Supreme Wrong Income In 26as

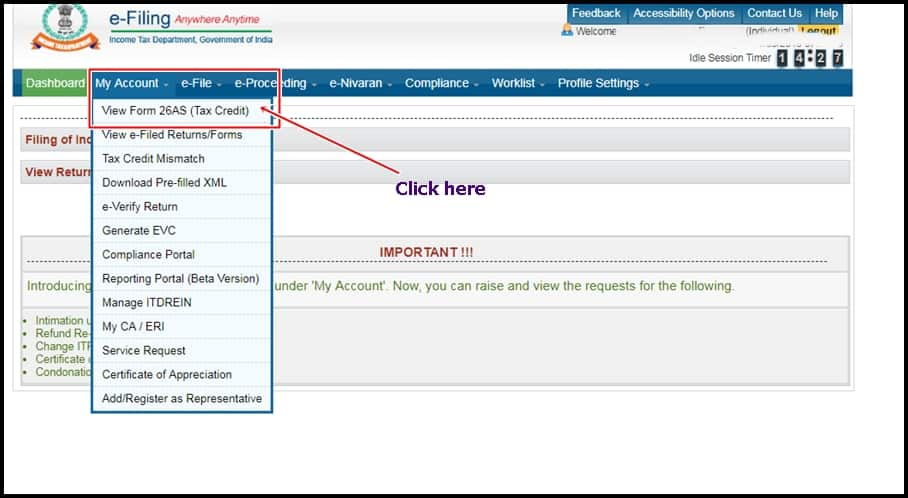

Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

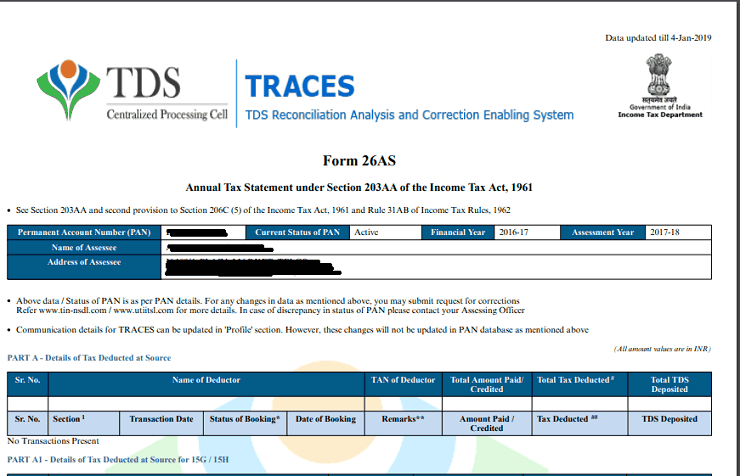

Wrong income in 26as. The possible reasons for incorrect credits in Form 26AS can be on account of wrong data provided by the deductor in the quarterly TDSTCS statement. Now they are comparing the gross income mentioned in form 26AS. For instance if the deductor employer or bank has made a mistake while depositing your tax against your PAN with the government then in such a case you need to.

The last date for filing an income tax return ITR is approaching soon and it is important for taxpayers to crosscheck the details mentioned in Form 26AS. Also provide them your Form 26AS and mention Part E to justify reason for your inquiry. Form 26AS basically provides details or information that the tax department has about transactions done by you during the year.

It is pertinent to note that the deduction of income-tax does not appear automatically in the Form 26AS. The following are the common errors leading to TDS mismatch. 1133 lacs was wrong.

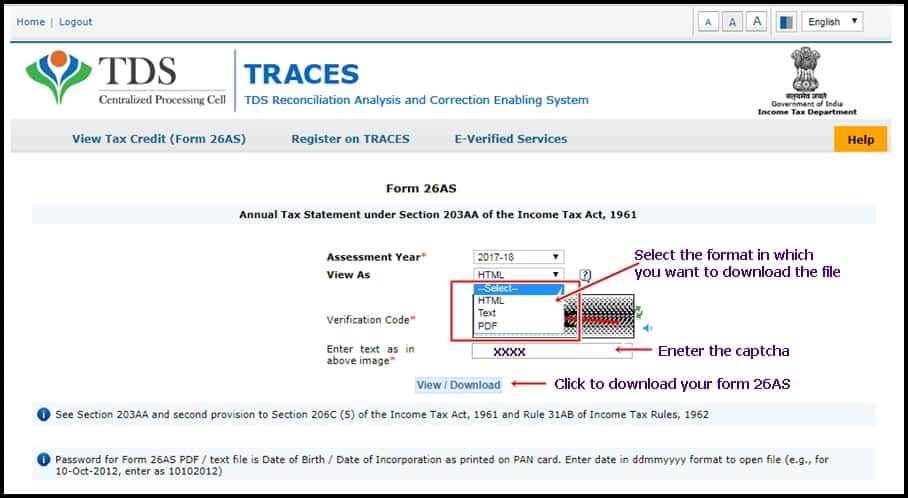

This mistake of incorrect amount being reflected in Form 26AS could be due to the reason that the bank has made error in data entry. Click View Tax Credit Form 26AS. You may request the deductor to rectify the TDSTCS statement using prescribed correction statement.

I do not have to pay extra 20 tax on this interest income because it is not updated in form 26AS. For this you must first compare both the forms and see which entries are not reflecting in Form 26AS. If I update the PAN in my bank account both income and TDS will start showing in Form 26AS correctly.

Wrong income and TDS in Form 26AS Dear sir I live in rented premises. The person deducting TDS has not filed TDS return. The address mentioned in the 26AS might be the address of the Axis Regional Head office.