Perfect Petty Cash In Trial Balance

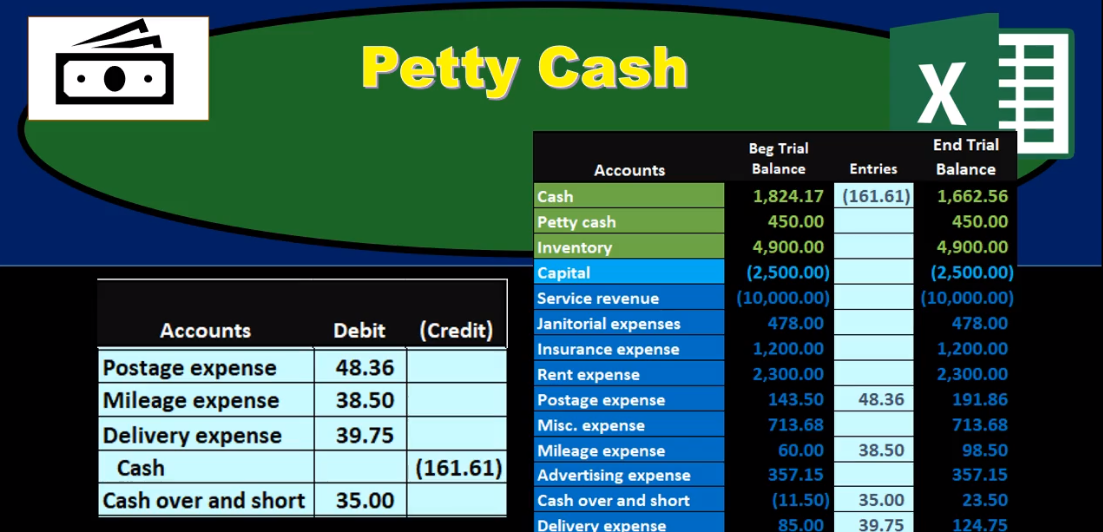

The entry simply records the movement of money in the business from cash to petty cash.

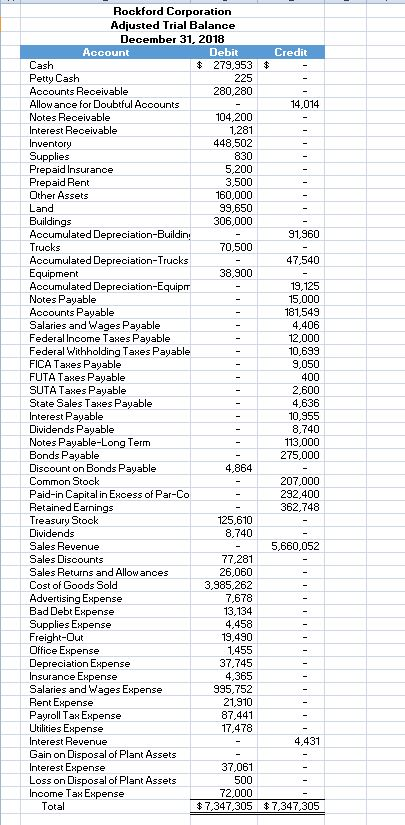

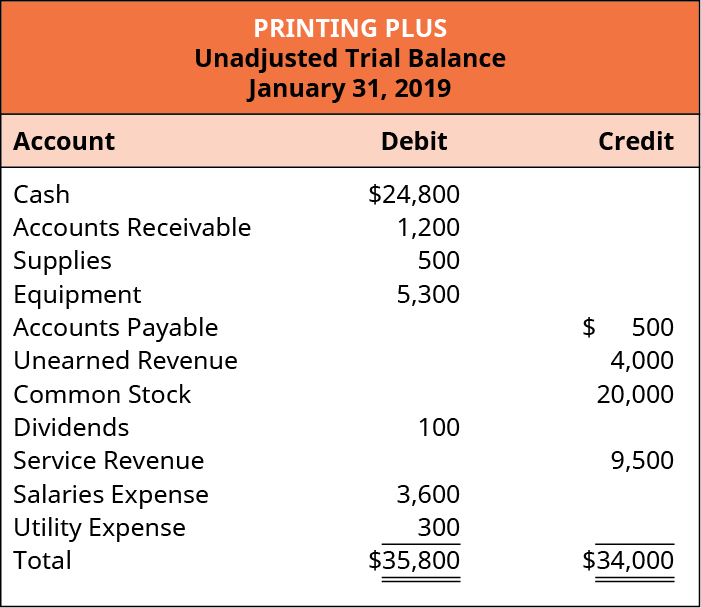

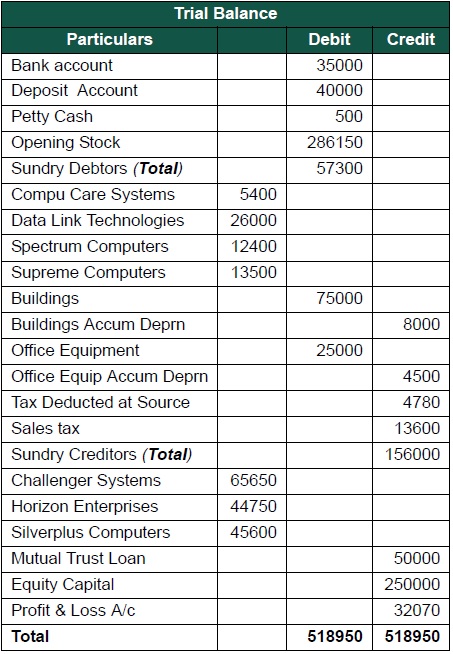

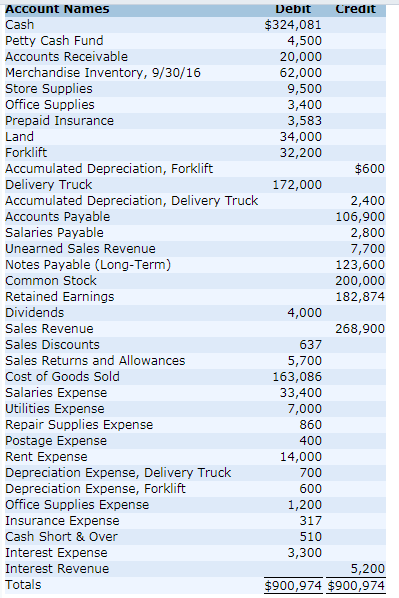

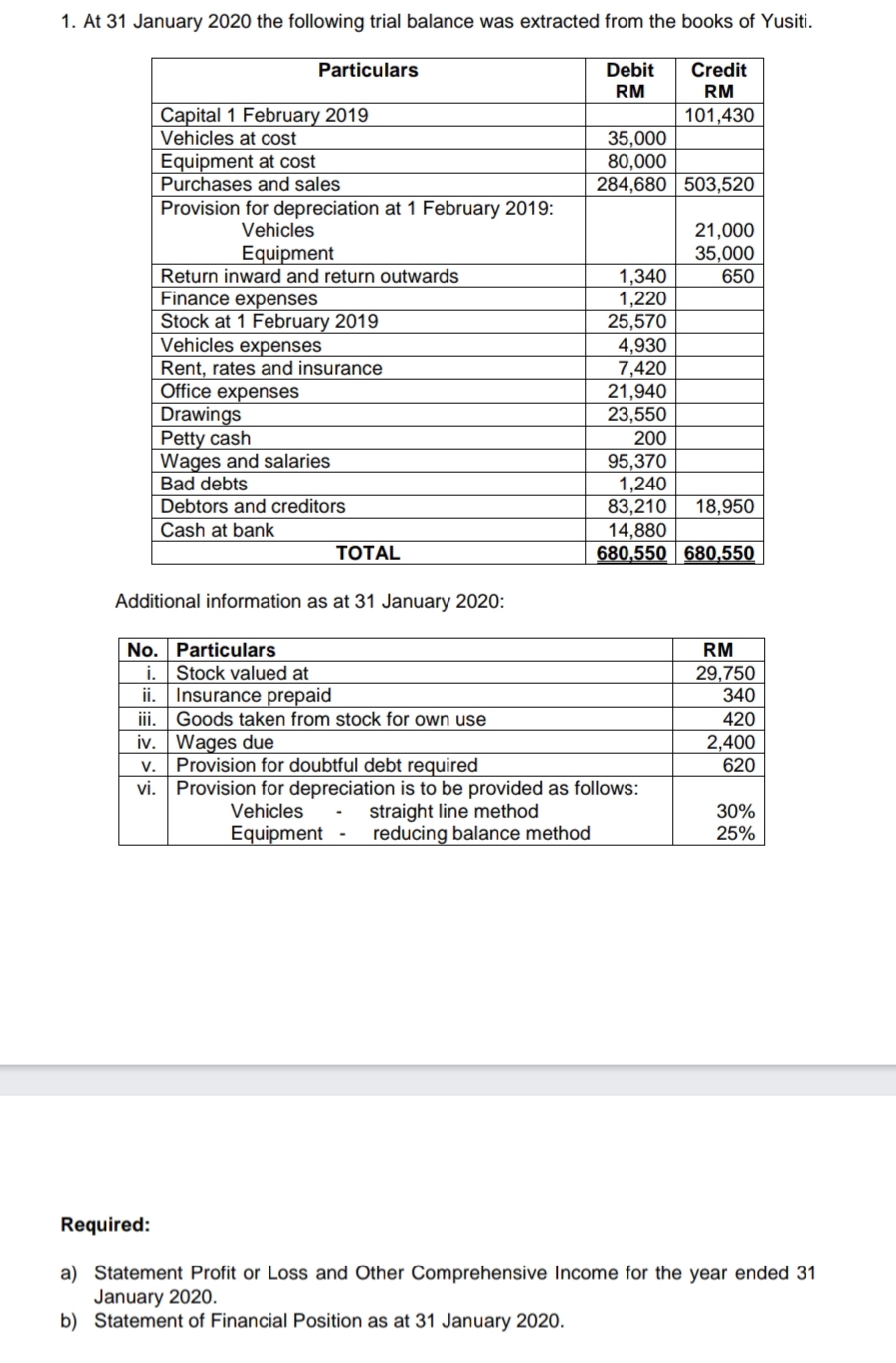

Petty cash in trial balance. At the end of an accounting period a count of the petty cash shows that the fund contains cash of 240 and expense vouchers for supplies of 40 and. The total is your ending balance. Cash 74210 Accounts receivable 13500 Supplies 200 Prepaid rent 3200 Merchandise inventory 24 265.

It should also be kept in mind that petty cash book is not like the cash book. Q does not keep receivables and payables control accounts. What I had done was set up a checking account in QB called petty cash and every purchase I made using my own cash not from the business I wrote a check for that amount in QB as a petty cash check using the appropriate expense account materials expense etc.

It is to be noted that the amount of cash in the hands of the petty cashier is a part of the cash balance therefore it should be included in the cash balance when the latter is shown in the trial balance and the balance sheet. This initial setup amount is sometimes referred to as your float. It contains a list of all the general ledger accounts.

Where petty cash appears in the balance sheet. 1 In recording an issue of shares at par cash. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts ie whether they are mathematically correct and balanced.

Petty cash appears within the current assets section of the balance sheet. It should match your cash on hand. For this transaction the Accounting equation is shown in the following table.

The Closing Balance of petty cash book is computed by deducting Total expenditure from Total cash receipt as received from the head cashier. The following entry is made. I would like to add a practical example for clear understanding.