Peerless Gross Profit Margin Ratio Analysis Interpretation

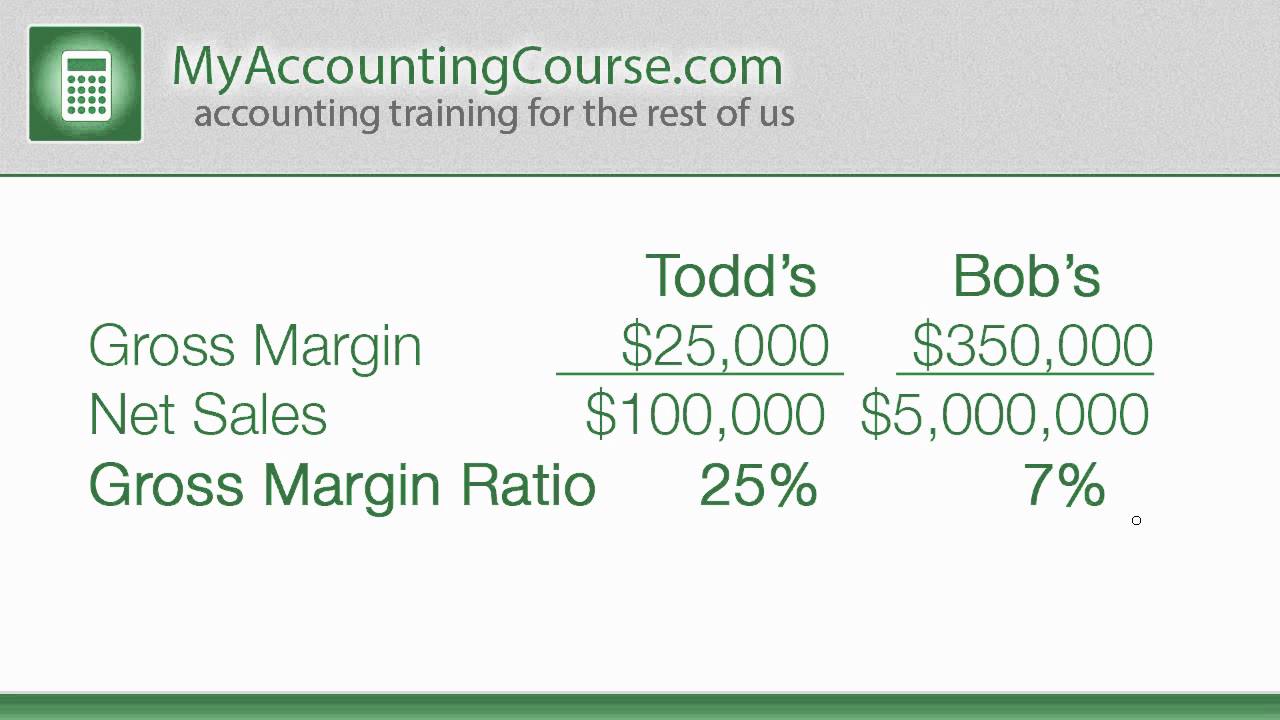

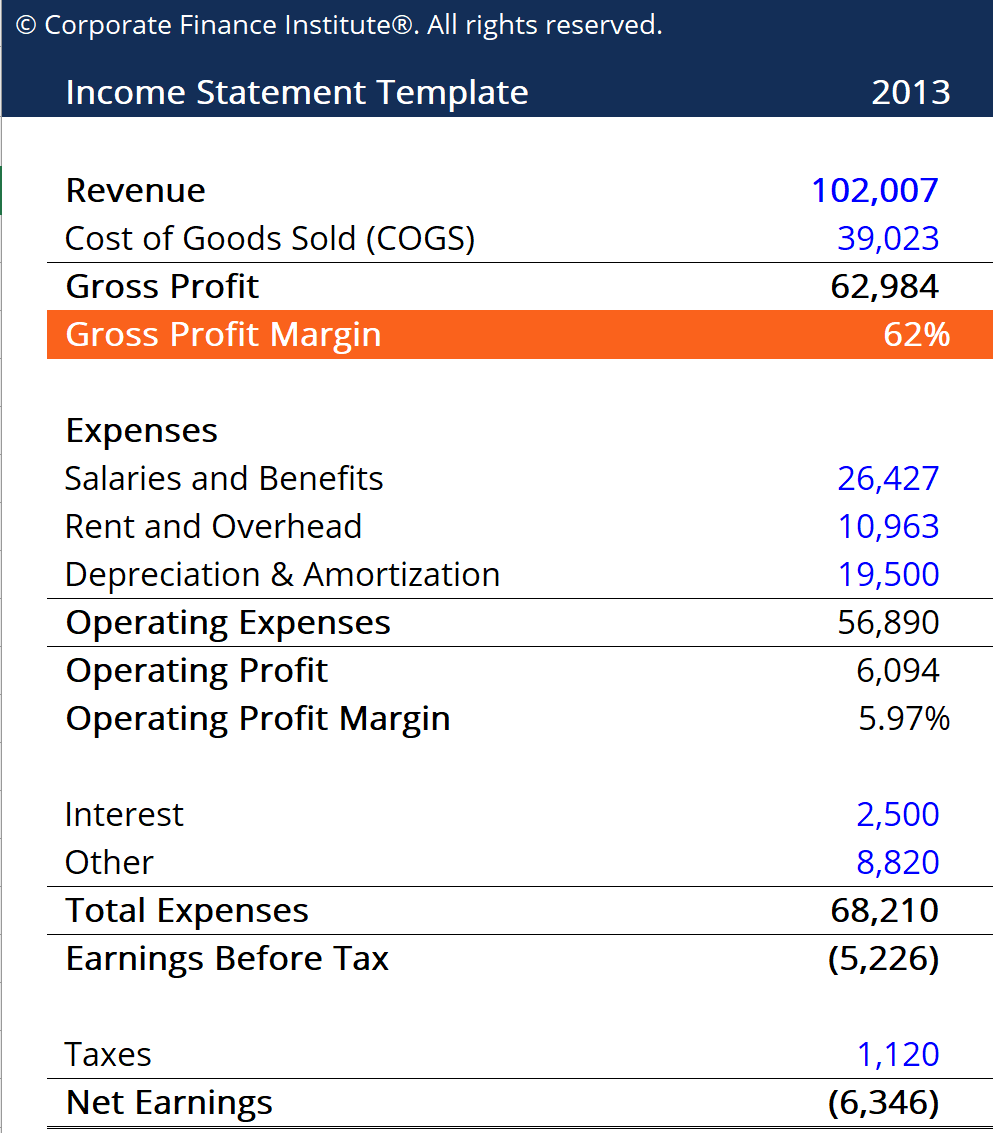

Gross profit is equal to total sales minus cost of sales the higher the GP margin the better.

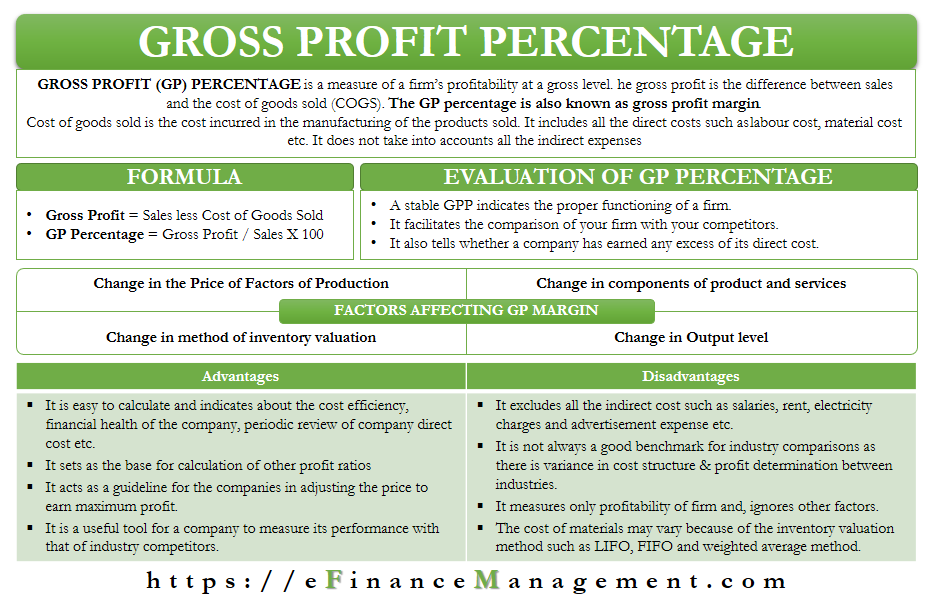

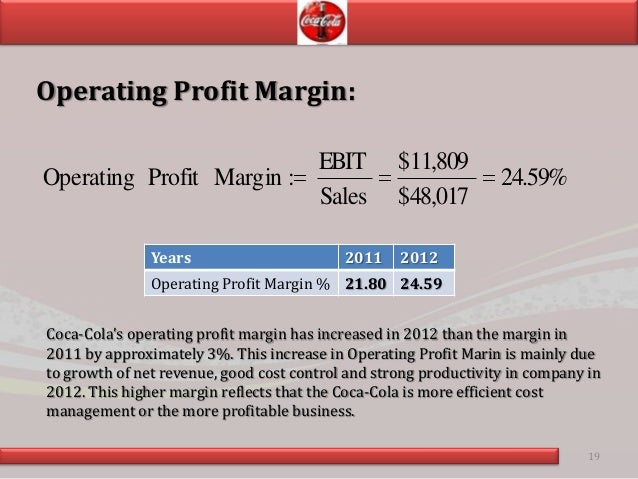

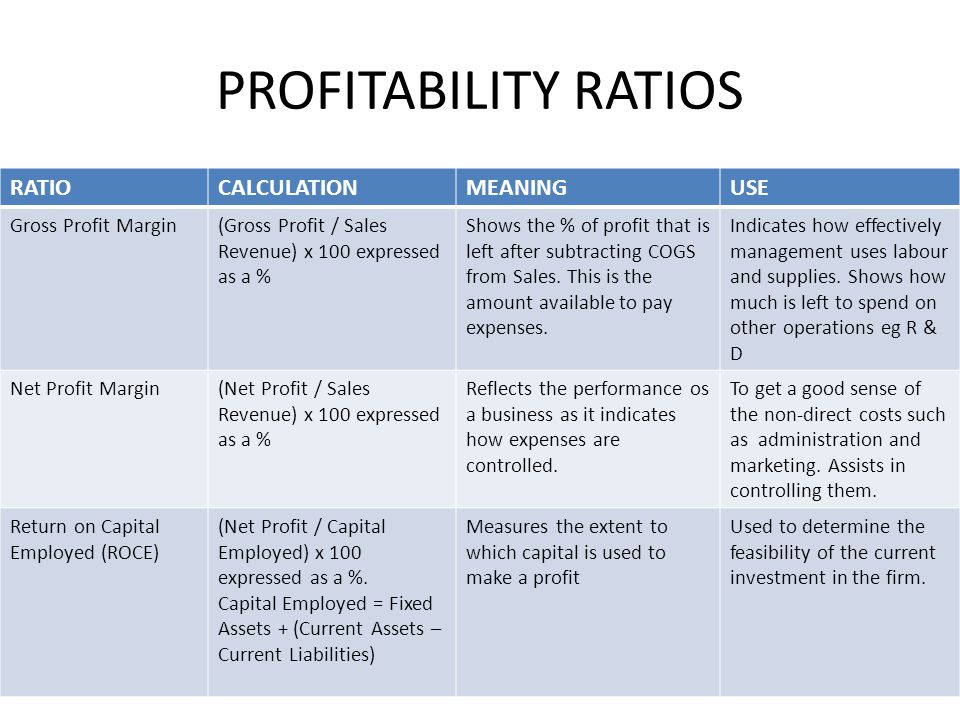

Gross profit margin ratio analysis interpretation. Gross Profit Margin Ratio shows the underlying profitability of an organizations core business activities. Financial Ratio Analysis 1. Better the gross profit ratio better the entitys ability to cover its operational financial and other expenses of business.

Gross Profit Margin Formula and Explanation Gross profit margin is calculated using the following basic formula. Gross profit margin or gross profit ratio is calculated using the following formula. The gross profit margin is the percentage of revenue that exceeds the COGS.

It tells investors how much gross profit every dollar of revenue a company is earning. It is a popular tool to evaluate the operational performance of the business. Such businesses would have.

Gross profit ratio or gross profit margin shows the gross profit as a percentage of net sales. The gross profit ratio tells gross margin on trading. Gross profit is taken before tax and other indirect costsNet sales means that sales minus sales returns.

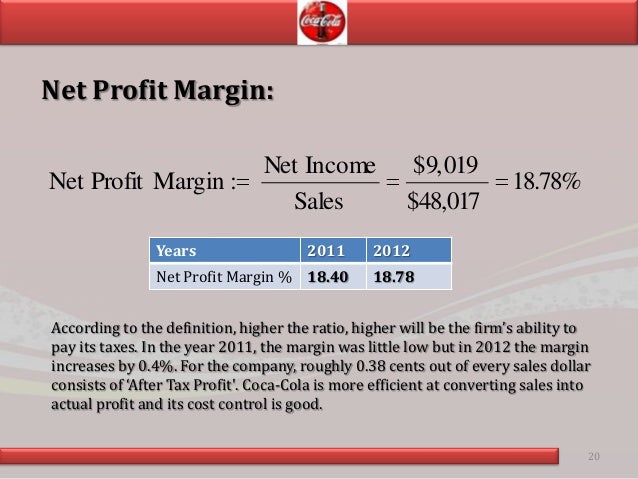

Companies and businesses always target a higher gross margin ratio. A GP Margin of 40 suggests that every 1 of sale costs the business 06 in terms of production expenditure and generates 04 profit before accounting for any non-production costs. Net profit margin measures how much of each dollar earned by the company is translated into profits.

Combined analysis Combine cross-sectional and time series analysis. Financial statement analysis explanations Gross profit ratio GP ratiois a profitability ratio that shows the relationship between gross profit and total net sales revenue. A high gross margin ratio means that a company is efficiently changing raw materials to finished products for profit.