Peerless Accounting For Dividends Received From Subsidiary

Dividend received by the holding company from its subsidiary out of pre-acquisition profits is treated as capital receipt.

Accounting for dividends received from subsidiary. Debit all expenses Credit all income. The exact relationship and the accounting methods they use directly affect how the parent treats subsidiary dividends. Since Dividend Received is Income it will be credit.

Dividend received from the subsidiary company out of pre-acquisition profits. For example on December 31 the company ABC receives a cash dividend from one of its stock investments. Company or its subsidiary engaged in Information technology entertainment pharmaceutical or bio-technology industry receives dividend in respect of GDRs issued by such company under an Employees Stock Option Scheme.

Although the subsidiary may capitalize retained earnings in connection with the stock dividend ASC 810-10-45-9 states that. Previously a parent entity recognised income from the investment only to the extent that it. I assume a debit entry would be cashbank and credit entry would be Investment income.

Stock dividends issued from a subsidiary to its parent normally result in a memorandum entry by the parent for the additional shares received. A question arises as to how dividends received from a subsidiary should be accounted for in the parents individual financial statements under FRS 102 where the parent accounts for its investment in the subsidiary at cost less impairment. The dividend received is 5 per share holding and the company ABC has a total of 1000 shares which represent 10 of ownership.

I need to make double enteries for dividends received from a subsidiary by a parent company owns 100 shares. The balance on the dividends account is transferred to the retained earnings it is a distribution of retained earnings to the shareholders not an expense. A dividend receivable or received exceeds the total comprehensive income of the subsidiary jointly controlled entity or associate in the period the dividend is declared.

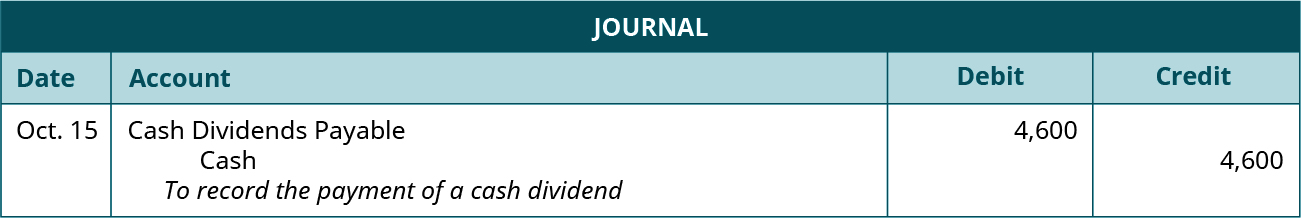

Accounting for goodwill and impairment testing. If not UK then it is still more than likely that a dividend received from an overseas subsidiary will not be taxable within the UK but if relevant you really need to check and look at any relevant DTT to be sure. The journal entry for its record being as follows.