Exemplary Bad Debts Recovered In Trial Balance

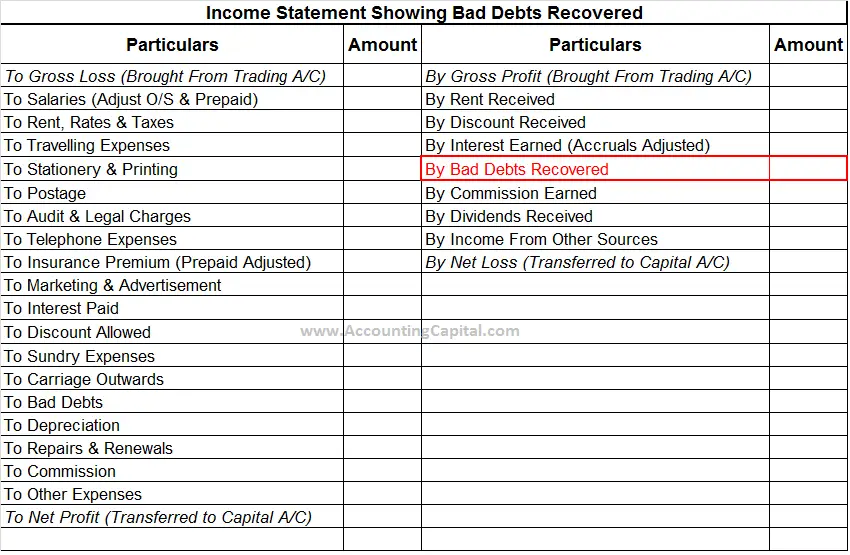

Nothing changes to the income statement.

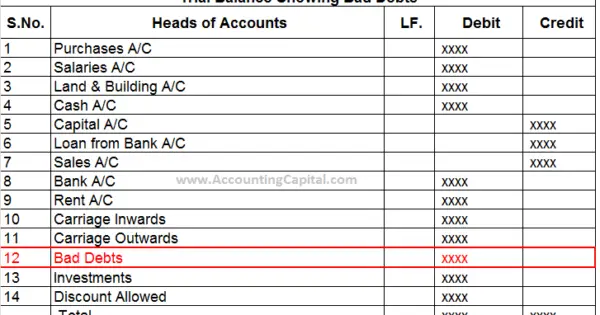

Bad debts recovered in trial balance. 8000 Outstanding Rent Rs. In such a case bad debts should be brought into account by passing the adjusting entry that is debiting bad debts account and crediting sundry debtors account. It is usually an income and hence.

As you can see the entry above actually does not affect the debtors control account at all you dont have to show that more is owing to us now. Bad Debts AC Dr. This may be clearer than crediting the recovery to the bad debts expense account because that would obscure the expense from bad debts.

Choose from the highest quality selection of Bad Debts Recovered In Trial Balance all submitted by our talented community of contributors. The accounting records will show the following bookkeeping entries for the bad debt recovery. Sometimes a debt written off in one year is actually paid in the next year a debit to cash and a credit to irrecoverable debts recovered.

Profit and Loss Ac Profit Rs. Again the percentages are determined by past experience and past data. 2000 received from Smith whose account was previously written off as bad debt should be credited to a Bad debts recovered Account b Smiths Account c Cash Account d None of the options.

While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should not be credited as in case of sales. Sometimes bad debts may occur at the end of accounting period after the accounts are balanced and the trial balance is prepared. When the debts that were written off in the past years is now recovered either fully or partly is termed as bad debt recovery.

We have passed the following entries. Where do you think the other side of the entry is going when you create a provision for bad debts. It is simply a recording of cash received with the contra entry being an income account.