Unbelievable Common Stock Formula Balance Sheet

Ad Choose from the leading companies and make profit by buying and selling their stocks.

Common stock formula balance sheet. First calculate the total preferred stock value. The general equation of the balance sheet is as follows. More than 11 million clients choose FBS as their reliable partner make the proven choice.

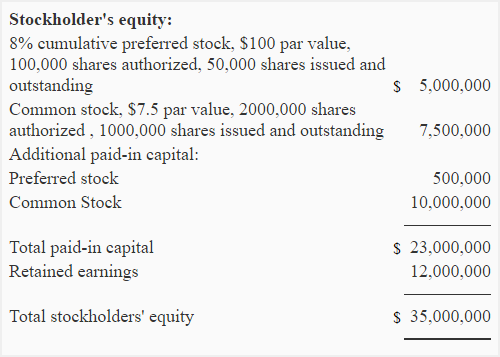

Add the total liabilities the retained earnings and the preferred stock value. Add the preferred stock value and the value of paid-in capital on preferred stock. The balance sheet number listed with the Common Stock line item will equal the par value per share multiplied by the total shares issued.

The claims on a companys assets are comprised of liability and equity. Then add the result to the common stock amount from your current balance sheet to calculate the common stock on your pro-forma balance sheet. Then youll calculate the common stock value.

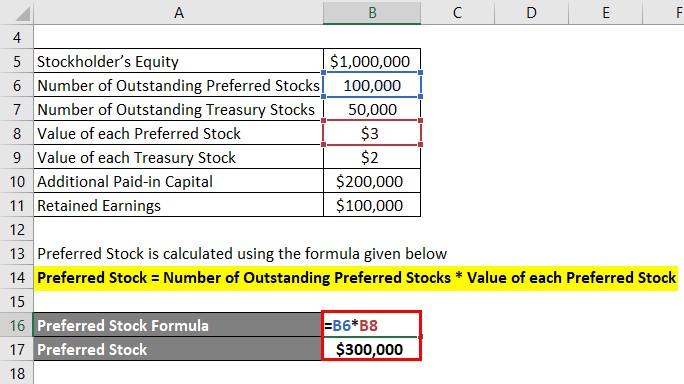

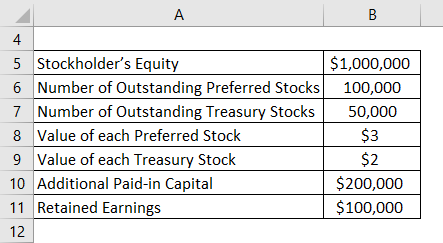

Common Stockholders are the companys owners. In this video on Common Stock Formula here we discuss how to calculate Common Stock number of outstanding shares with the practical examples and downloada. Common StockTotal EquityTreasury Stocks-Additional paid in capital-Preferred stocks-Retained earnings.

Formula Used for a Balance Sheet The balance sheet adheres to the following accounting equation where assets on one side and liabilities plus shareholders equity on the other balance out. Generally speaking a company divides. Ad Choose from the leading companies and make profit by buying and selling their stocks.

Information regarding the par value authorized shares issued shares and outstanding shares must be disclosed for each type of stock. They can either be company promoters insiders or outside investors. The common stock formula is represented as follows Common Stock Outstanding Shares Number of Issued Shares Treasury Stocks.

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)