Impressive Balance Sheet Debit And Credit Side

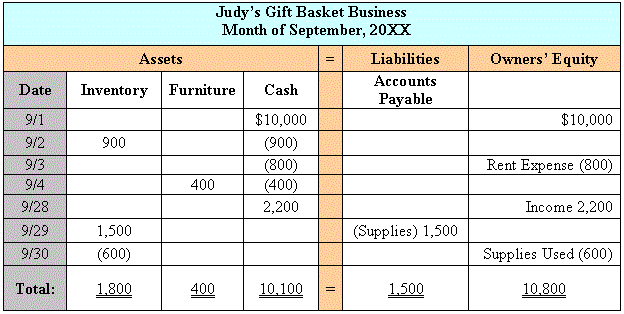

Example of Profits Effect on the Balance Sheet.

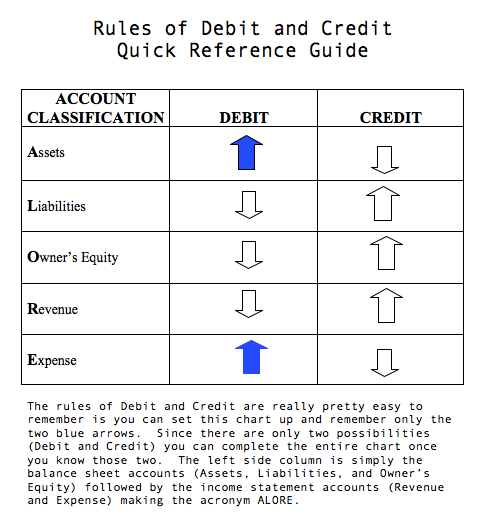

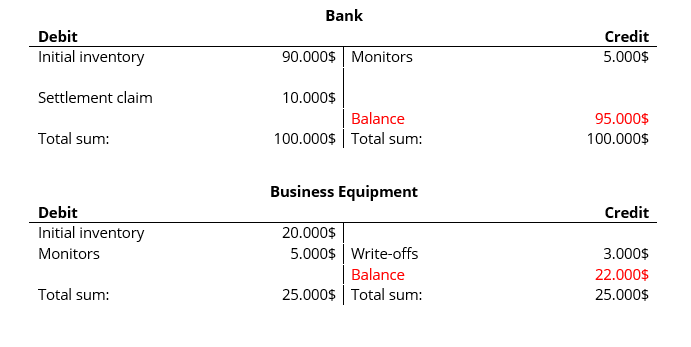

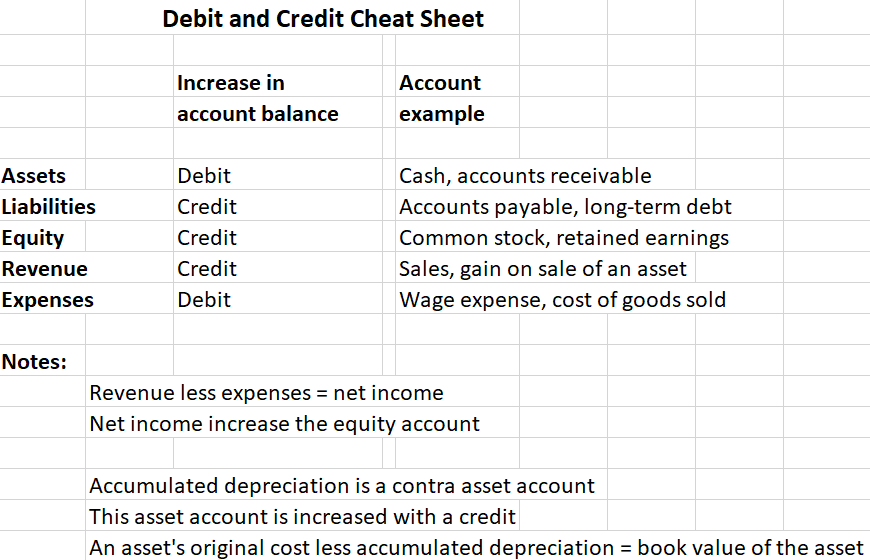

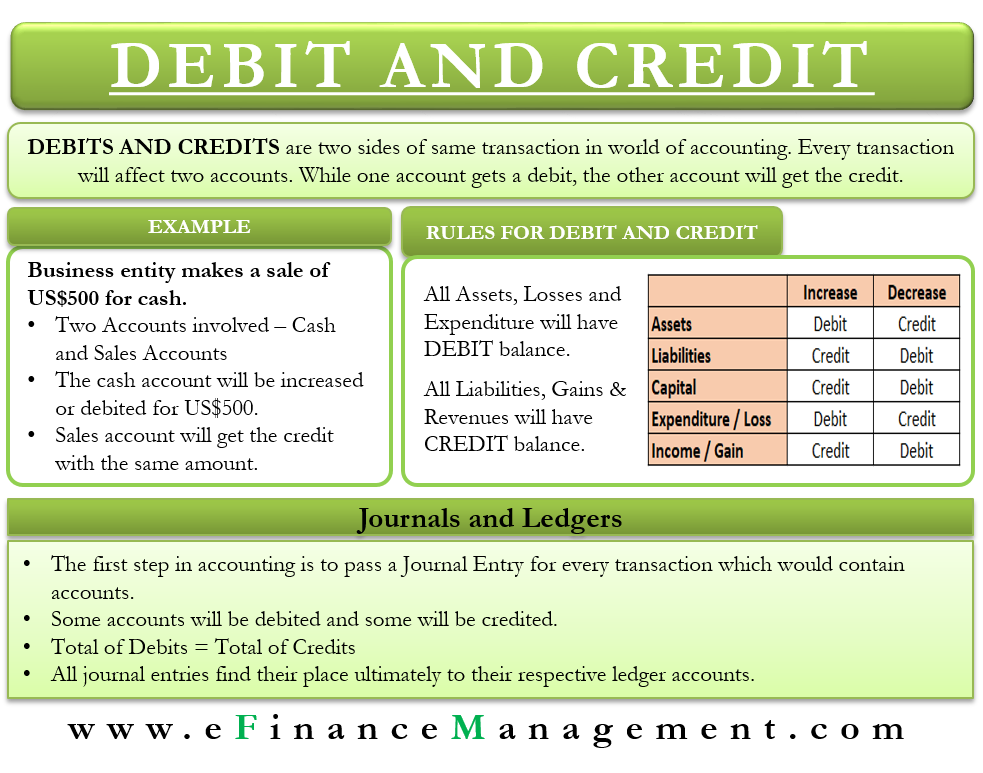

Balance sheet debit and credit side. A credit increases a revenue liability or equity account. If a company prepares its balance sheet in the account form it means that the assets are presented on the left side or debit side. Expenses decrease retained earnings and decreases in retained earnings are recorded on the left side.

Common stocks are the number of shares of a company and are found in the balance sheet. C r edits go on the r ight. There are two sides of it- the left-hand side Debit and the right-hand side Credit.

Asset account balances should be on the left side of the accounts. We will use the accounting equation to explain why we sometimes debit an account and at other times we credit an account. The side that increases debit or credit is referred to as an accounts normal balance.

Recall that the balance sheet reflects the accounting equation Assets Liabilities Owners Equity. Debit and Credit Side. The capital revenue and liability increases when it is credited and visa versa.

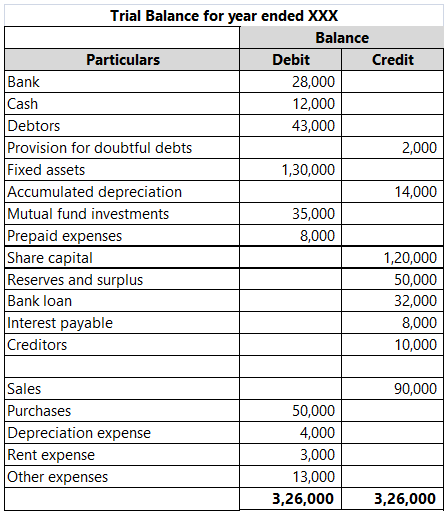

The balance sheet accounts are debited from the closing balance sheet account. The trial balance has two sides the debit side and the credit side. Items that appear on the credit side of trial balance Generally capital revenue and liabilities have credit balance so they are placed on the credit side of trial balance.

The side of the accounting journal that will lead to an increase in. C r edit does have an r in it. Debits must always be on the left side or left column and credits must always be on the right side or right column.