Out Of This World Bad Debts Entry In Balance Sheet

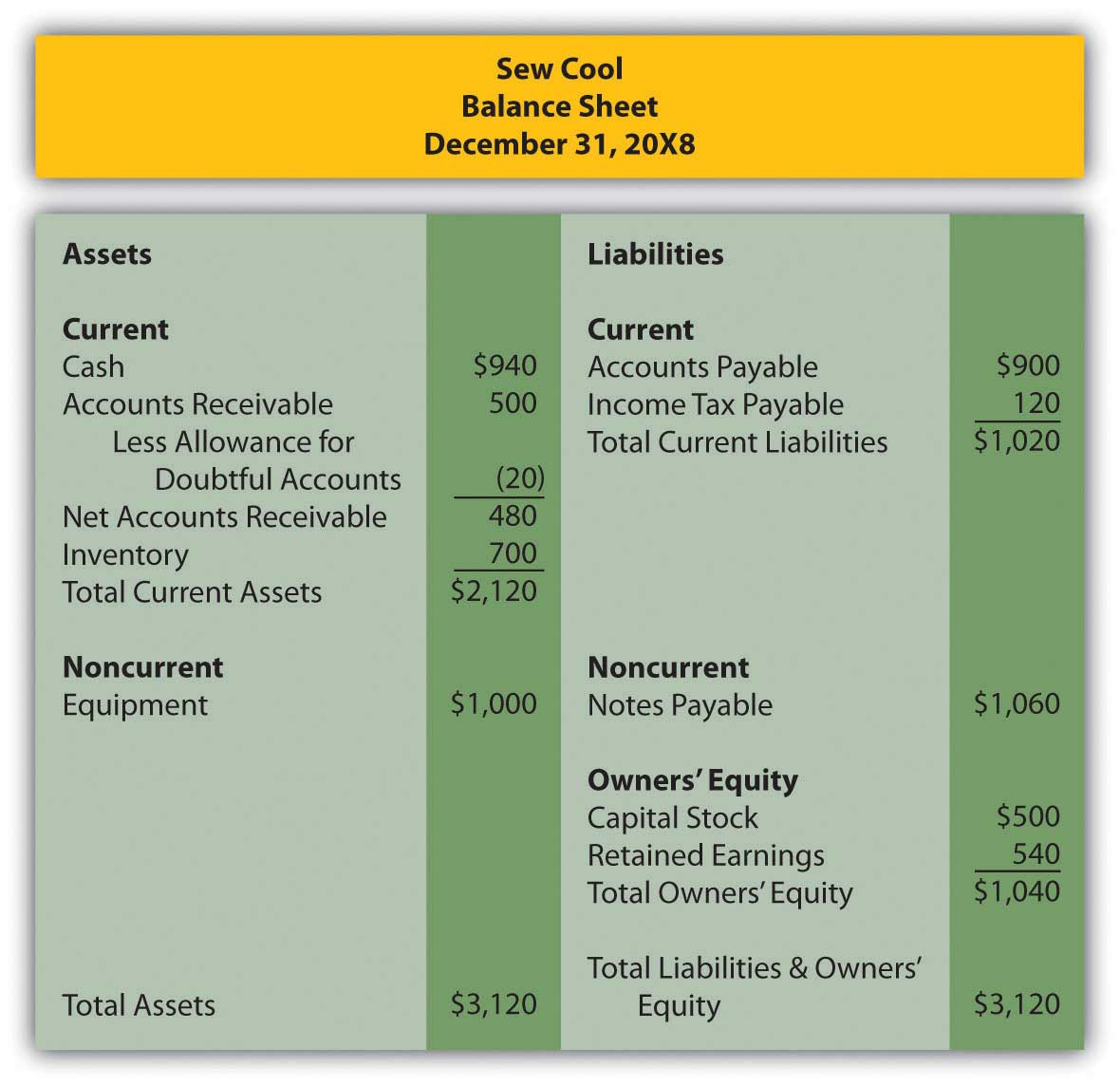

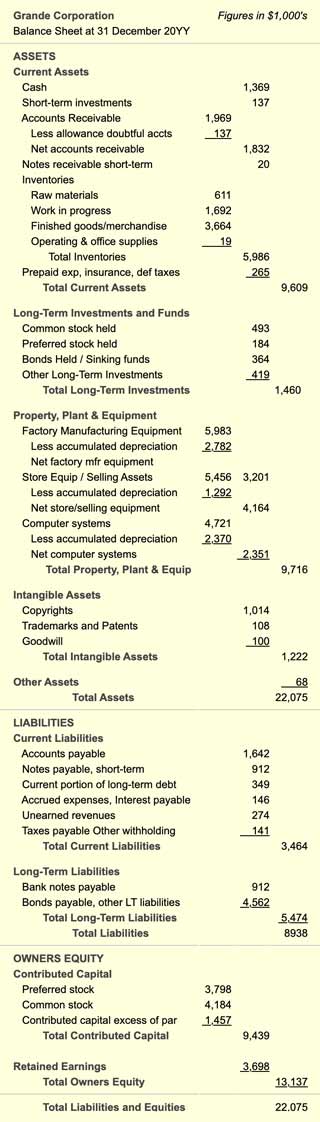

Provision for Bad Debts The debit account is charged against current years profit and the credit head is shown as a deduction from debtors in the balance sheet.

Bad debts entry in balance sheet. This process is called. Credit Cr Provision for doubtful debts. Debit Dr Income statement.

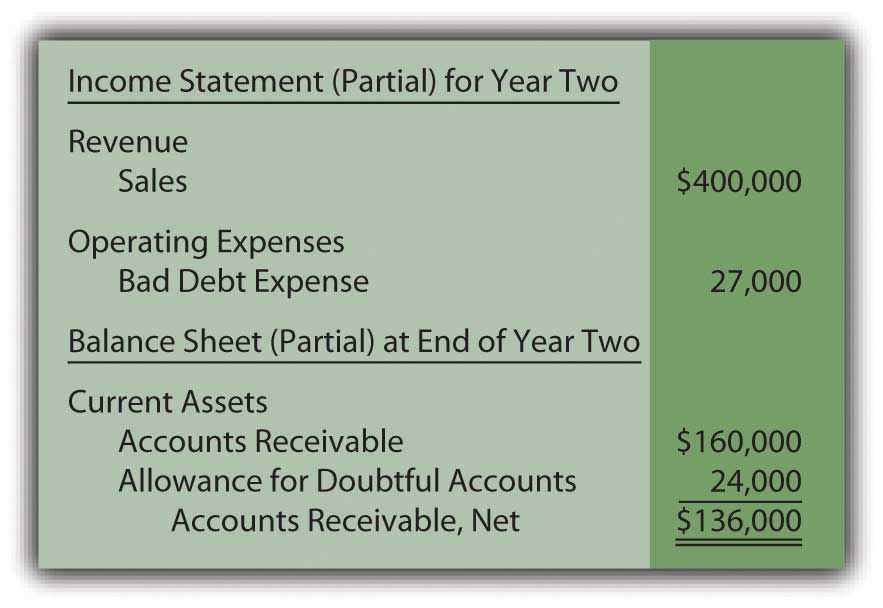

When a customer pays a debt that had previously been written off then we need to make an adjusting journal entry. This entry will directly affect both the income statement and balance sheet. A bad debt amount of 500 will be recognized as expenses in the income statement and the account receivable will be reduced by 500.

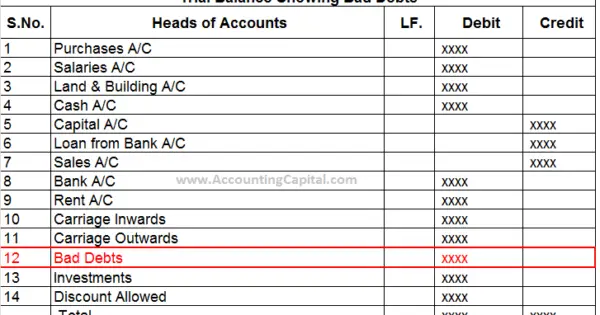

Read the full article on how to write off the account receivable. The accounting records will show the following bookkeeping entries for the bad debt write off. This approach assume the firm will take a percentage of balance of account receivables and this percentage express the ending balance of allowance for bad debts at the end of reporting period.

1 The entry made in writing off the account is reversed to reinstate the customers account 2 The collection is journalized in the usual manner The recovery of a bad debt like the write-off of a bad debt affects only balance sheet accounts. Now if the amount of bad debt is received in any succeeding year the same will be credited to Profit and Loss of that year as an income. A provision for bad debts is recorded in the accounting records as follows.

Recording decrease in provision for doubtful debts. Bad debt expense is something that must be recorded and accounted for every time a company prepares its financial statements. A bad debt write-off adds to the Balance sheet account Allowance for doubtful accounts.

Having reinstated the accounts receivable balance in step 1 the cash received is now used to clear the balance. In simple words recovery of bad debt is an income and posted to Profit. When a company decides to leave it out they overstate their assets and they could even overstate their net income.