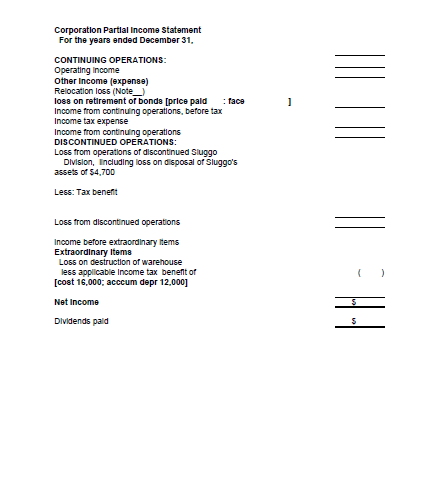

Top Notch Partial Income Statement Discontinued Operations

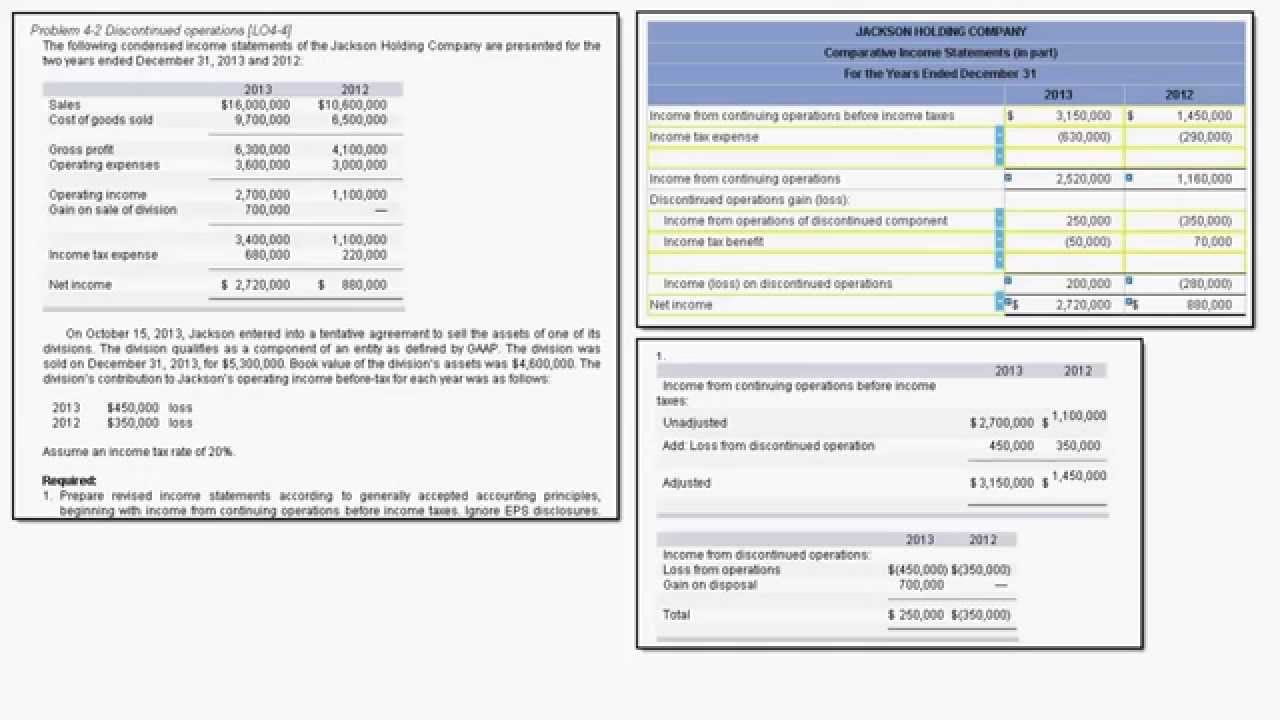

Suppose ABC Company had two segments.

Partial income statement discontinued operations. A companys income statement summarizes the revenues expenses and profits for an accounting period. Income tax expense has not yet been recorded. A discontinued operation is a component of an entity that IFRS 532.

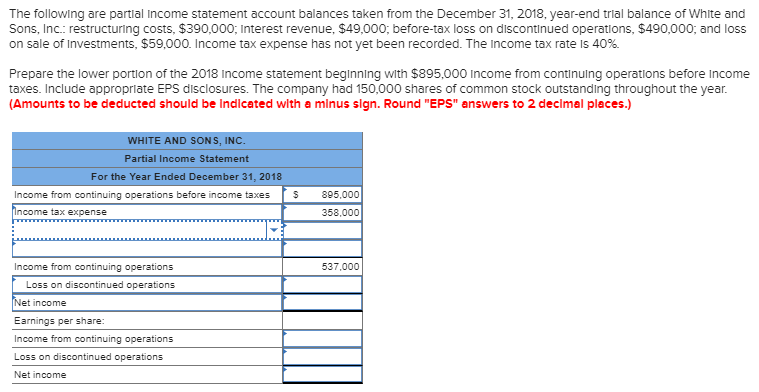

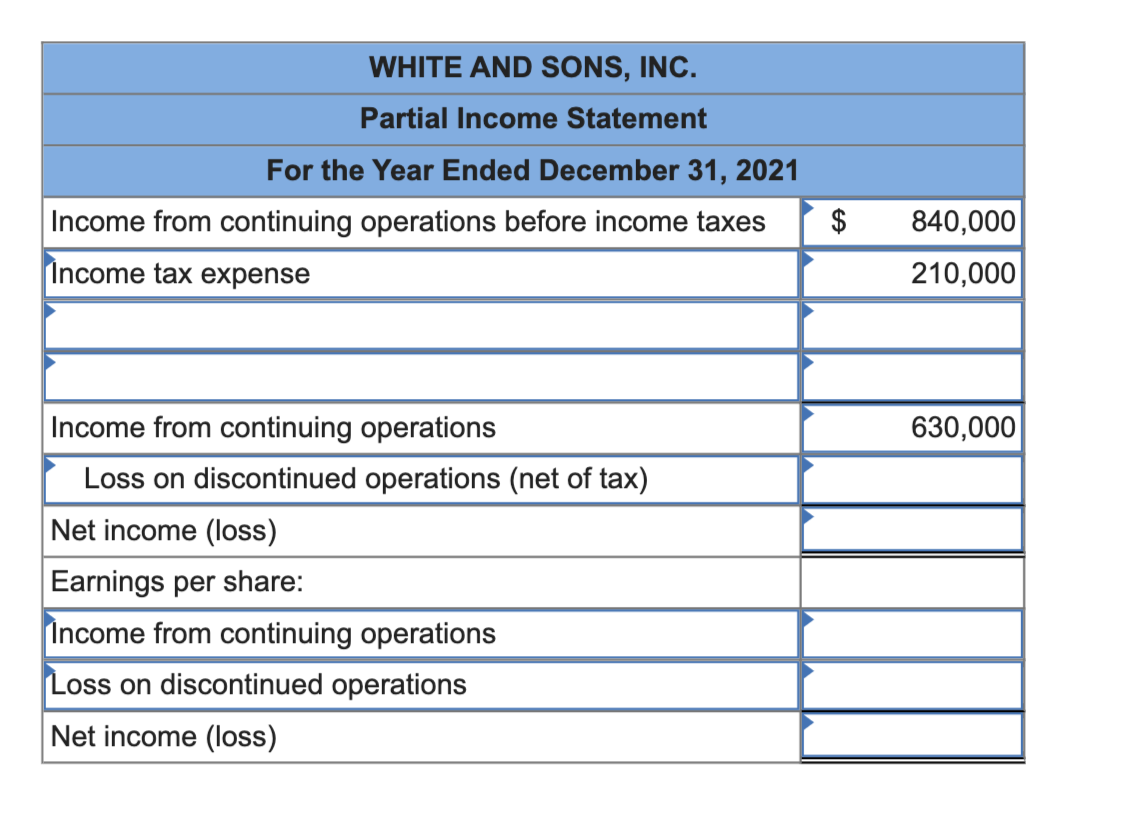

Prepare a partial income statement for Apex Inc beginning with income from continuing operations before income tax. The following are partial income statement account balances taken from the December 31 2021 year-end trial balance of White and Sons Inc. Loss from Disc Brake operations net of income tax 67500 Loss on disposal of Disc Brake division net of income tax 52500 Loss from Discontinued Operations 120000 Profit 105000 Note that the income tax.

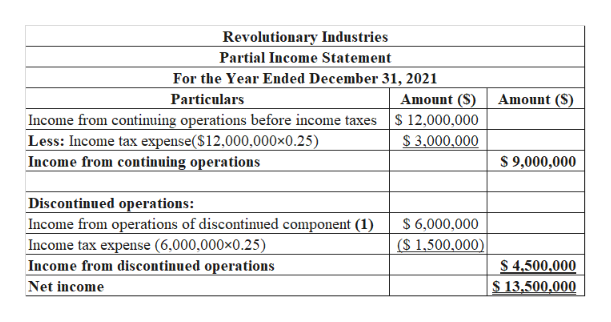

It represents the after tax gain or loss on sale of a segment of business and the after tax effect of the operations of the discontinued segment for the period. Has been disposed of or is classified as held for sale represents a separate major line of business or geographical area of operations is part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations or. The following are partial income statement account balances taken from the December 31 2021 year-end trial balance of White and Sons Inc.

Before-tax loss on discontinued operations 520000. And loss on sale of investments 63000. The designated results of operations must be reported as a discontinued operation within the financial statements if both of the following conditions are present.

A discontinued operation is a separate major business division or geographical operation that the company has disposed of or is holding for sale. Income from Discountinued Operations Income or Loss from Discontinued Operations is a line item on an income statement of a company below Income from Continuing Operations and before Net Income. Income tax expense has not yet been recorded.

Discontinued operations are the operations of that segment of the company which has been disposed of or sold. Add together the income from discontinued operations net of taxes and the gain on sale net of taxes to calculate the total income from discontinued operations net of taxes. And loss on sale of investments 62000.