Fine Beautiful Net Financing Cash Flow Formula

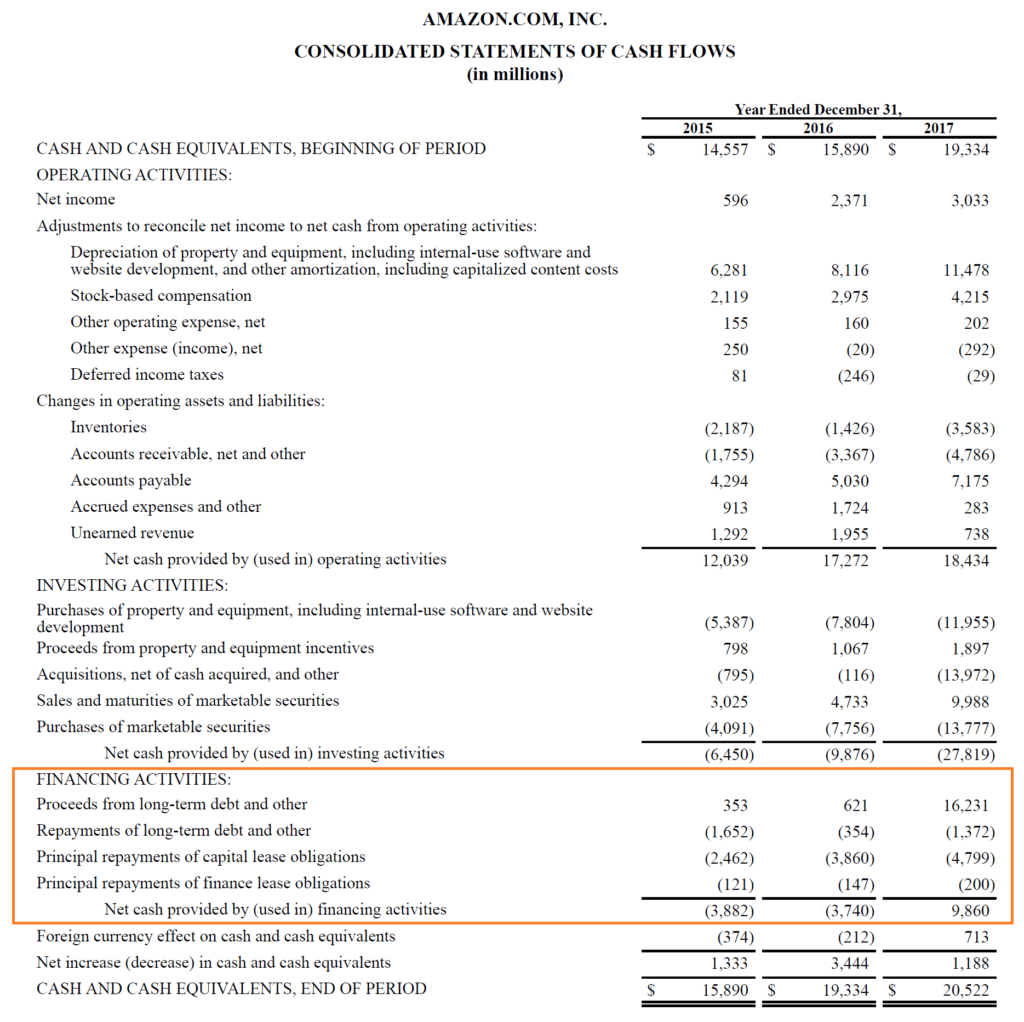

A companys cash flow statement shows its cash inflows and outflows during an accounting period.

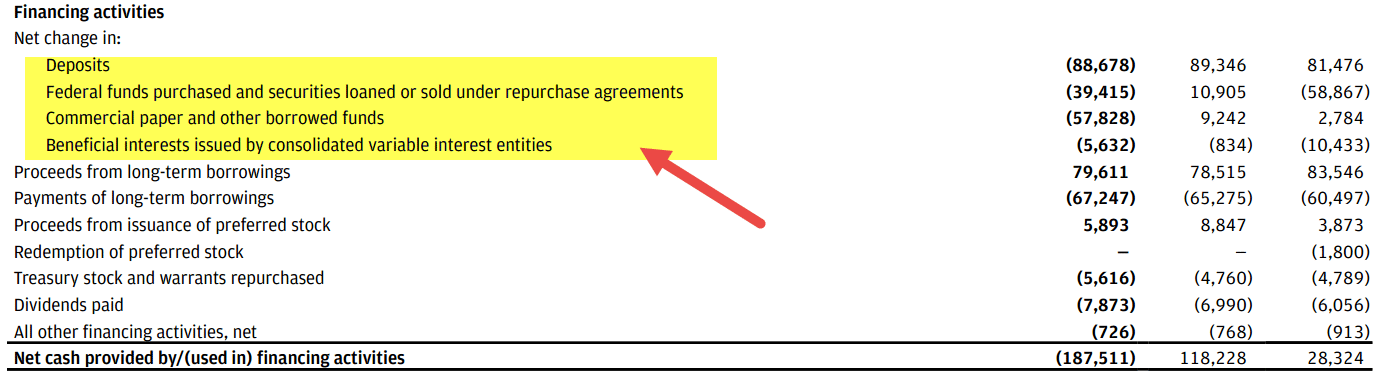

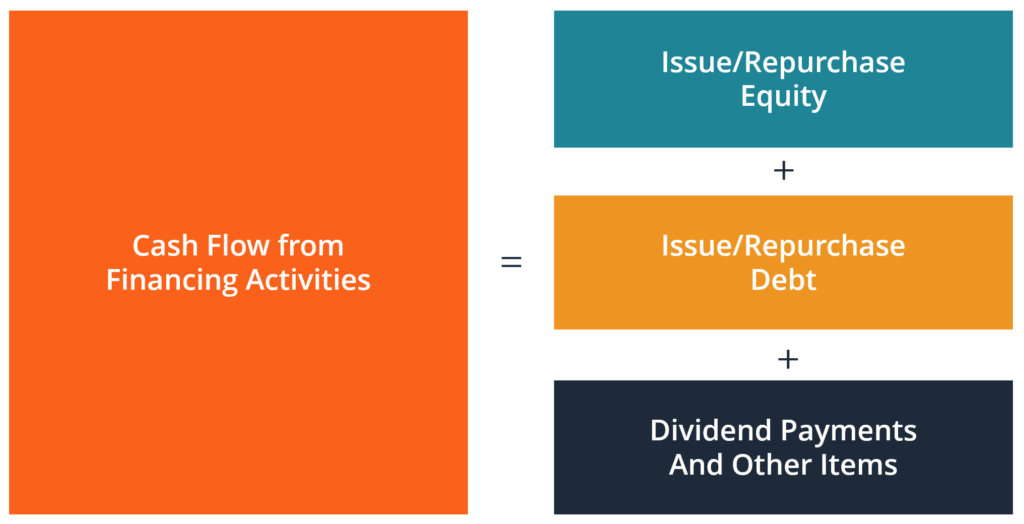

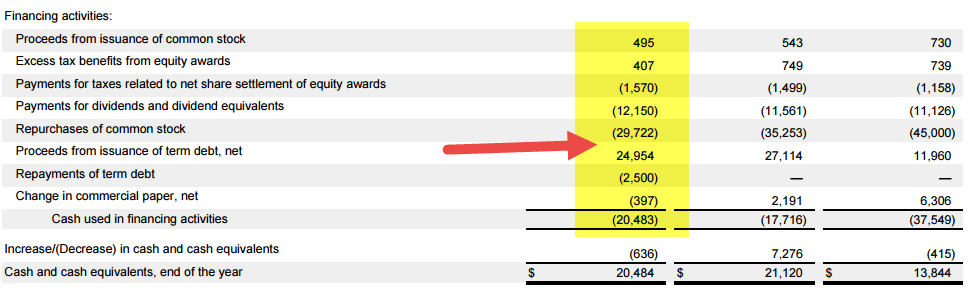

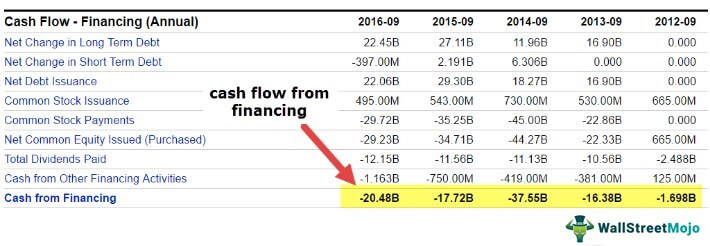

Net financing cash flow formula. If investing and financing continually produce a significant cash flow but cash flow from operations are continually in the negative this can be a red flag. Net Cash Flow Definition. Net cash provided by financing activities equals total cash inflows minus total cash outflows from the financing.

The 3 main sources for cash flow are operations investments and financing. Net Cash Flow Total Cash Inflows Total Cash Outflows. How to Calculate Net Cash Flow For example if Company ABC had 250000 cash inflows and 150000 cash outflows during the first quarter of their fiscal year their net cash flow.

Net cash flow means the amount of cash generated by an operating business over a period of time say one year six months or nine months. Cash inflow might include. Net cash flow is a metric used to describe the total cash flow of a company that is being generated from all sources.

Some businesses lend money. CF is the cash from financing. It is calculated by subtracting a companys total liabilities from its total cash.

The most common way to calculate operating cash flow is through the indirect method which takes into account the net. Net Cash Flow 100 million 50 million 30 million. Calculation of net cash flow can be done as follows.

Cash flow forecast example. Cash from Financing activities end of the first month Investment by Mr. If you are new to accounting you.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)