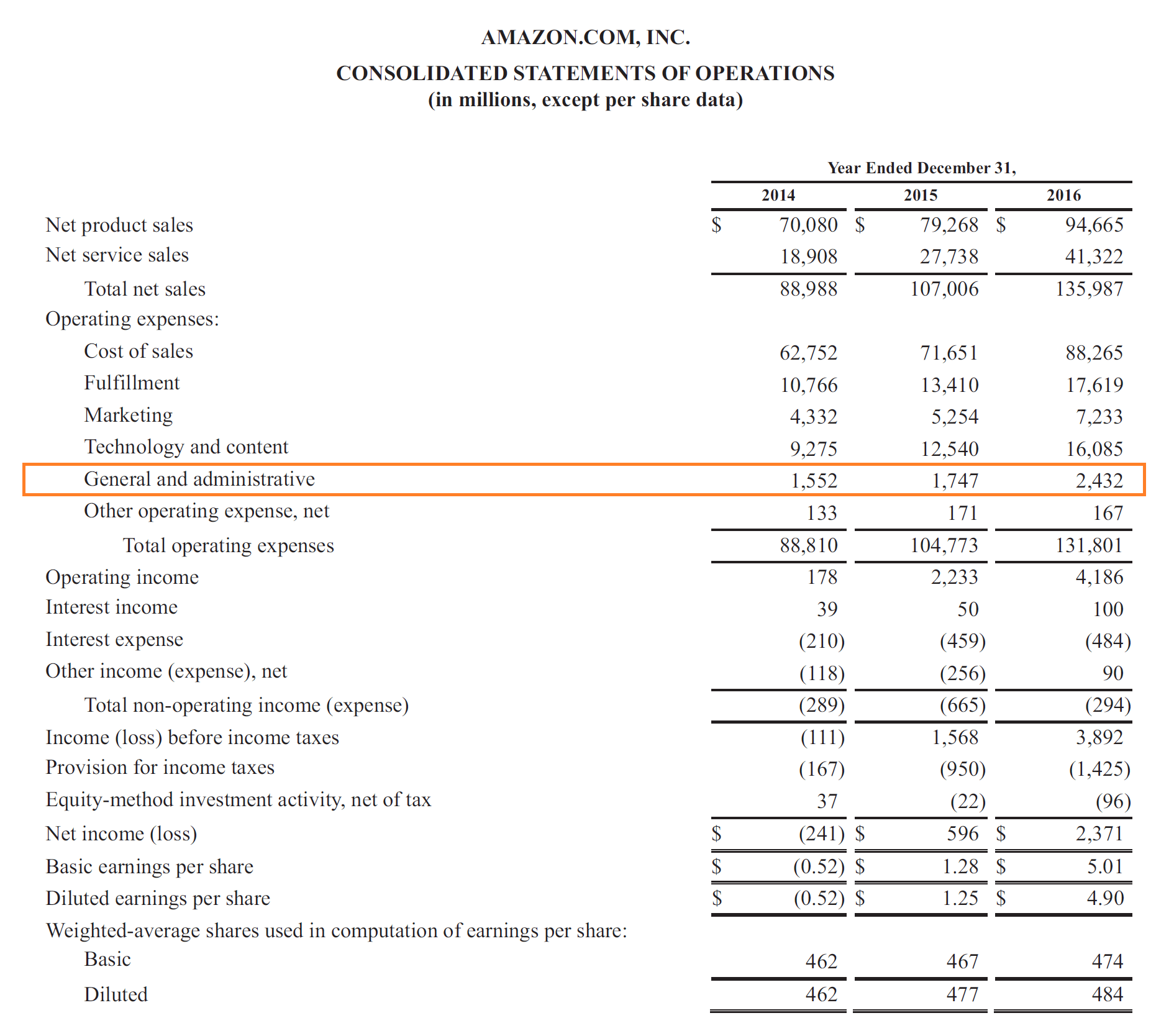

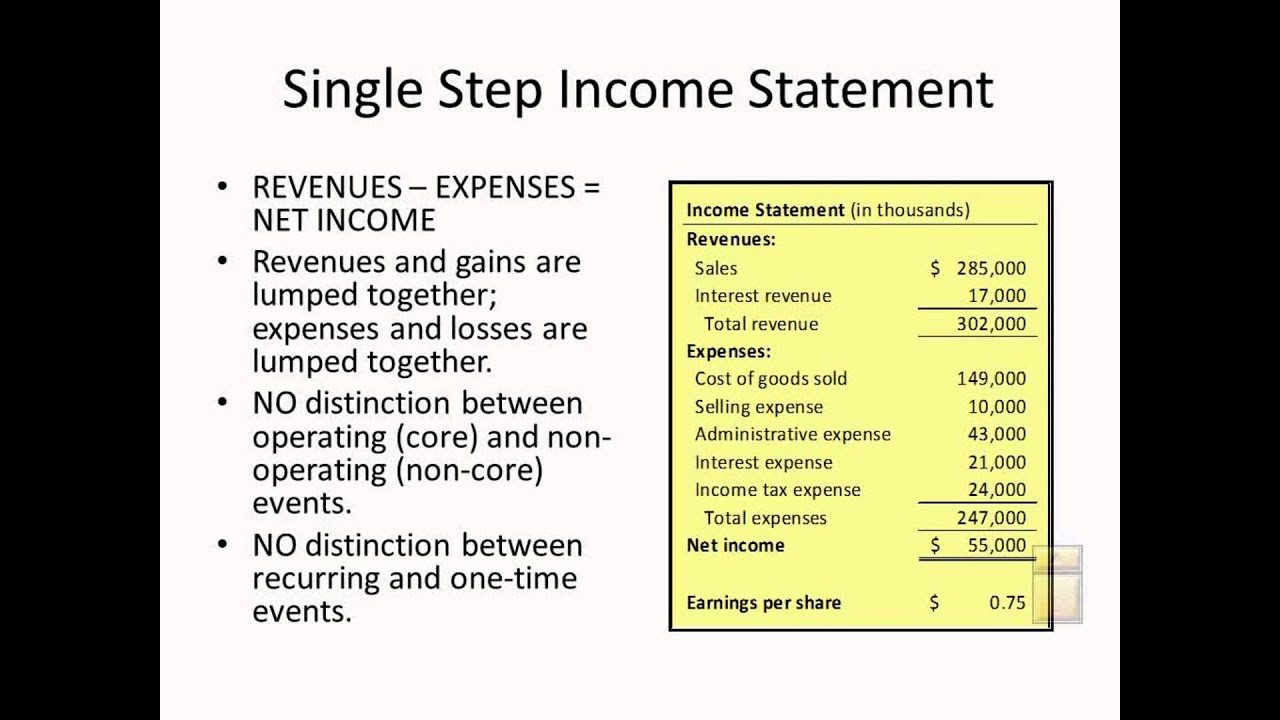

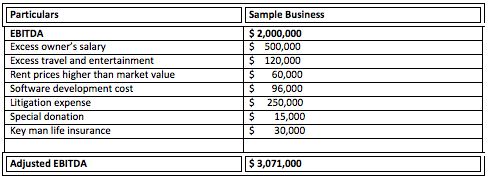

One time expenses income statement. Also known as profit and loss PL statements income statements summarize all income and expenses over a given period including the cumulative impact of revenue gain expense and loss transactions. These are adjustments that eliminate one-time gains or losses other unusual items non-recurring business elements expenses of non-operating assets and the like. With Odoo Expenses youll always have a clear overview of your teams expenses.

42 IFRS Supplement 3If a company prepares a statement of comprehensive income then disclosure is required for 1 other comprehensive income classified by nature 2 comprehensive income of associates and joint ventures and 3 total comprehensive incomeThe statement of comprehensive. The income statement records all revenues for a business during this given period as well as the operating expenses for the business. The income statement is a report showing the profit or loss for a business during a period as well as the incomes and expenses that resulted in this overall profit or loss.

Ad Managing your expenses has never been easier. Not surprisingly the income statement is. 1 An income statement always represents a period of time like a month quarter or a year.

Validate or refuse with just one click. Every appraiser employs such income statement adjustments in the process of adjusting normalizing historical income statements. An income statement otherwise known as a profit and loss statement is a summary of a companys profit or loss during any one given period of time such as a month three months or one year.

One-time expenses or incomes include restructuring fees gain on winning a lawsuit etc. An example of a one-time expense would be costs associated with a relocation while an example of one-time revenue would the periodic sale of an assetsuch as a buildingat a profit. One-time expenses or revenues arise from non-operating activities that is those outside a companys usual activities.

The income statement above shows five full calendar years plus a last twelve months LTM period as of 93013. In certain cases the business can also reserve a place before or after the income tax expense line for extraordinary expenses which include one-time costs such as lawsuit settlements. Validate or refuse with just one click.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/GENOte23saleonetimeitem-ef0a5df240b94d3c98042e62dca9b917.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)