Cool Prepaid Expenses Balance Sheet Classification

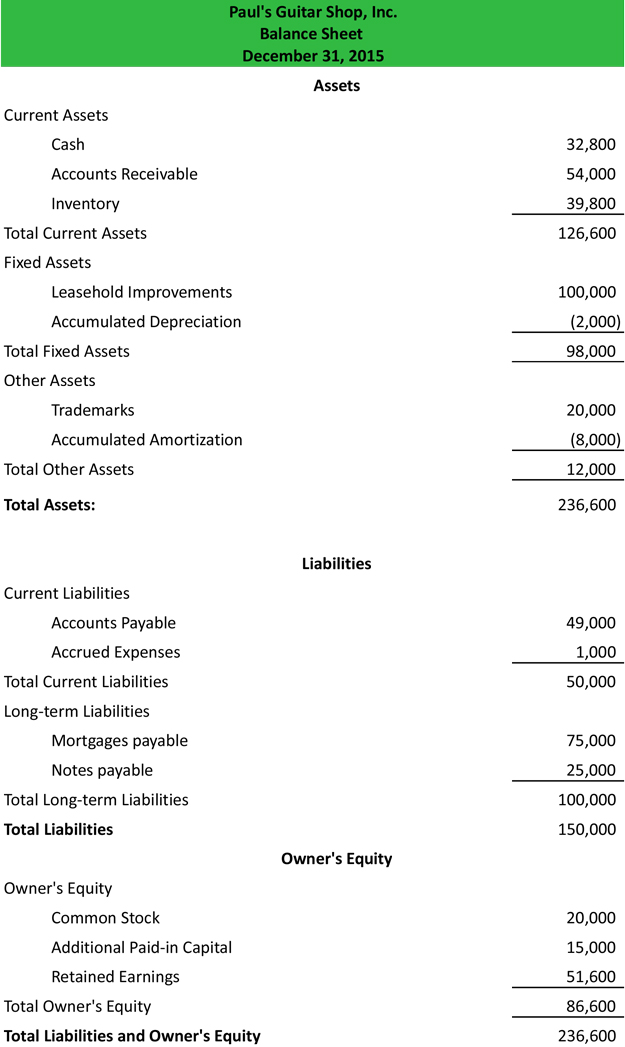

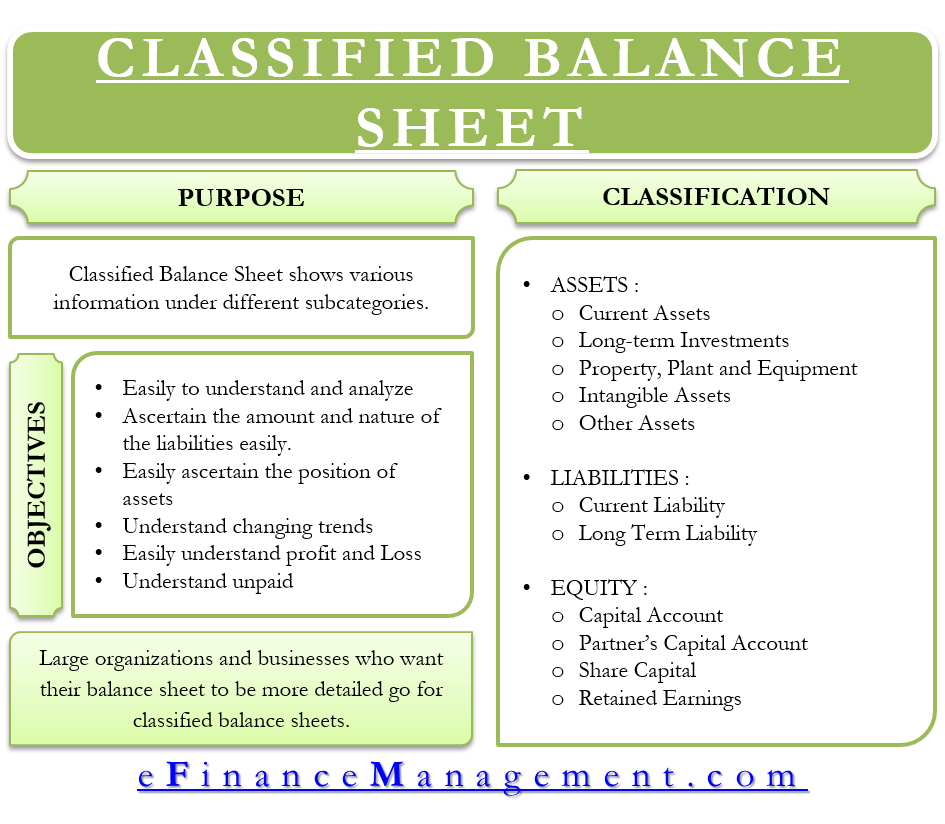

The balance sheet format helps the user by grouping these accounts into classes such as the function of the account the business use of the resources and whether resources and liabilities are short-term or long-term.

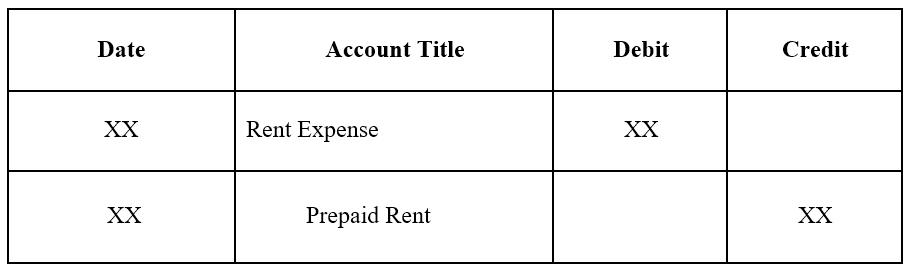

Prepaid expenses balance sheet classification. On a classified balance sheet prepaid expenses would be found under. Prepaid expenses only turn into expenses when you actually use them. Refer to the first example of prepaid rent.

In other words prepaid expenses are costs that have been paid but are not yet used up or have not yet expired. Other current assets are cash and equivalents accounts receivable notes receivable and inventory. Cash and cash equivalents.

Validate or refuse with just one click. Advertisements various advertising campaigns. As mentioned earlier Prepaid Expenses are mentioned on the Balance Sheet as a Current Asset.

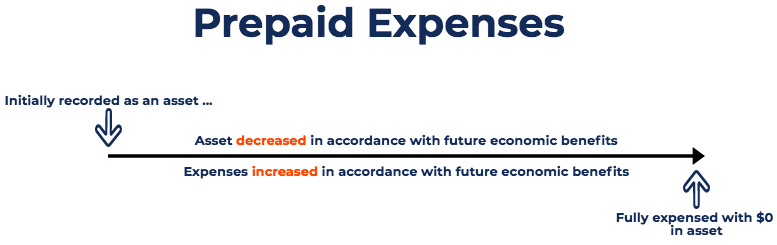

Prepaid expenses in balance sheet are listed as assets too. Ad With Odoo Expenses youll always have a clear overview of your teams expenses. Prepaid expenses usually represent a short-term asset because they will be consumed amortized over a year or less after the balance sheet day.

Other Current Asset types include Inventory Accounts Receivable and Cash and Cash Equivalents. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are the money set aside or effectively pre-paid for goods or services before they actually receive delivery of them.

If a prepaid expense were likely to not be consumed within the next year it would instead be classified on the balance sheet as a long-term asset a rarity. Managing your expenses has never been easier. Prepaid expenses are not recorded on an income statement initially.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-05-0a18b601c53e44e29084a0b778b79723.jpg)

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)