Neat Modified Cash Basis Financial Statements Example

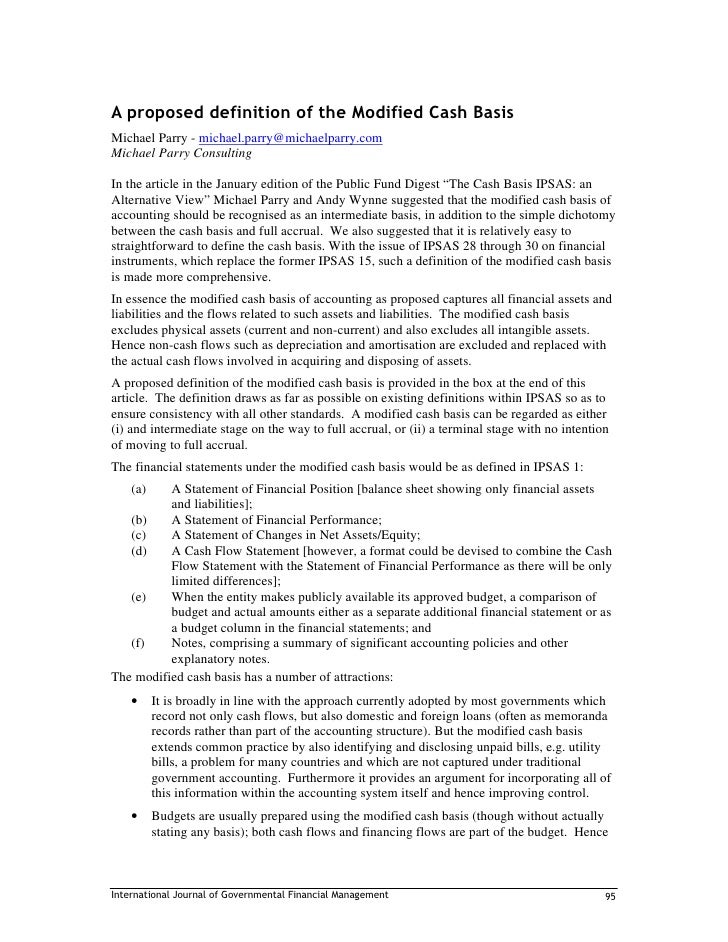

The same as the cash basis except that long-term assets and long-term liabilities are included in the balance sheet.

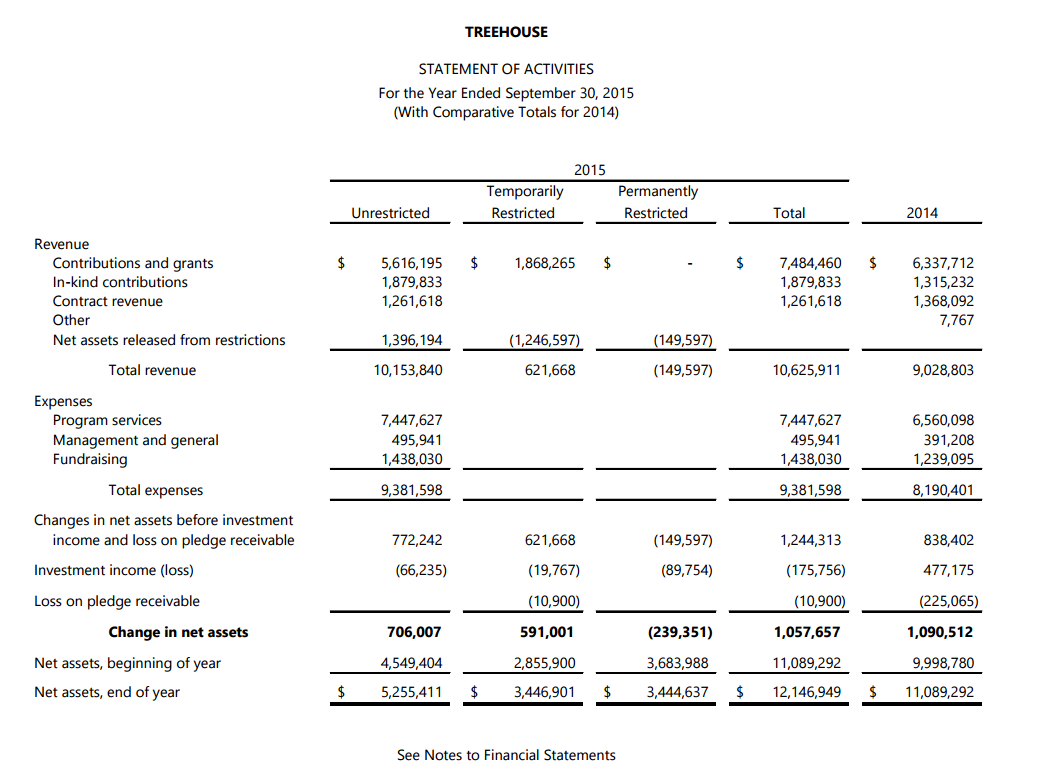

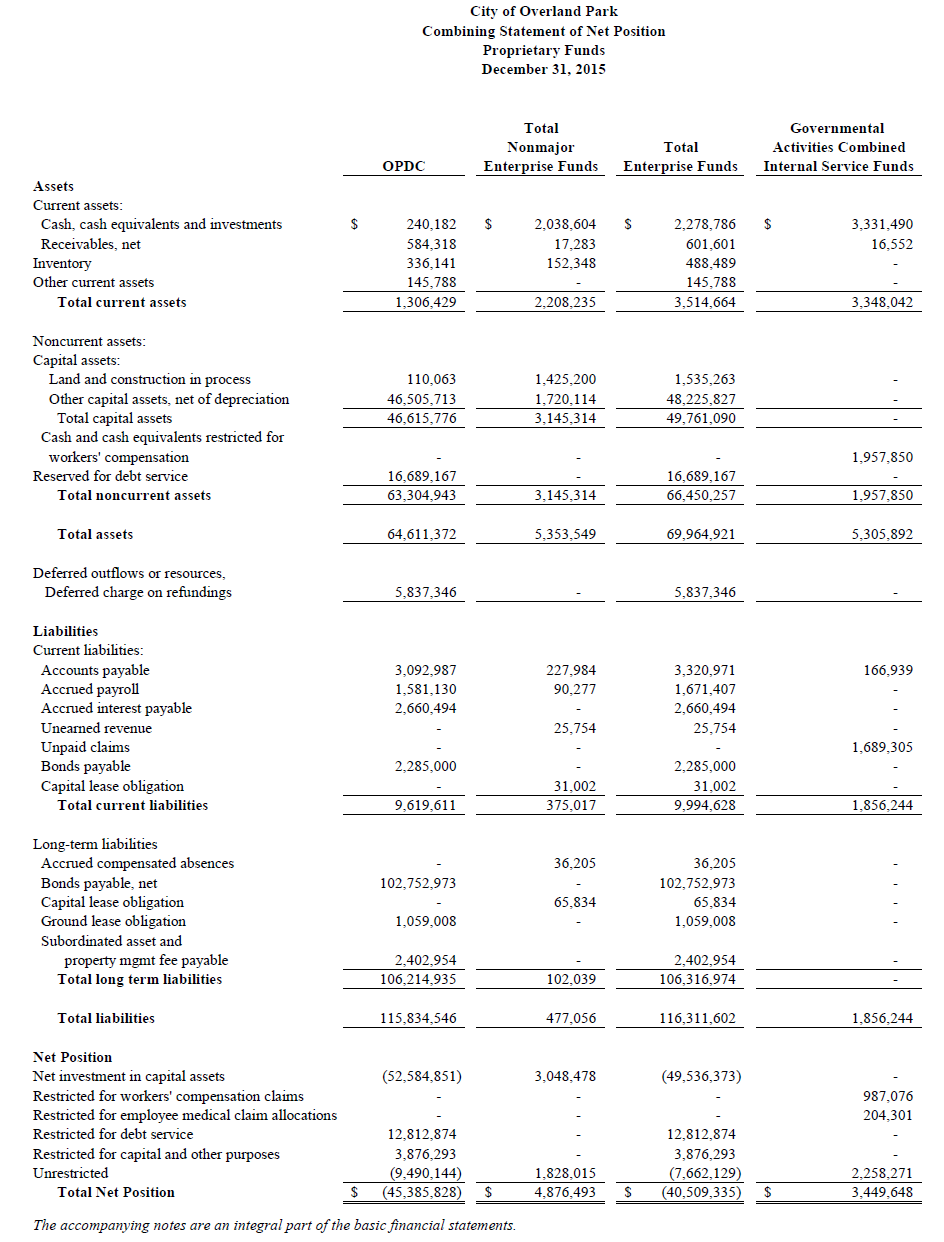

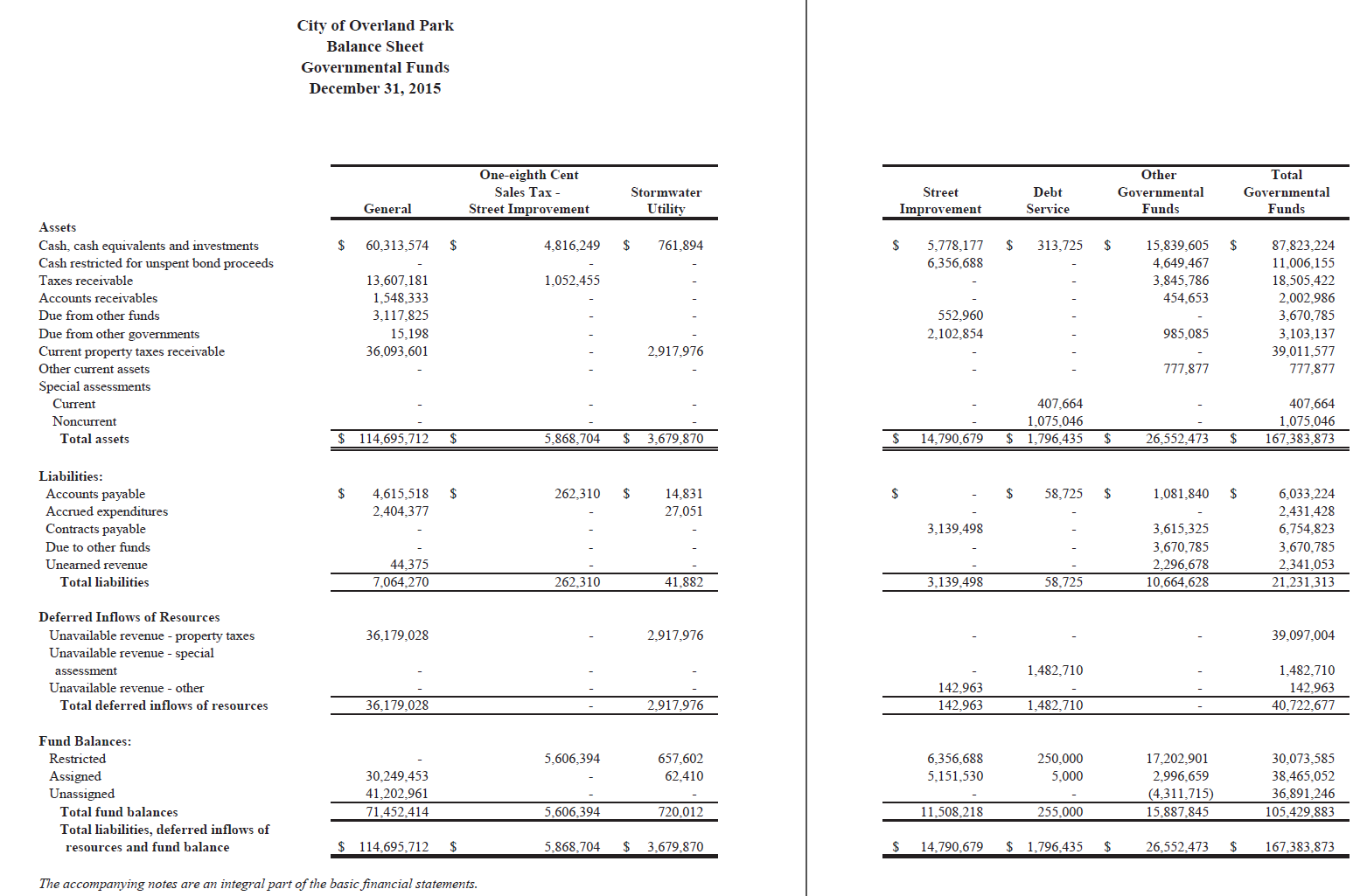

Modified cash basis financial statements example. Financial statements - modified cash basis 3 statements of assets liabilities and net assets - modified cash basis 4 statements of revenue expenses and other changes in net assets - modified cash basis 5 statements of cash flows - modified cash basis 6 notes to financial statements 7. Activities of the whole District presenting both an aggregate view of the Districts cash basis finances. The prior year comparative information has been derived from.

It defines the cash basis of accounting establishes requirements for the disclosure of information in the financial statements and supporting notes and deals with a number of specific reporting issues. Modified cash basis accounting. 341 West Tudor Rd.

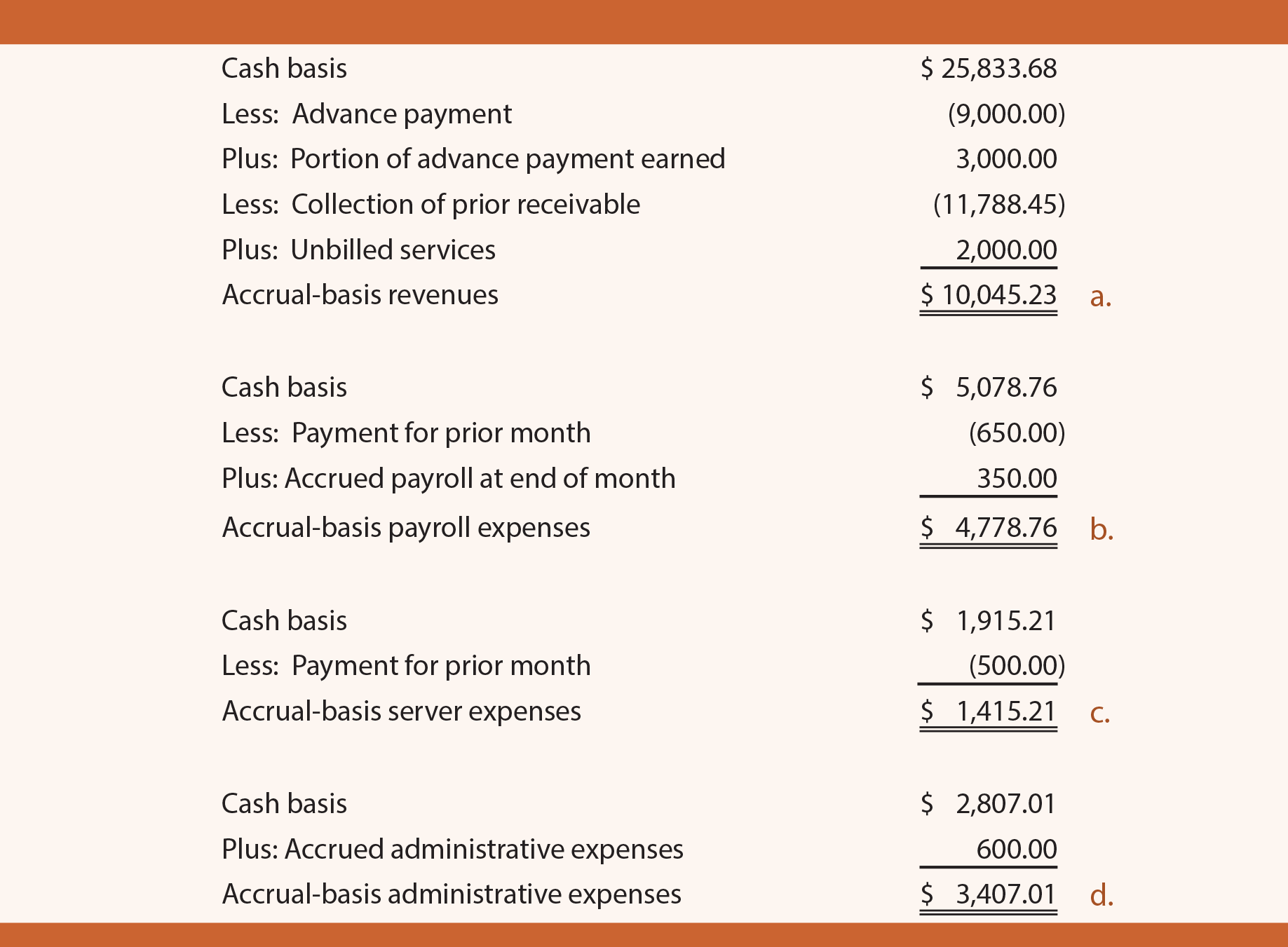

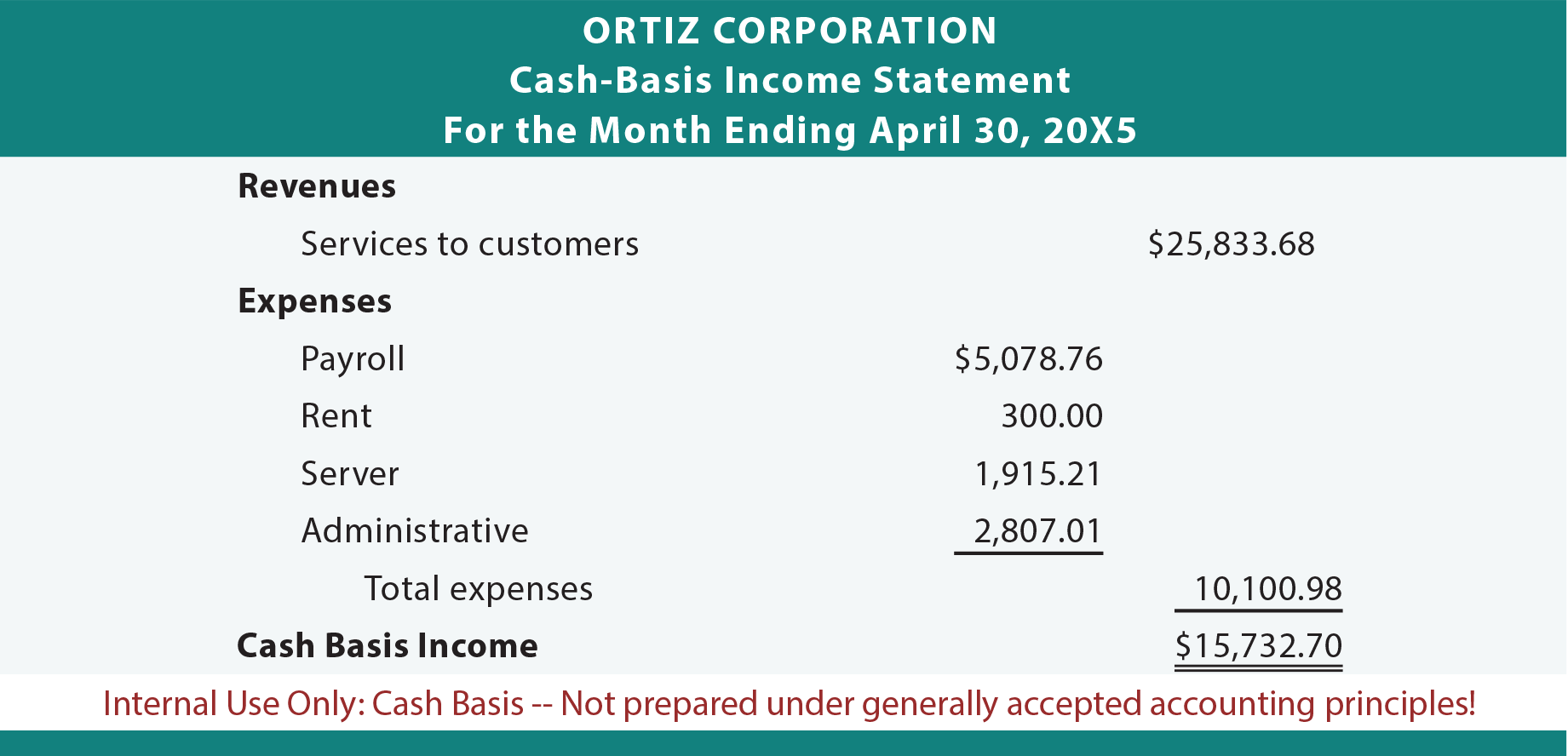

While it is common for CPAs to modify cash-basis statements to include fixed assets and the related depreciation and to record liabilities for short-term and long-term borrowings and the related interest cost practitioners should not go so far in modifying cash-basis statements so in the end they have prepared GAAP-basis statements. It seeks to get the best of both worlds recording sales and. The fund financial statements also look at the Districts most significant funds with all other nonmajor funds.

The modified basis has the following features. It is the middle ground that is used to get a better evaluation of your financial performance by. Statements of Financial Position Modified Cash Basis 3 Statement of Activities and Changes in Net Assets Modified Cash Basis Year ended December 31 2017 4 Statement of Activities and Changes in Net Assets.

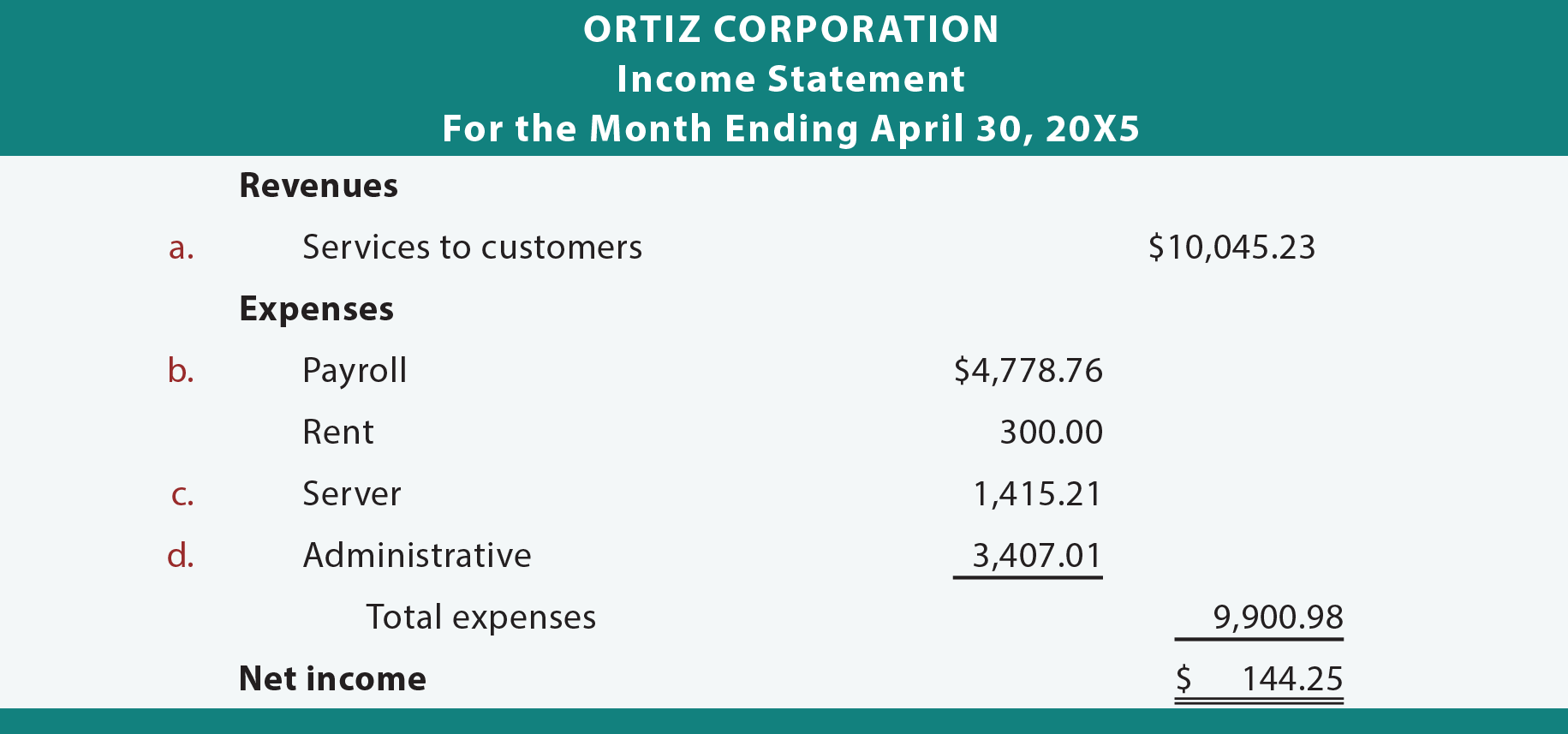

Cash 6651 4 Cash in Savings 226994 Total Current Assets 293508 Property and. A modified cash basis accounting system is used when the firm wants to represent its financial statements more accurately and precisely than cash basis accounting but does not want to invest the money and time in an accrual basis accounting system. Support revenue and expenses cash basis and cash flows for the year then ended.

Example financial statements prepared when applying the cash or taxbasis of accounting may not meet the needs of certain users such as regulators and certain lenders. STATEMENTS OF FINANCIAL POSITION MODIFIED CASH BASIS June 30 2016 2016 Current Assets. A short-term item such as recurring monthly expenses rent facilities internet are recorded on the income statement according to cash basis.