Awesome Balance Sheet Of Banking Companies

Cash is cash held on deposit and sometimes banks hold cash for other banks.

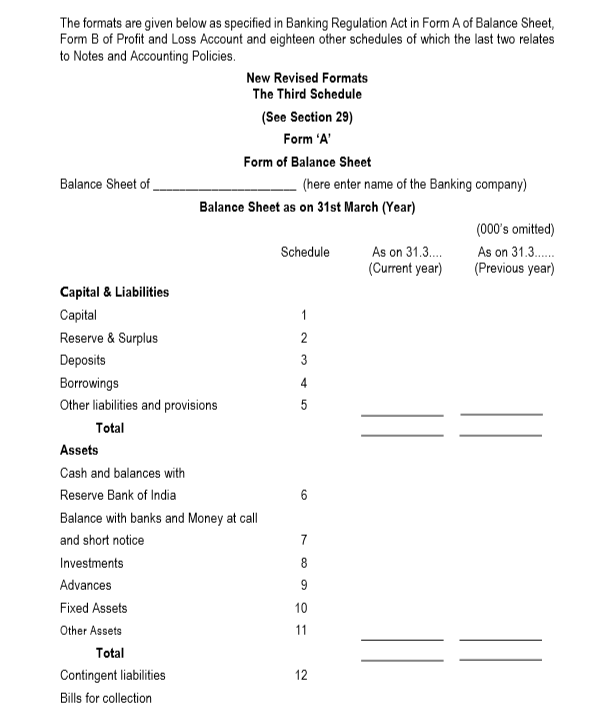

Balance sheet of banking companies. Generally the balance sheet of a bank is either liability driven or asset driven. Unlike the previous form the present one is devoid of details the latter being shown in the schedules. Which section of Banking Regulation Act 1949 relates with the Power of Reserve Bank to issuedirections in respect of stressed assets.

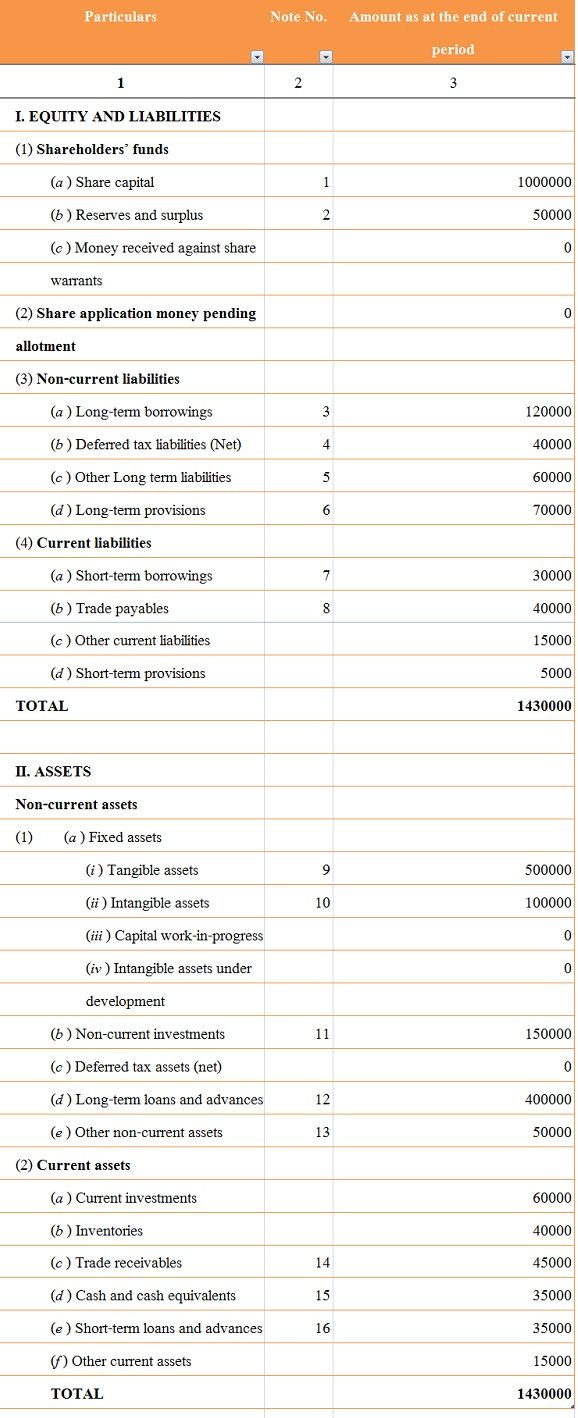

The balance sheet consists of total 12 schedules. An asset-driven balance sheet is less common for retail banks but more common for investment banks. In the case of a banking company incorporated outside India balance-sheet and profit and lossaccount shall be signed by _____ of the company.

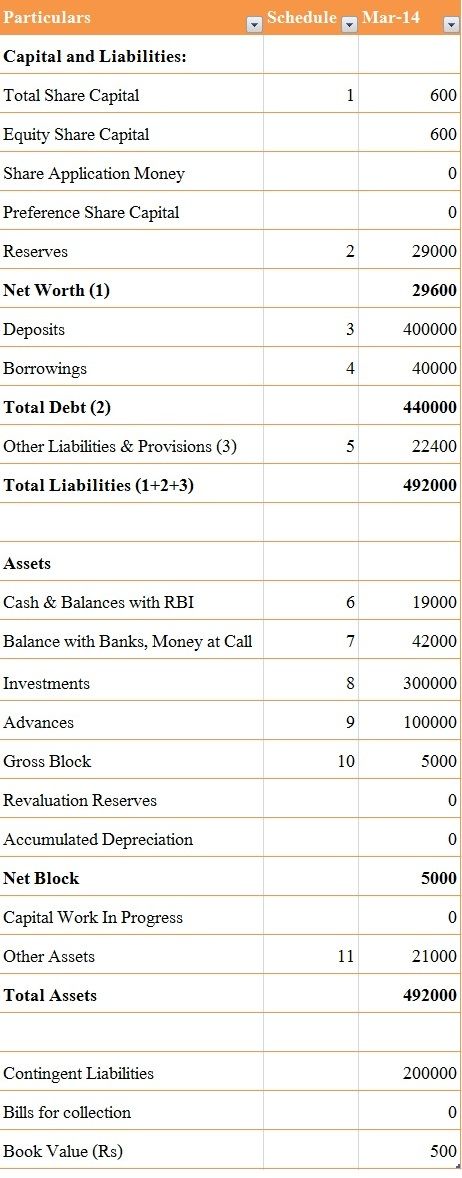

Form of Balance sheet of banking Companies includes Reserve. There are three key areas of focus. Below is an imaginary Balance Sheet is given for ABC Bank as on 31st March 2014.

Every banking company has to prepare balance-sheet and profit and loss account as per provisions of Section 29 of Banking Regulation Act 1949. Schedule XIII Income. Bank of Americas balance sheet is below from their annual 10K for 2017.

The Balance sheet of a banking company is to be prepared in Form A given in third schedule to the Act. It is mainly divided into two broad heads 1 Capital and Liabilities 2 Assets whose amount must be same. Bank Balance Sheet Balance Sheet The main purpose of the Balance sheet is to give the understanding to its users about the financial position of the business at the particular point of time by showing the details of the assets of the company along with its liabilities and owners capital.

Its main activity consists of using money from savers to lend to those requesting credit. Form A in a summary form and the details of the various items are given in the schedules. There are several different bank business models with either asset-driven or liability-driven balance sheets.