Spectacular Treatment Of Capital Reserve In Cash Flow Statement

Below are the steps an analyst would take to forecast NWC using a schedule in Excel.

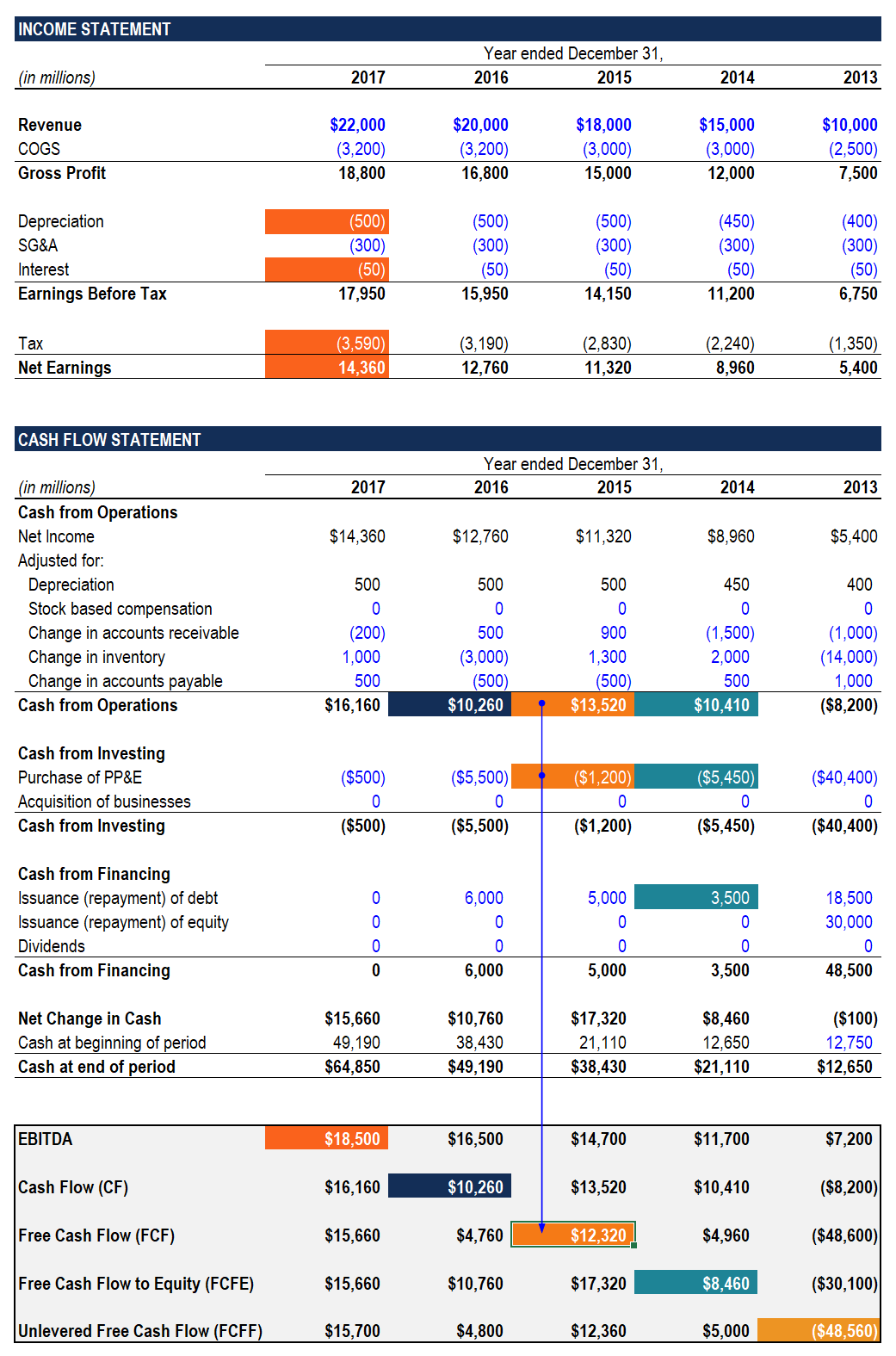

Treatment of capital reserve in cash flow statement. Setting up a Net Working Capital Schedule. The EO reserve balance needs to be added back in order to accurately reflect the cash transactions of the company. A cash flow statement provides information about the historical changes in cash and cash LEARNING OBJECTIVES After studying this chapter you will be able to.

But one only need to account all the receipt and payment of cash in Cash Flow Statement and any Profit or Loss from Sale of any Capital Asset will must needs to be Transferred to Capital Reserve and must be deducted from Sales Proceeds in Cash Flow Statement. These usually arise as a result of stock in excess of par value. Reserve account is a part of a companys net worth.

These can include adjustments for available-for-sale securities and assets. No Treatment needs to be carried out in Cash Flow Statement for Capital Reserve. So No Treatment needs to be carried out in Cash Flow Statement for Capital Reserve.

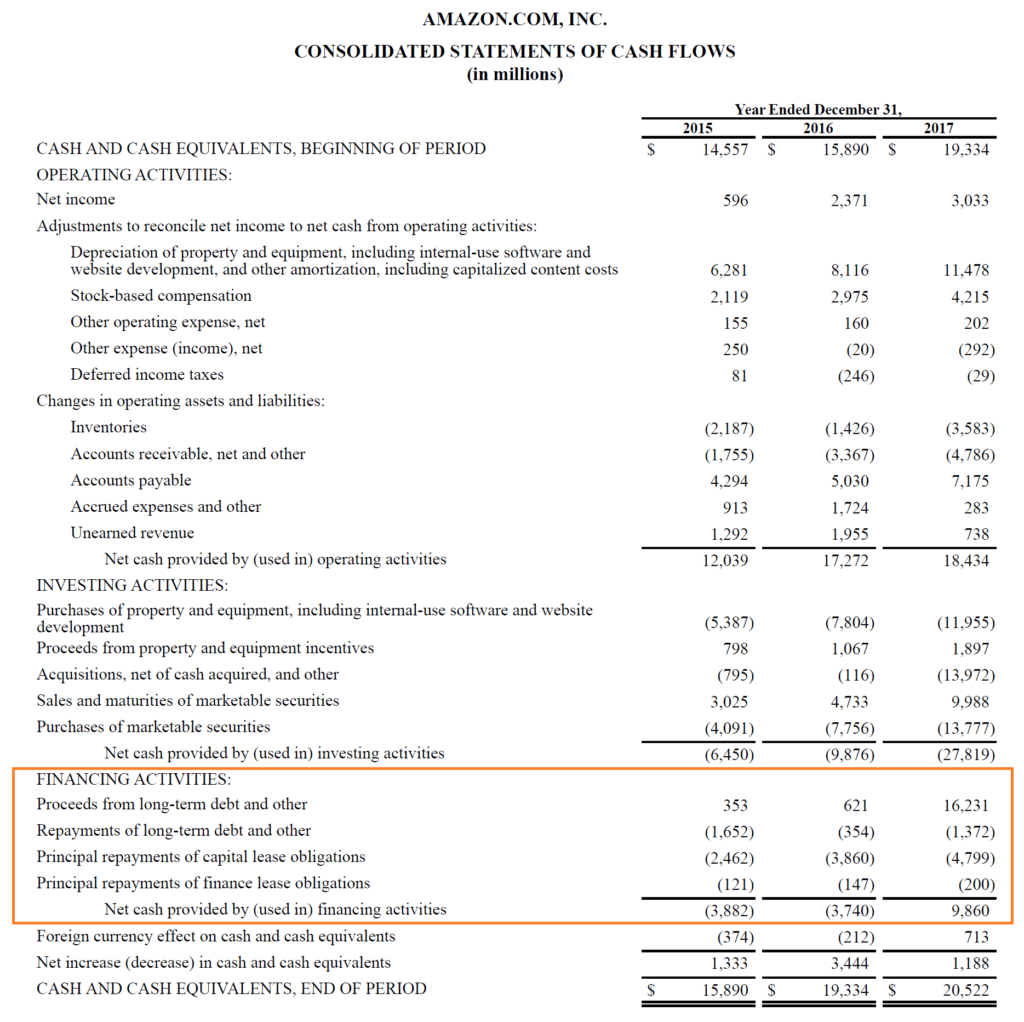

Cash flows from capital and related financing activities include acquiring and disposing of capital assets borrowing money to acquire construct or improve capital assets repaying the principal and interest amounts and paying for capital assets obtained from vendors on credit. State the purpose and preparation of statement of cash flow statement. Differences will be reflected in the changes in operating assets and liabilities or as additions to qualifying assets if interest has been capitalised in the cost of these assets.

Financing cash flows typically include cash flows associated with borrowing and repaying bank loans and issuing and buying back shares. In simple terms retained earnings are net profits that have not been paid to shareholders as dividends. Step 4 Eliminate intragroup transactions.

Classification of certain cash payments and receipts in the statement of cash flows which has led to diversity in practice. Example Following is an illustrative cash flow statement presented according to the indirect method suggested in IAS 7 Statement of Cash Flows. It is also defined as the common and preferred stock a company is authorized to issue according to their corporate charter.