Unbelievable Adjusting Entry For Accrued Interest On Notes Payable

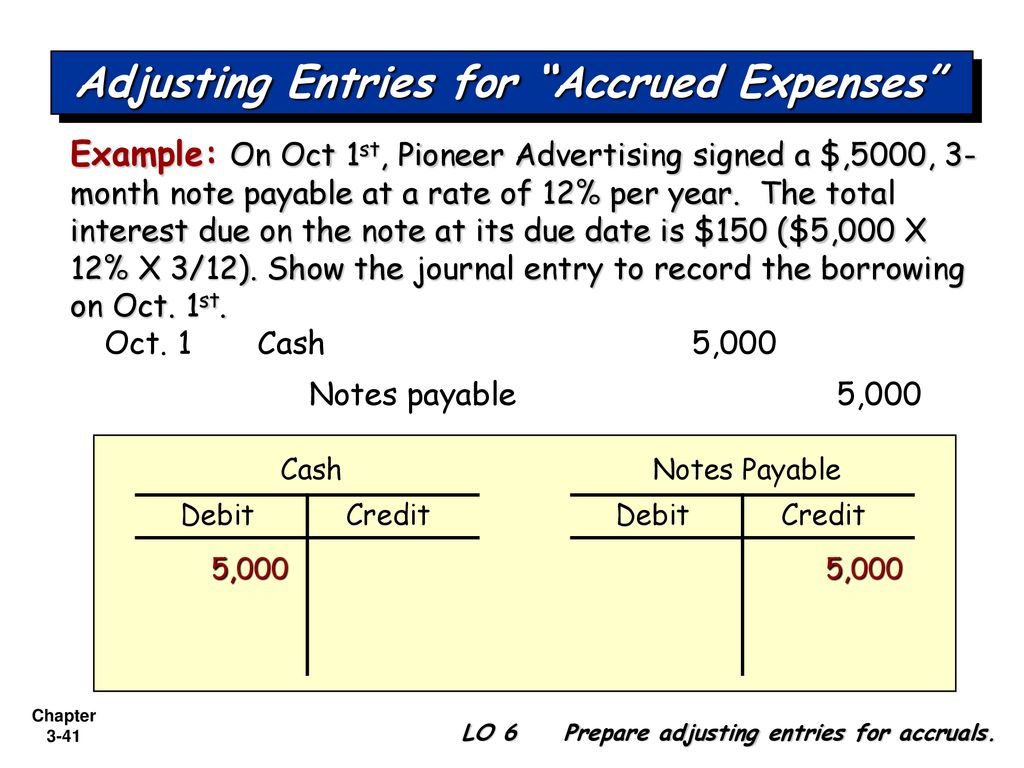

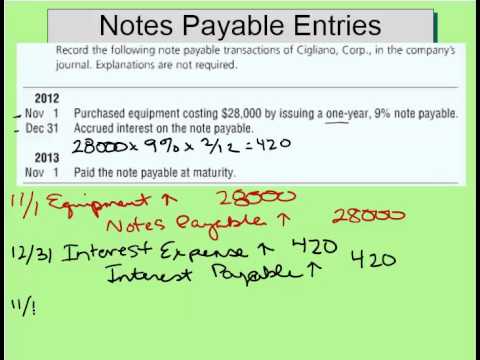

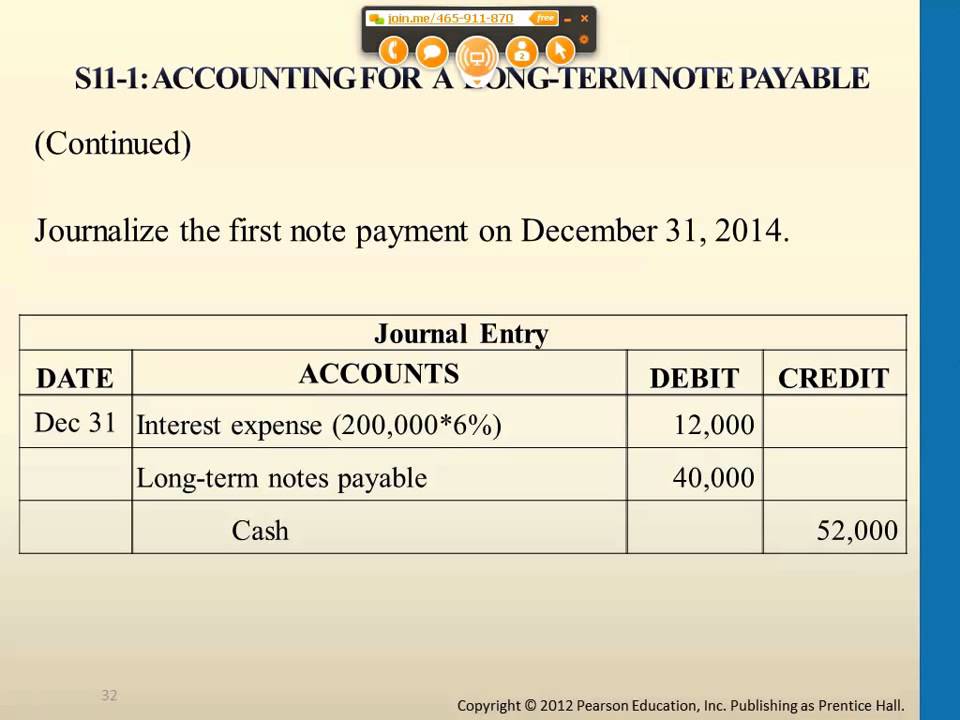

To illustrate how to record adjusting entries to the trial balance assume that a corporation issues a one-year notes payable for 30000 with 8 percent interest.

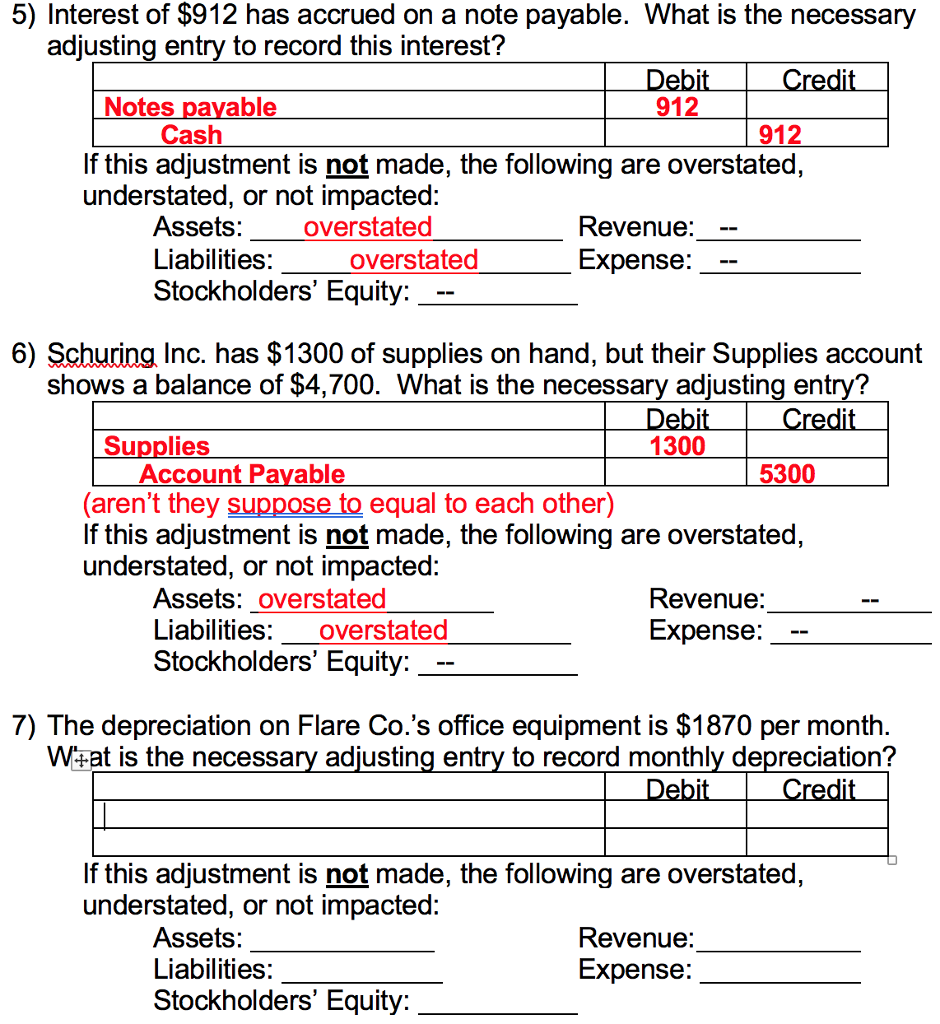

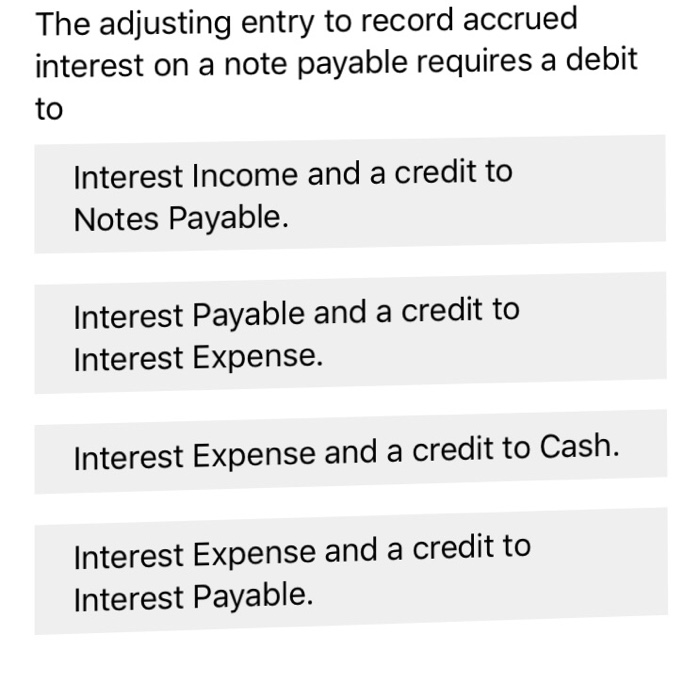

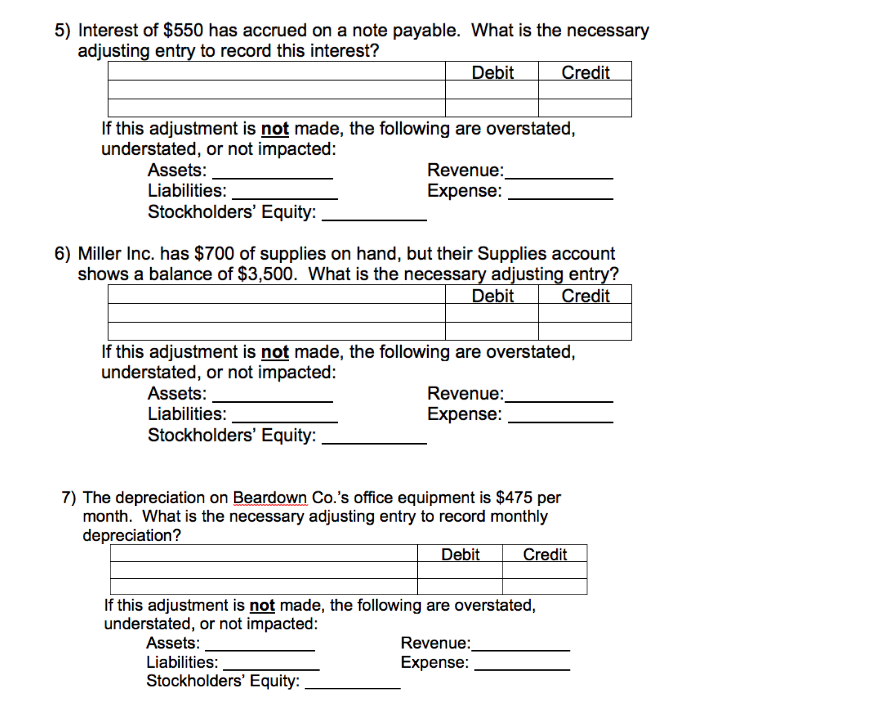

Adjusting entry for accrued interest on notes payable. A debit to Interest Expense and a credit to Interest Payable for 500 3. A debit to Interest Expense and a credit to Cash for 500 b. The adjusting entry to record interest that has accrued on a note payable to the bank will cause an immediate.

Adjusting journal entry required to accrue interest on December 31 2018. A debit to Cash and a credit to Interest Payable for 500 c. At the period-end the company needs to recognize all accrued expenses that have incurred but not have been paid for yet.

Therefore it must record the following adjusting entry on December 31 2018 to recognize interest expense for 2 months ie for November and December 2018. In the future months the amounts will be different. B Services earned but unbilled total 1400.

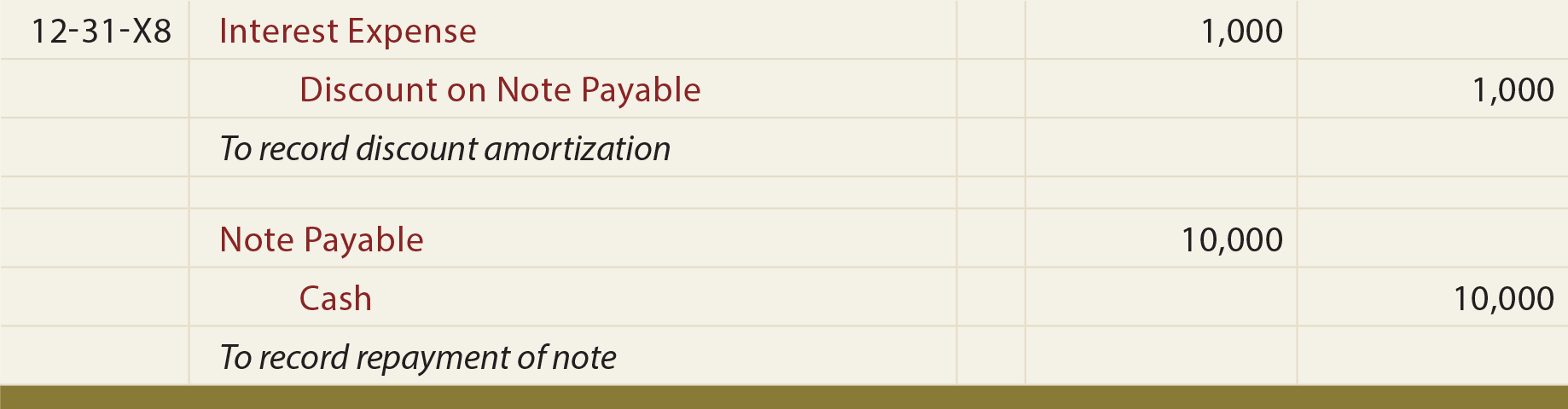

The adjusting entry to record this debt would be. The adjusting entries. To record accrued interest on note at year end.

For example if interest of 1000 on a note payable has been incurred but is not due to be paid until the next fiscal year for the current year ended December 31 the company would record the following journal entry. In this case the company creates an adjusting entry by debiting interest expense and crediting interest payable. Each month that a company has a notes payable an adjusting entry is required to record accrued interest expenses.

Notes Payable principal amount 10000. Interest payable amounts are usually current liabilities and may also be referred to as accrued interest. 10000 x 9 x 60 days remaining in note 360 days in year Cash 10000 75 150 10225.