Stunning Verizon Financial Ratios

A liquidity ratio calculated as cash plus short-term marketable investments plus receivables divided by current liabilities.

Verizon financial ratios. Within Communications Services industry 12 other companies have achieved higher Quick. Two-Component Disaggregation of ROE Three-Component Disaggregation of ROE Five-Component Disaggregation of ROE. Find the latest Verizon Communications Inc.

Quick Ratio first quarter 2021 Comment. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio. Total Debt to Enterprise Value 040.

Verizon Communications Inc s Cash cash equivalent grew by 136 in I. View the latest VZ financial statements income statements and financial ratios. Price to Cash Flow Ratio.

Common Stock VZ Nasdaq Listed. Data is currently not available. 67 rows Verizon current ratio for the three months ending June 30 2021 was 089.

The EVEBITDA NTM ratio of Verizon Communications Inc. Verizon Communications Inc. Annual stock financials by MarketWatch.

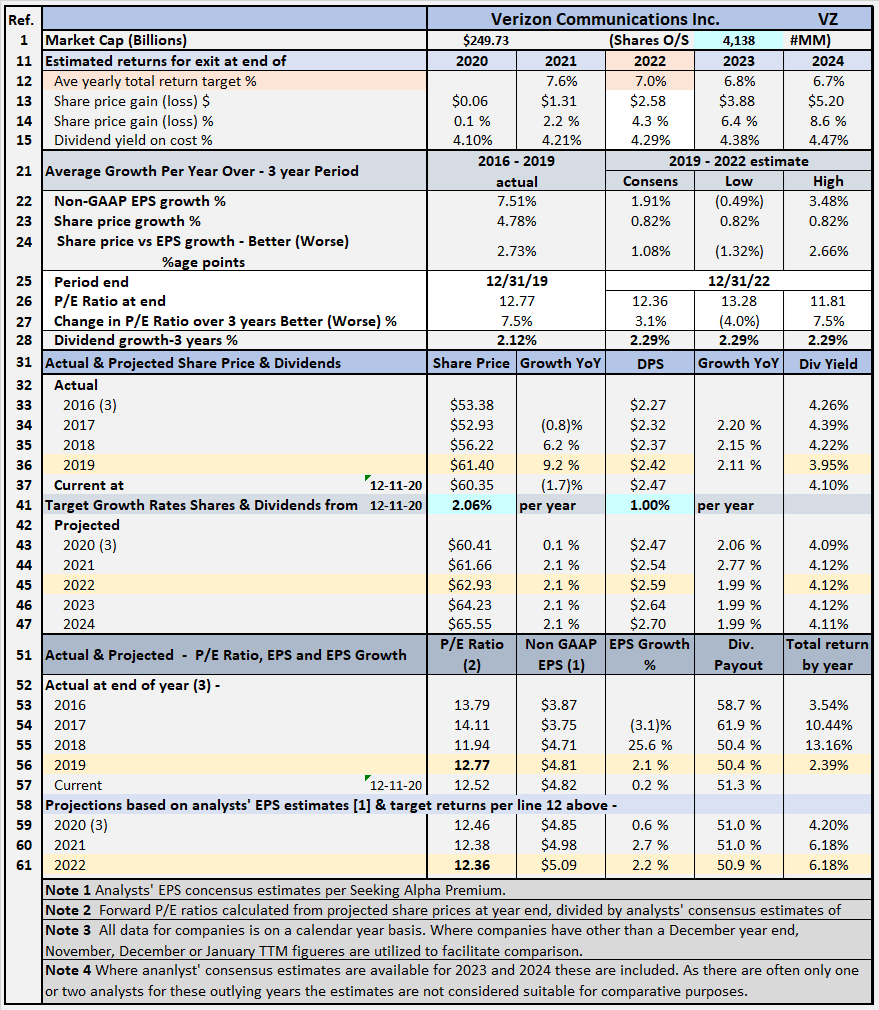

Verizons net income in fourth-quarter 2020 was 47 billion and its adjusted EBITDA non-GAAP was 117 billion. According to these financial ratios Verizon Communications Incs valuation is above the market valuation of its sector. According to these financial ratios Verizon Communications Incs valuation is way above the market valuation of its peer group.