Spectacular Newly Incorporated Companies Financial Statements

Startups venture-backed PE-backed and public.

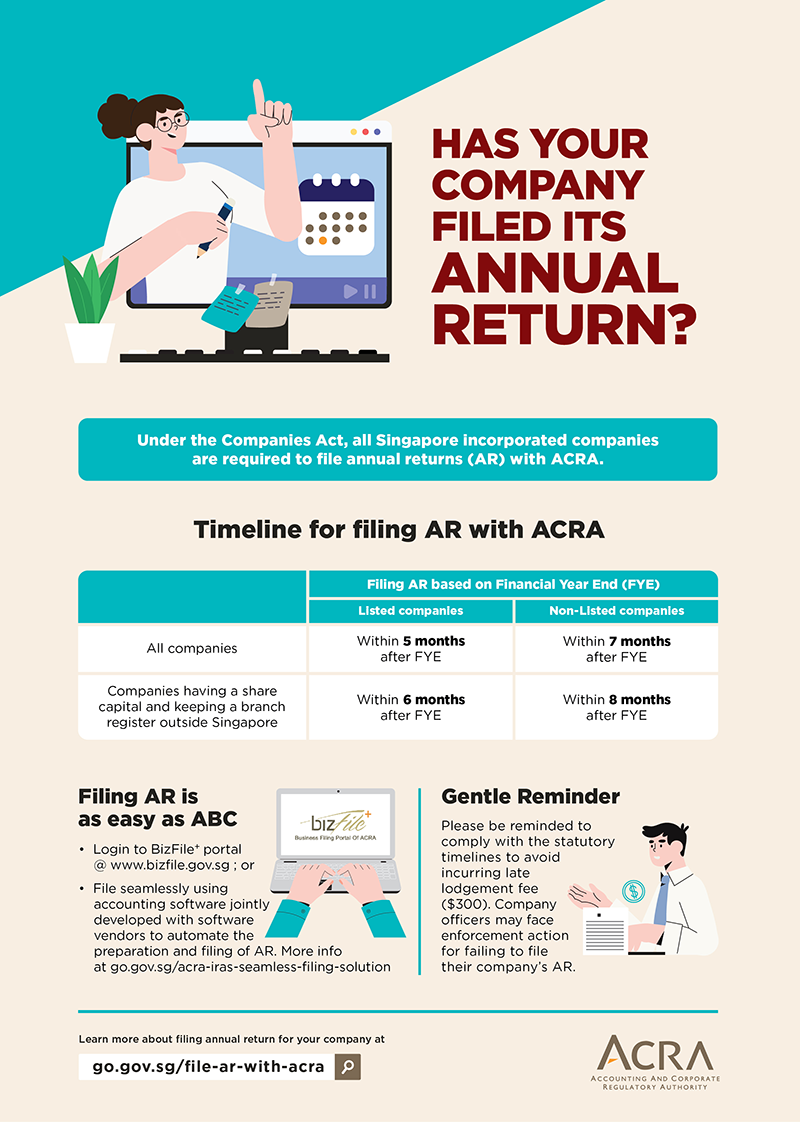

Newly incorporated companies financial statements. The follow are explanations of the four major financial statements. The bank is not a first-time adopter of IFRS see Technical guide. In the absence of such notification before 31 August 2018 the anniversary of the date of incorporation is deemed by law to.

This publication provides a set of sample financial statements of a fictitious group of companies. It illustrates one possible format for financial statements based on a fictitious banking group involved in a range of general banking activities. Ad Research and analyze 3 Million companies.

Financial Year in case of newly incorporated company under New Act. As per the provisions of Companies Act 2013 it clearly states that where a company has been incorporated after the 1st day January of any year the period ending on the 31st day of March of the following year shall be the first accounting year in respect whereof the financial statement of a company or body corporate is made up. The names of people and entities included in this publication are fictitious.

See detailed company financials including revenue and EBITDA estimates and statements. Aside from having fewer fields to fill qualifying small companies are also not required to submit financial statements and tax computation because essential tax information and financial information would have to be declared in the Form C-S. Request A Demo And Speak To A FactSet Specialist About Our Flexible Data Solutions.

No Need to Submit Documents unless Requested. As per the New Act every company is obliged to have the financial year starting from 1st April to 31st March. Filing Financial Statements in XBRL.

Creating these financial statements may seem pointless because you dont have an ongoing business at this point. Ad Best-in-Class Data Marketplace Connected Symbology for Financial Professionals. Financial year cannot exceed 12 months.

-act-2017/Companies_AGMtimelines.png)

-act-2017/Companies_AGMtimelines_2018.png)