Beautiful Work Standard Ratios In Ratio Analysis

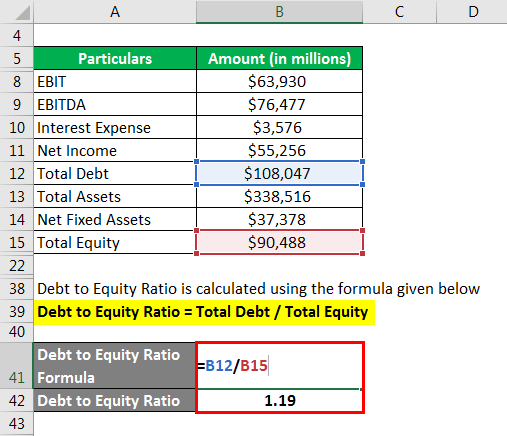

We calculate this as.

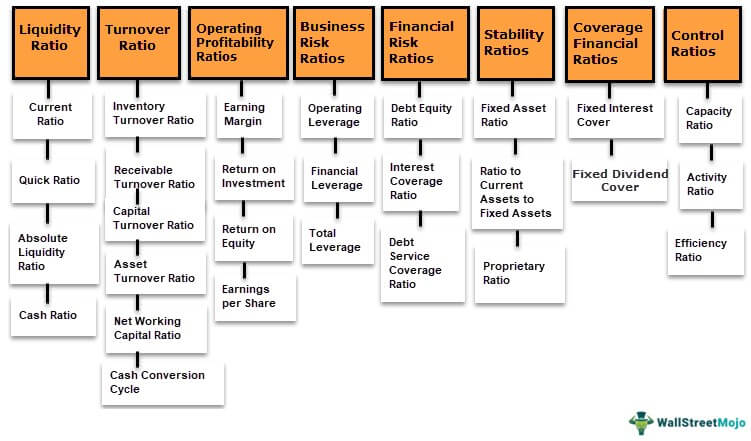

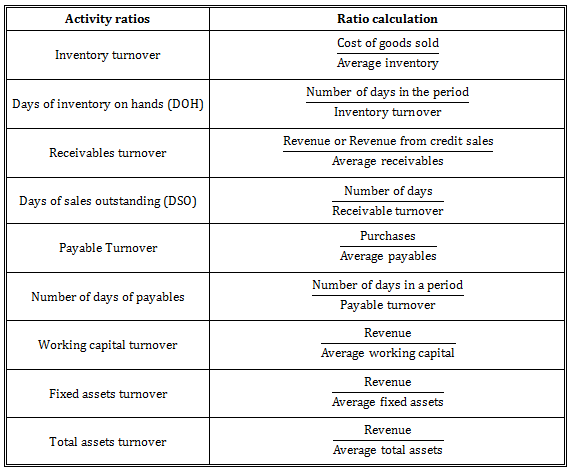

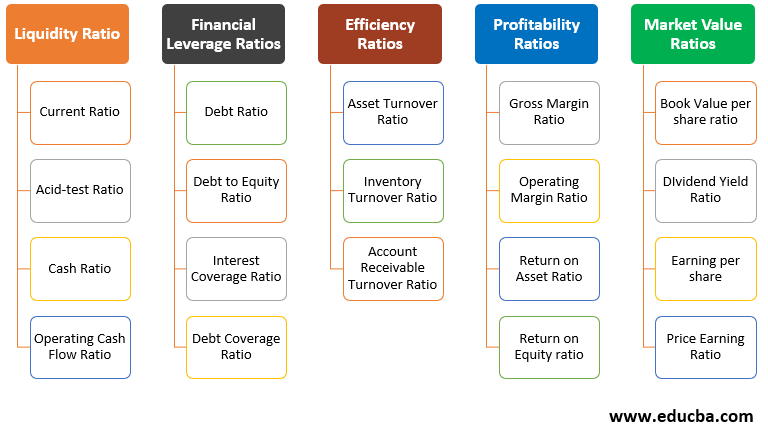

Standard ratios in ratio analysis. There are six categories of financial ratios that business managers normally use in their analysis. Definitions of various concepts used in ratio analysis. Leverage Funding Debt Equity Grants The ratios presented below represent some of the standard ratios used in business practice and are provided as guidelines.

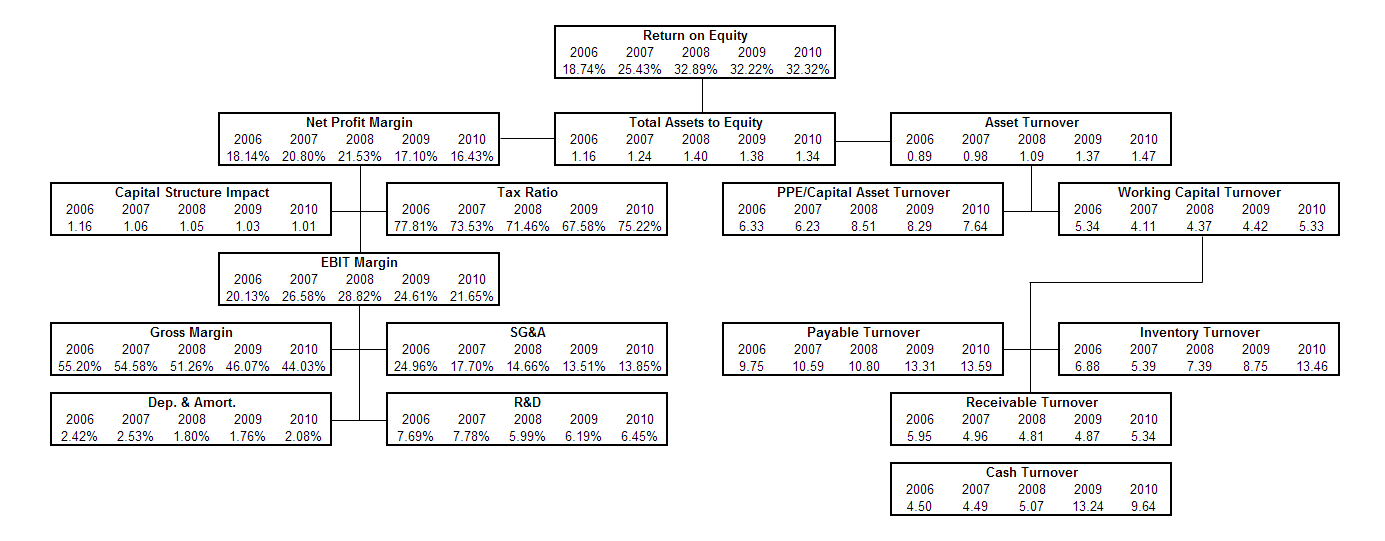

Financial ratio analysis compares relationships between financial statement accounts to identify the. Financial ratios are only valuable if there is a basis of comparison for them. In recent years donors raters investors and practitioners have come to consensus around common financial definitions and basic indicators that are used for.

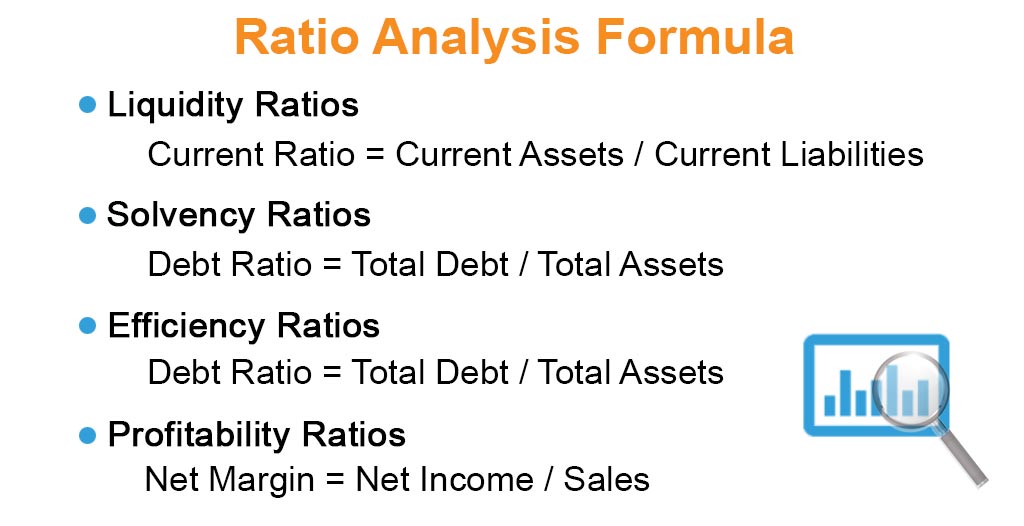

Analysis and interpretation of financial statements with the help of ratios is termed as ratio analysis. Ratios can be divided into four major categories. Normally it includes all current liabilities but sometimes it refers to current liabilities less bank overdraft.

On the basis of such standards ratios have been found out and these ratios are called Standard Ratios or Absolute Ratios or Ideal Ratios. Lack of universally accepted standard levels. These are the most commonly used ratios in fundamental analysis.

One factor to be kept in mind is that ratio analysis is used only to compare numbers that make sense and give us. These financial ratios might be used by the managers of a firm creditors of a firm and current and potential shareholders of a firm. Within these six categories are 15 financial ratios that help a business manager and outside investors analyze the financial health of the firm.

Financial statement ratio analysis focuses on three key aspects of a business. Ratio analysis is used to evaluate relationships among financial statement items. It is only a means of better understanding of financial strengths and weaknesses of a firm.