Ace Treatment Of Outstanding Expenses In Cash Flow Statement

The bottom line of the cash flow statement is simply the net change in the money available to pay the firms bills.

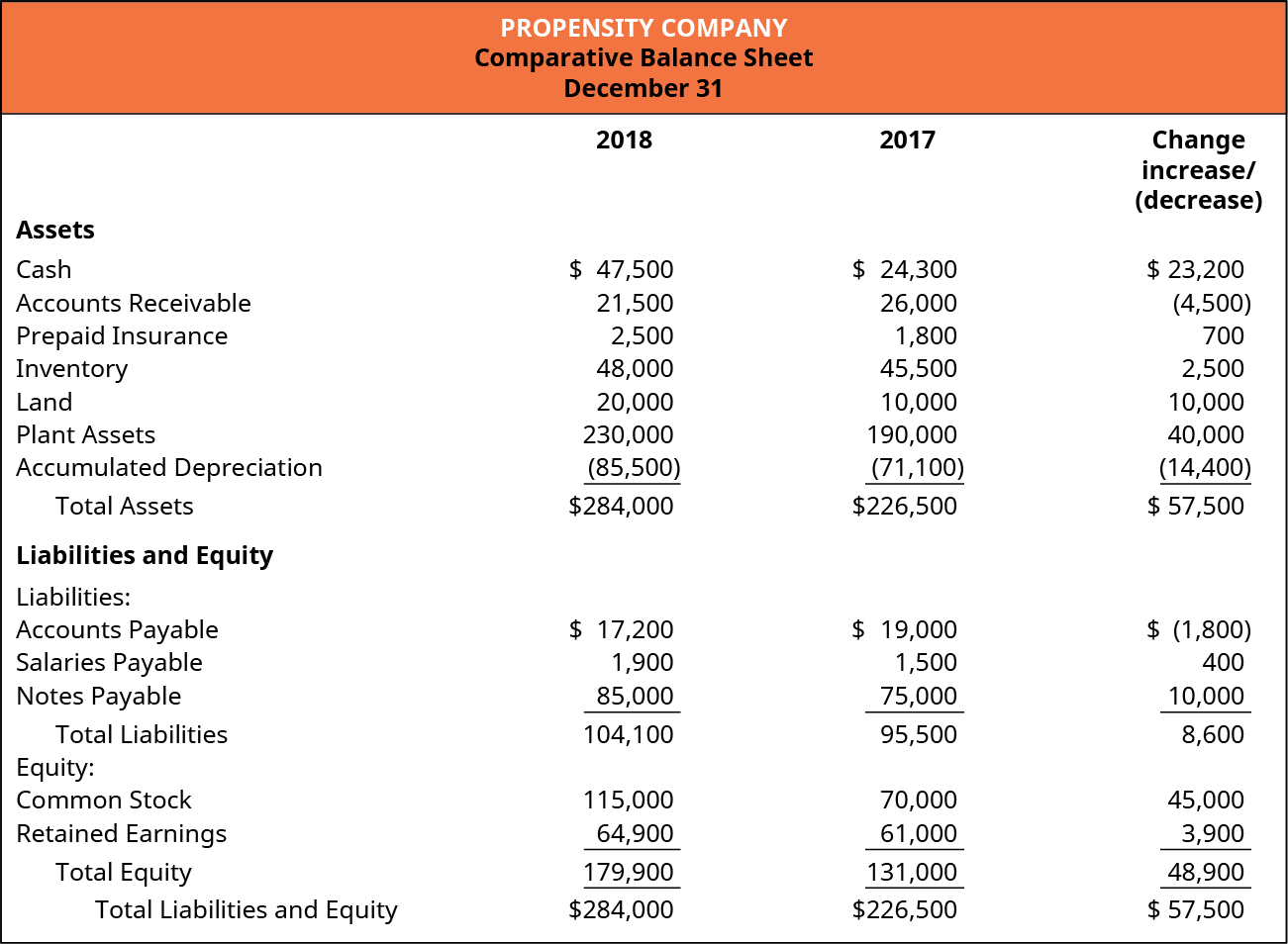

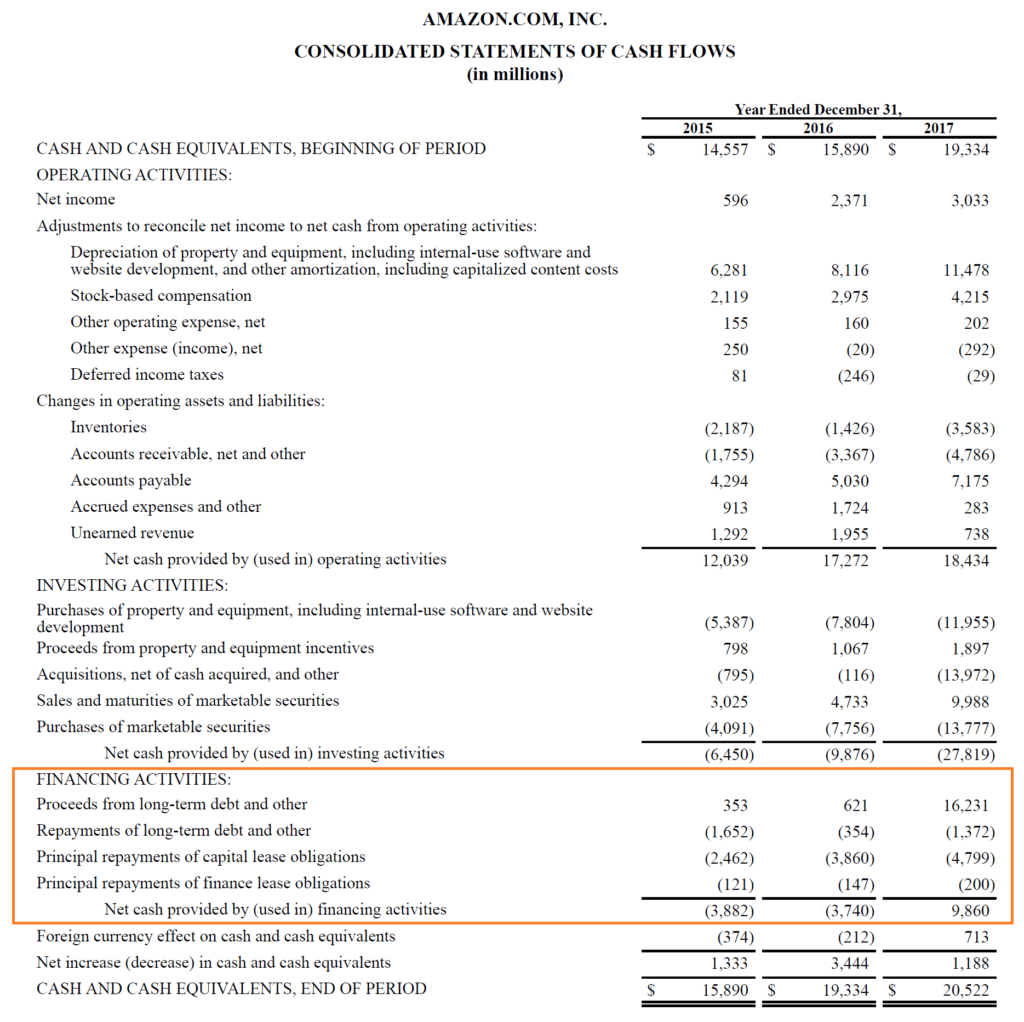

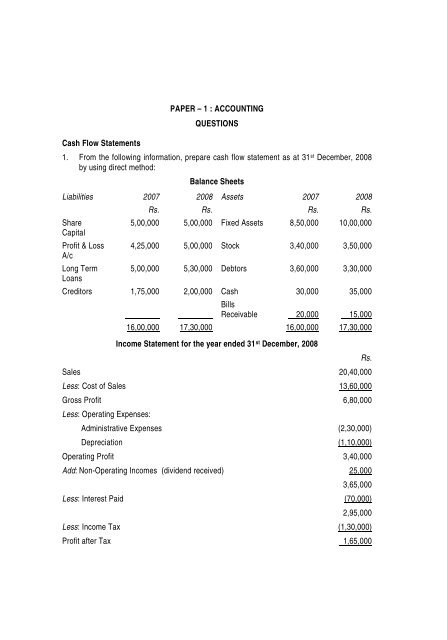

Treatment of outstanding expenses in cash flow statement. All changes are summarized in the cash flow statement. The method used is the choice of the finance director. Deducted as a cash outflow under cash from financing.

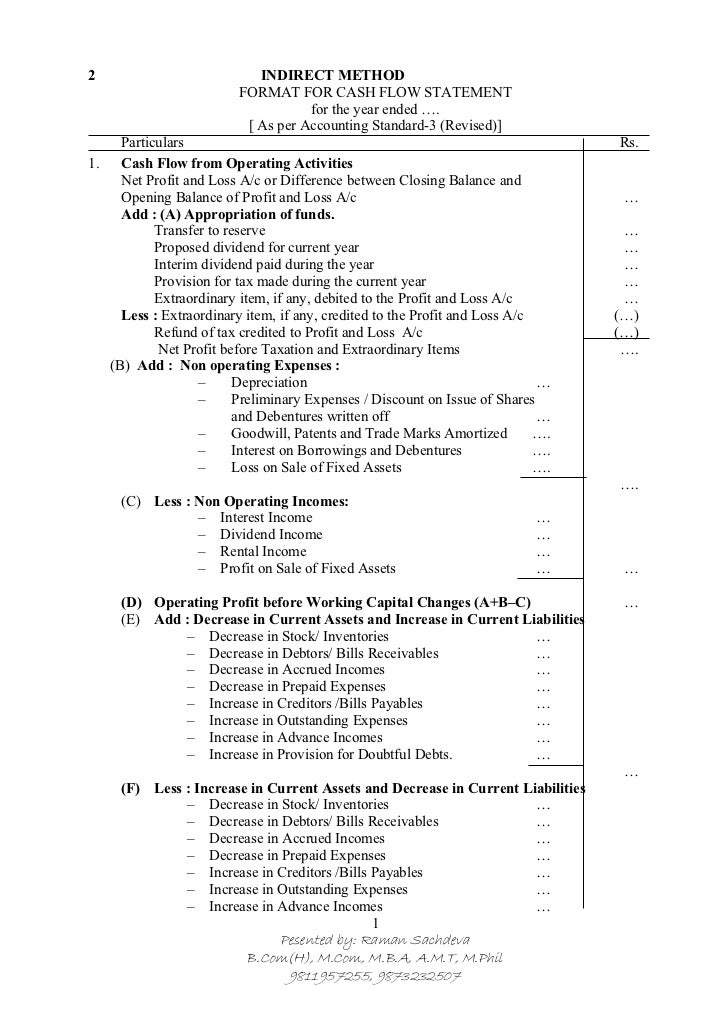

In a Cash-flow statement no distinction is made between current assets and fixed assets and current liabilities and long-term liabilities. Depreciation Amortization Both depreciation and amortization are non-cash expenses that need to be added back on the cash flow statement. Many companies present both the interest received and interest paid as operating cash flows.

By contrast the indirect method starts with net operating profit and then puts through some adjustments to arrive at the cash flows from operating activities balance. Cash flows related to acquisitions and disposals of business units are reflected in the investing section of the cash flow statements. Items on the cash flow statement fall into three general areas.

The cash flow statement looks at the inflow and outflow of cash within a company. Finance cost paid are treated in two ways in a cash flow statement. No treatment for preliminary expenses is required if cash flow statement is prepared by direct method.

5000 Increase in AP. 10000 Increase in Accrued Payable. Operating cash flow starts with net income then adds depreciationamortization net change in operating working capital and other operating cash flow adjustments.

This is when we prepares cash flow statement. In recent years the FASB issued ASU 2016-152 and ASU 2016-183 which clarified guidance in ASC 230 on the classification of certain cash flows and removed some of. A Cash-flow statement aims at helping the management in the process of short-term financial planning.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)