Divine Provision For Bad Debts Questions And Answers

The total of the list is the provision required.

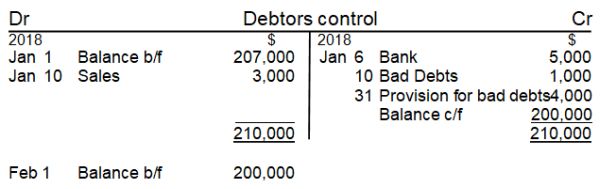

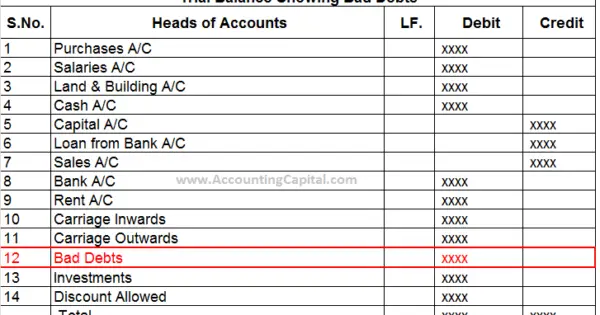

Provision for bad debts questions and answers. 1 Cash account Balance of debtors after 1 790000 2 Machinery account deducting all old bad 2 700000 3 Capital account debts 3 1400000 4 Purchases account 4 180000 5 Trade creditors account 5 75000 6 Sales account 6 350000 Old bad debts 7 Trade debtors account 7 135000 8 Bad debts account 8 15000 9 Salaries account 9 10000 Provisions for doubtful debts account 6000 1830000 1830000 Old provision for doubtful debs New bad debts Adjustments. Question 5 a Prepare the following. 7To write off bad debt following entry is passed.

1000 from Ms KBC as bad debts. An allowance of Rs. To retained earning ac or pl ac 3.

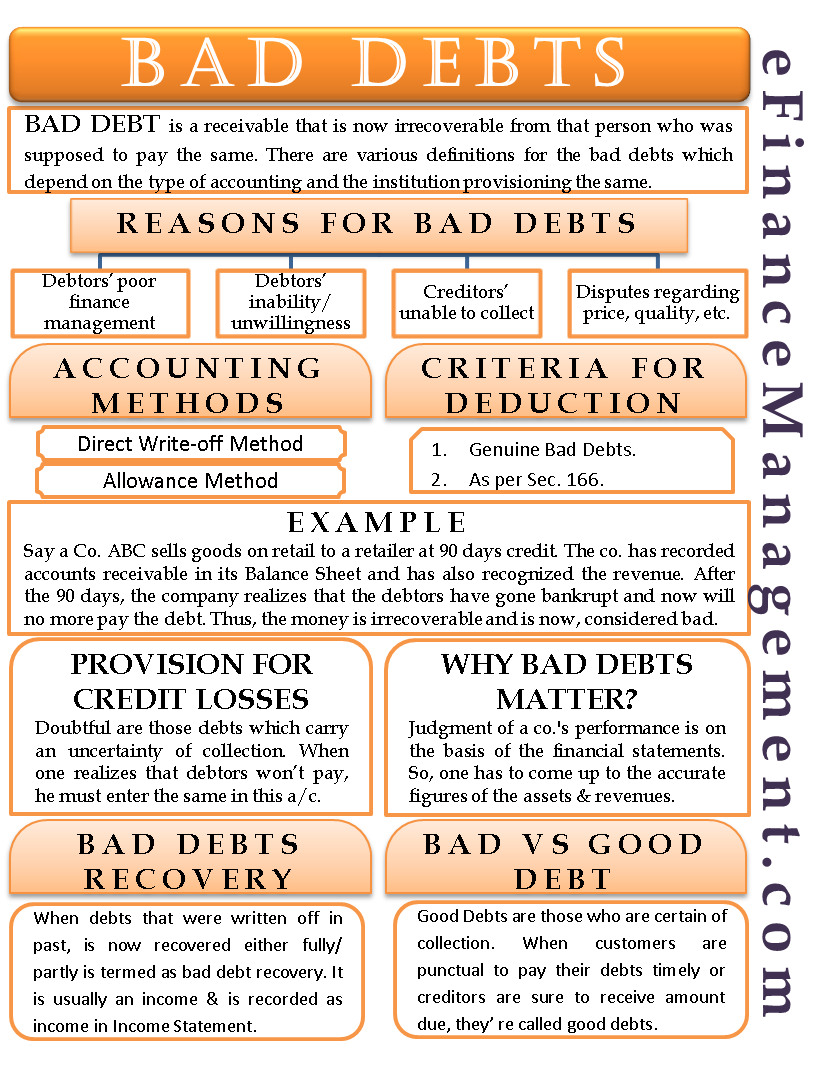

In other words collection. Browse more Topics under Financial Statements An Introduction to Financial Statements. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the debtors.

The provision for bad debts is an estimate of the debts owed to us that will go bad in the future. Per M perc1 M perc2. But since there is already an existing provision for5600 brought forward from the previous year we need to create a further provision of only 1400 ie.

Accounting entry is provision for bad debt ac dr. Bad debts debit. It is similar to the allowance for doubtful accounts.

In actual practice each account is examined and a list of doubtful debts prepared. For example lets say that at the end of the year we have 200000 in. If you have difficulty answering the following questions learn more about this topic by reading our Accounts Receivable and Bad Debts Expense Explanation.