Fine Beautiful Treatment Of Dividend In Consolidation

Proposed Dividend belonging to t.

Treatment of dividend in consolidation. PARENT VS SUBSIDIARY Powered by. If the company owns 20 or less of the other company it will use the cost method which reports dividend income and the asset value of the investment. But the dividend which belongs to the holding company will simply be added to either Consolidated Profit and Loss Account or Capital Reserve depending on whether the said dividend has been proposed out of post-acquisition profits or pre-acquisition profits.

A If the whole of the dividend is from the pre-acquisition profits it must be treated as capital gain and must be used either for reducing the cost of shares or for increasing capital reserve. Dividend received from the subsidiary company out of pre-acquisition profits. Dividend received by the holding company from its subsidiary out of pre-acquisition profits is treated as capital receipt.

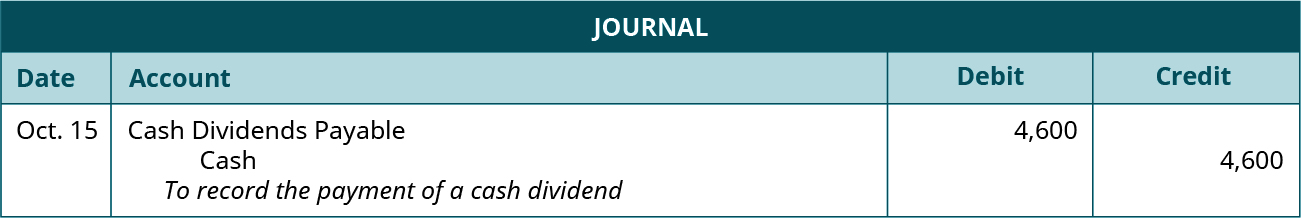

If the company owns more than 20 it will use the equity method which reports its share of the firms earnings. For individuals or companies with relatively small investments in other companies the dividend payout is treated as income. The journal entry for its record being as follows.

The recipient records this transaction when it gains the rights to the payout. Consolidated Financial Statements of Group Companies 54 Section 129Clause 3of the Companies Act 2013 requires companies compulsory to prepare Consolidated Financial Statements According to this section where a company has one or more subsidiaries it. Besides the treatment of proposed dividend may alternatively be summed up as under.

The company receiving the payment books a debit to the dividends receivable account and a credit to the dividend income account for the payout. Special rules may apply where a recipient is a member of a consolidated group or a multiple entry consolidated MEC group. On consolidation we need to eliminate the element of the dividend that is paid received within the group So on the balance sheet reduce receivables by the amount of dividend receivable from another company in the group and reduce obligations by the same amount.

Its effect on the holding companys balance sheet is as follows. If dividend is proposed by a subsidiary company Profit and Loss Appropriation Account will be debited and Proposed Dividend Account will be credited which will be shown as a current liability in the Balance Sheet. This Video will be.

/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)