Impressive Pan Card Tds Statement

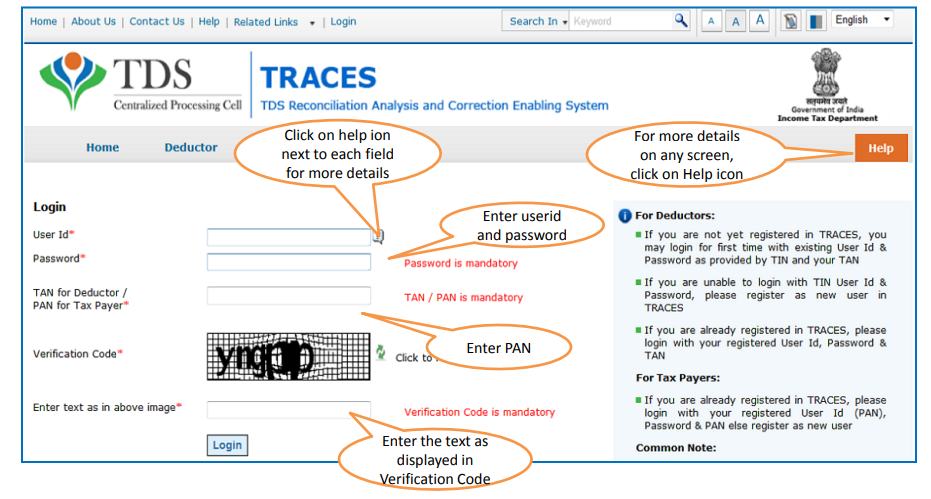

Both these portals require your PAN Number.

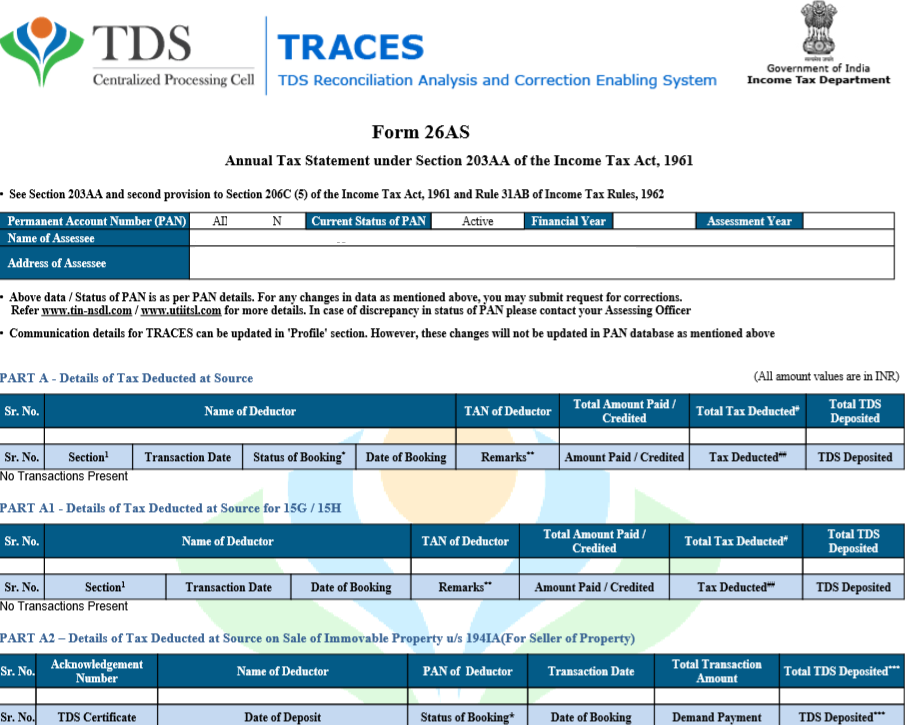

Pan card tds statement. PAN is structurally invalid 2. TAX INFORMATION AND SERVICES. However TDS Credit can also be checked via Form 26AS which is a consolidated tax statement and contains details of tax deposited or credited.

There are two ways to check your TDS status. PAN Card is an important input criterion to check your TDS status online.

PAN Verification and Consolidated TAN PAN File facility on TRACES can be used for verifying the deductees. You can either check the status through the TDSCPC Portal or through the Income Tax e-Filing Portal. There are various ways to check your TDS status but the most common amongst all is via PAN Card.

You all may have read this news that from 01042010 TDS tax deducted at source rate without dedcutee PAN is. How to Verify. PAN not available with CPCTDS 3.

Check PAN Card Status by Name and Date of Birth. Only Valid PANs reported in the TDSTCS statement corresponding to the CINBIN detailsin Part1 must be entered in Part2 of the KYC. 1 Online Application - An online application can be made from the website of UTIITSL or NSDL.

The form used for quarterly e -TDS returns are Form 24Q 26Q and 27Q. Link Aadhaar to Permanent Account Number PAN e-TDSTCS RPU version 36 for Statements from FY 2007-08 onwards is released 01042021. HOW TO MATCH PAN CARD DETAILS WITH AADHAAR CARD DETAILS.