First Class Wipro Ratio Analysis

Cash earnings retention ratio.

Wipro ratio analysis. The current ratio measures the companys ability to pay short-term and long-term obligations. Inventory Turnover Ratio X 55274. Quick Ratio X 294.

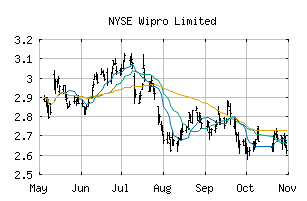

Current Ratio Inc. Interest Coverx 2830 1772 1666 1857 1958 2159. Wipro has a market cap or net worth of 4346 billion.

Wipros data analytics and AI services enable organizations to deliver value across the customers journey by empowering users with more agile and intuitive processes. Current Ratiox 227 240 267 237 235 230. Wipro Ltd the flagship company of the Azim H Premji group was incorporated in the year 1945.

It is highly variable from one industry sector to another. Quick Ratiox 227 239 265 235 233 228. Is the flagship company of the Azim H Premji group.

As per NASSCOM estimates the workforce in the Indian IT sector will touch 30 million by 2020. Our services help organizations use data and analytics to create new business models and revenue streams all while ensuring security quality and regulatory compliance of data. 22 rows PB Ratio.

Ratio Analysis for WIPRO. Total DebtEquityx 015 014 018 029 028 027. Dividend payout ratio net profit 544.