Brilliant Tds Certificate Axis Bank

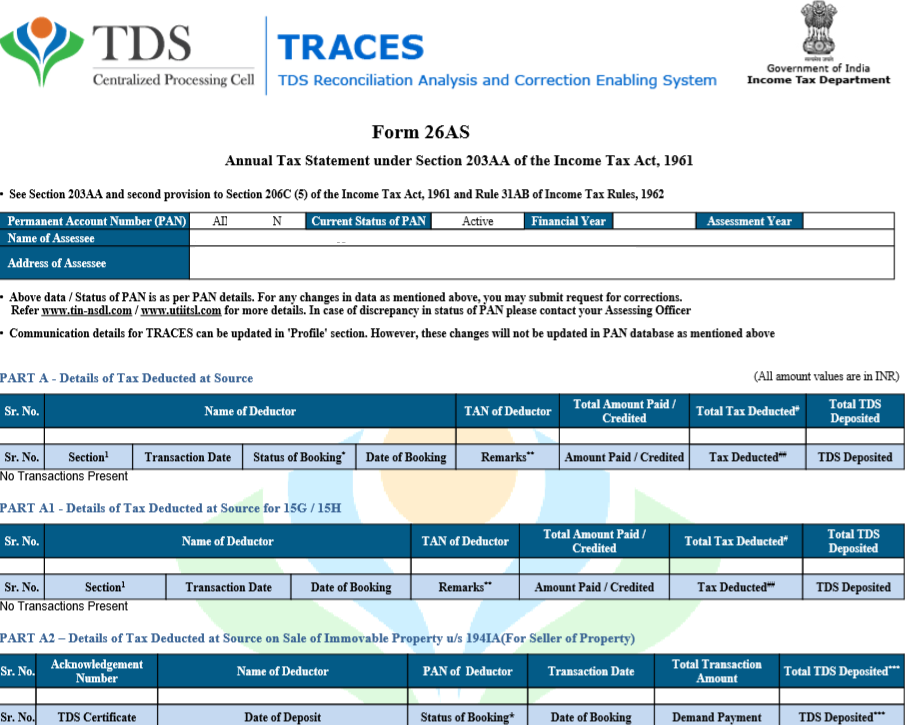

All deductors including government deductors who deposit TDS in the Central Government Account through book entry shall issue TDS certificate in Form No.

Tds certificate axis bank. Quarter TDS Certificate Form 16A issued to Deductees. Form 16 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Ad Find Bank Certificate.

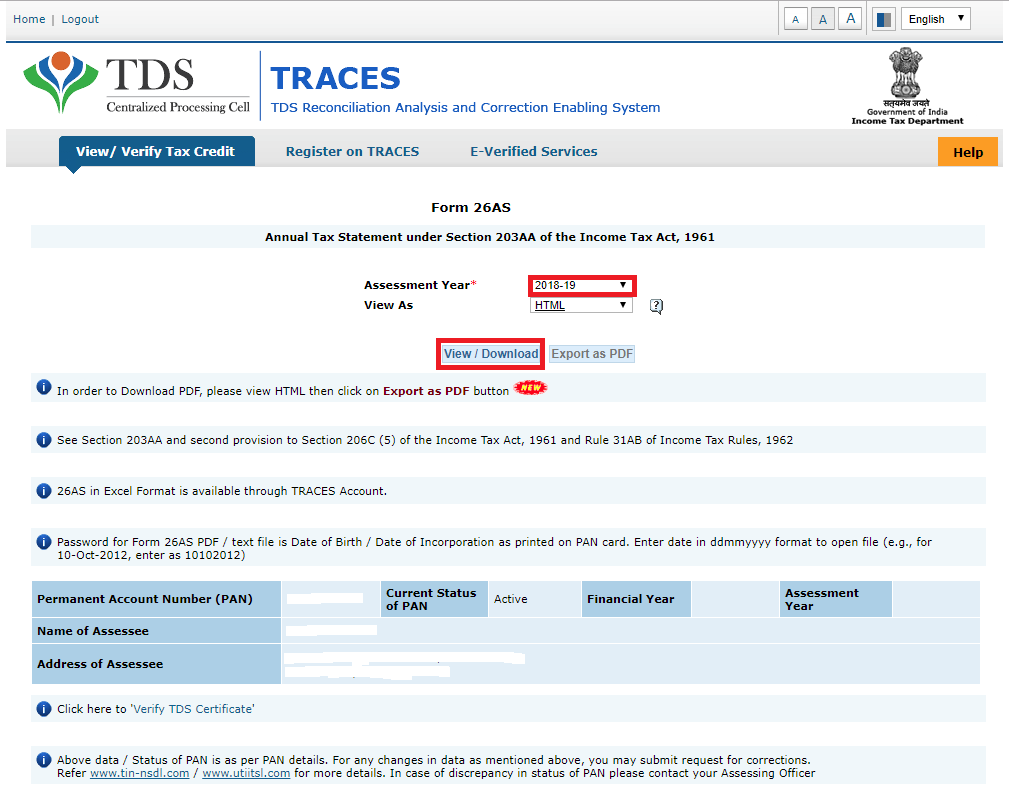

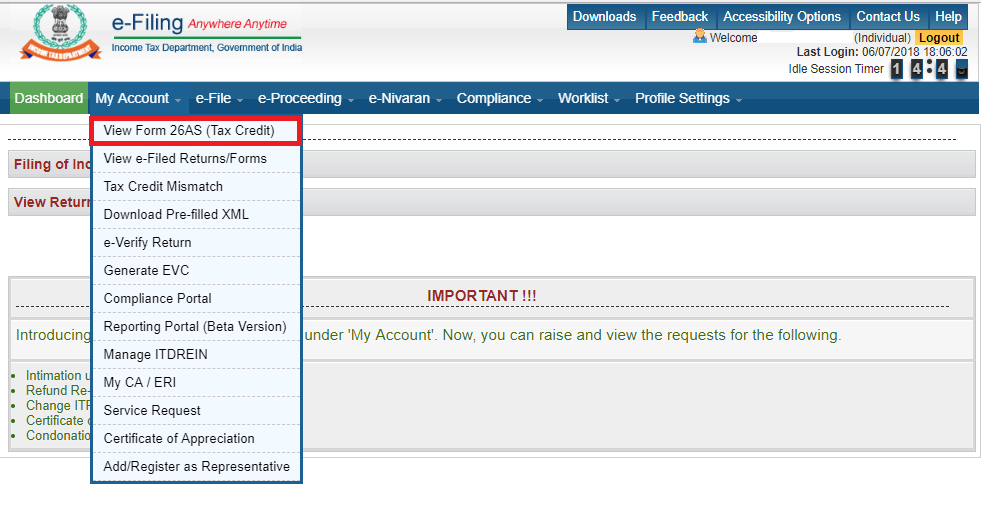

Click on the option Tax Credit Statement or TRACES 26AS Services to view your Form 26AS. Ad Find Bank certificate. Ad Find Bank Certificate.

It informs you that tax has been deducted from your fixed deposit and the same has been paid to the government. 16A generated through TIN central system and which is downloaded from the TIN website with a unique TDS certificate number in respect of all sums. It is mandatory to issue these certificates.

Step 1. To know the status of your existing complaint you. These certificates provide details of TDS TCS for various transactions between deductor and deductee.

Open a Tax Saver Fixed Deposit by simply filling out the application form and submitting it at any of your nearest Axis Bank branches. The documents will differ for individuals and type of entity depending on the eligibility for the same. Axis Banks online tax payment facility allows you to pay your income tax corporation tax wealth tax tax deducted at source TDS tax collected at source TCS etc.

Yes Bank has a facility to download TDS certificate. IFSC CODE and BSR CODE both are used to repersent the uniqueness of. You can also apply for Fixed Deposit online.