Looking Good Comparative Ratio Analysis Of Two Companies

CHAPTER ONE INTRODUCTION 11 Background of the study Financial sector is the backbone of economy of a country.

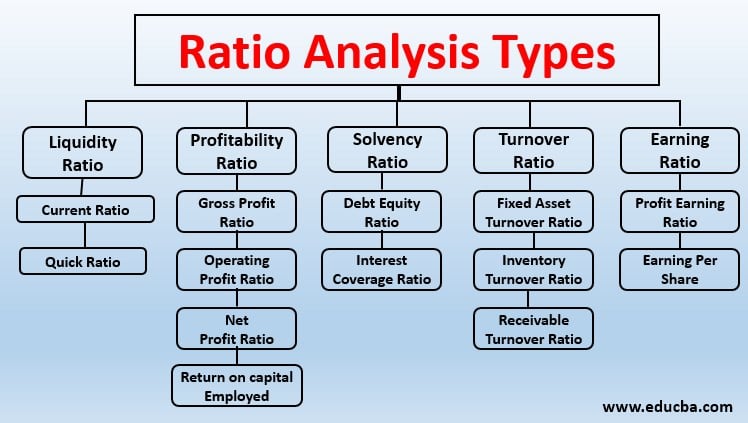

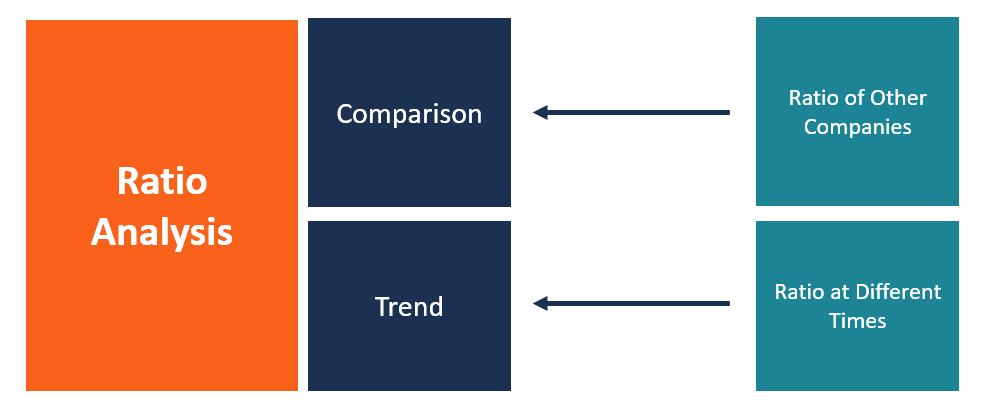

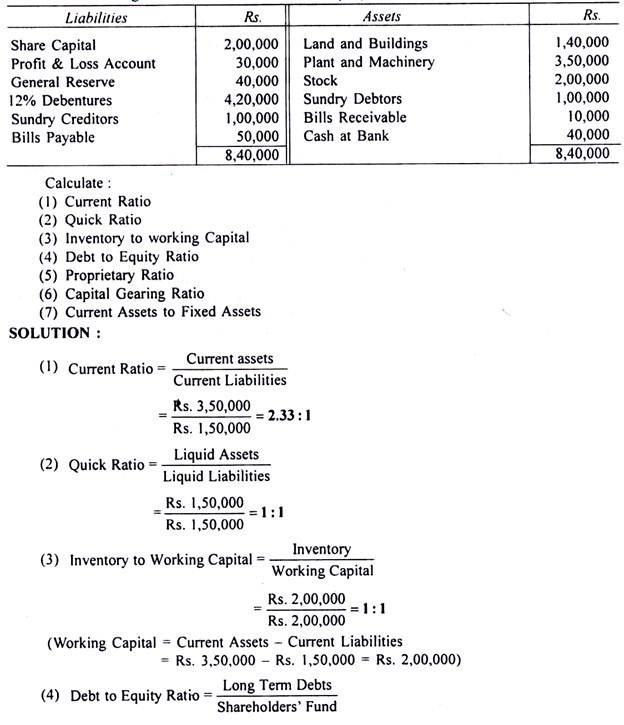

Comparative ratio analysis of two companies. 15 rows Ratio analysis involves comparisonsa companys ratios are compared. The comparative analysis allows investors to see the actual earnings of a company whereas ratio analysis allows investors to use formulas such as liquidity solvency and profitability in order. A national council of applied economic research NCAER study on the carbonated soft drink industry indicates that this industry has an output multiplier effect of 21.

In the comparative analysis of Coca Cola and Pepsi my main emphasis is on the financial. Ratio analysis is mainly done using financial statements for examining the financial health of a business. Investors generally use ratios to evaluate companies and make comparisons between companies within an industry.

MBA Project on Financial Ratios. The purpose of the comparative and ratio analysis is to determine a companys financial health and evaluate its performance during a specific period. Barco Kyan Company Company Data from the current year-end balance sheets Assets Cash 19500 34000 Accounts.

This information is important in evaluating a companys weaknesses and make judgment as to how efficiently its assets are being utilized. Comparative Financial Performance Analysis of HBL and EBLpdf. ACCORDING TO RN ANTHONY.

A strong financial system promotes investment by. SHIKHA AGARWAL BBM 5TH SEM. Financial ratio is a ratio of selected values on an enterprises financial statement.

It works as a facilitator for achieving sustained economic growth through providing efficient monetary intermediation. Ratio Analysis and Comparitive Study. Introduction This is the project about financial statement analysis of two companies of the same industry.