Supreme Importance Of Cash Flow Analysis

Positive cash flow means your business is running smoothly.

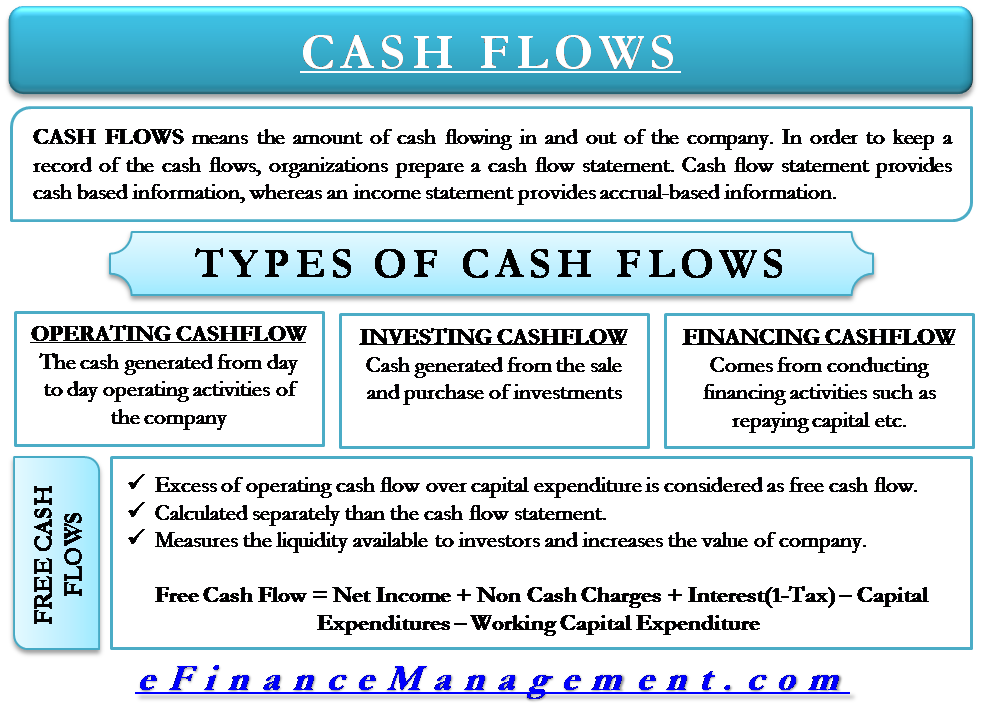

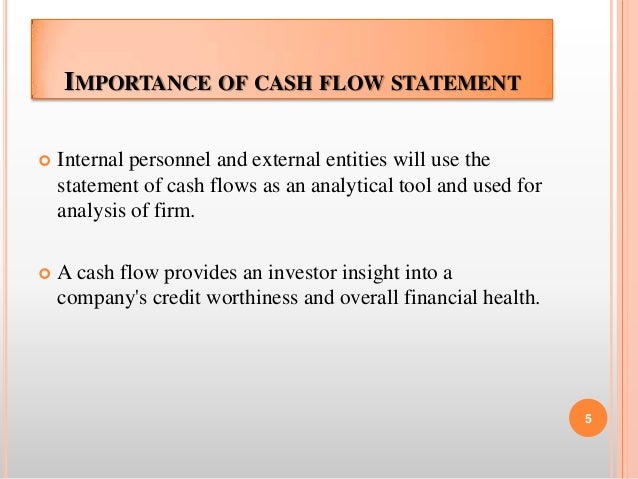

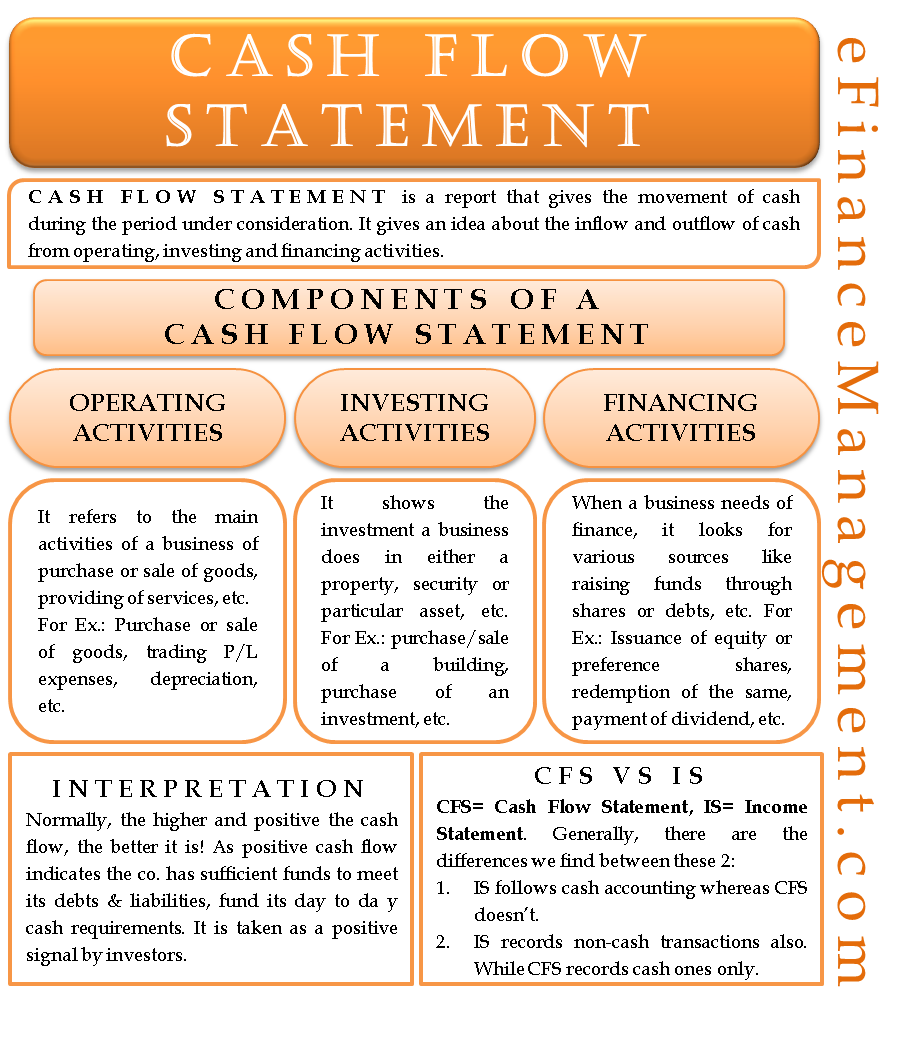

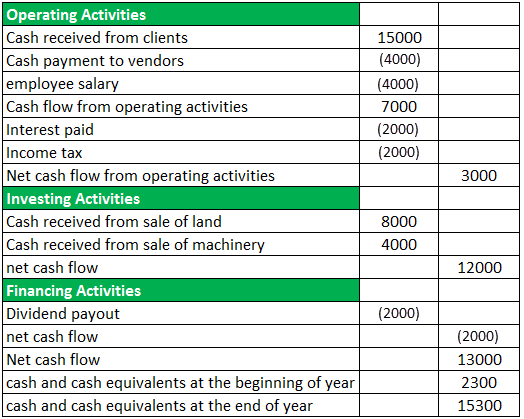

Importance of cash flow analysis. Assess the Liquidity Status of Company. Purpose of Cash Flow Statement Analysis The purpose of the cash flow statement is to show where an entities cash is being generated cash inflows and where its cash is being spent cash outflows over a specific period of time usually quarterly and annually. The purpose of the cash flow analysis is to reveal the causes of the deficit if any and to identify.

It is important for analyzing the liquidity and long term solvency of a company. Profits are one of the things that help create cash. Cash flow ratios are sometimes reserved for advanced financial analysis.

A cash flow analysis can help show you the next best steps to take for your business. Cash on hand determines a companys runwaythe more cash on hand and the lower the cash burn rate the more room a business has to maneuver and normally the higher its valuation. Why Cash Flow Statement is Important.

Prepare Cash Flow Statements and Conduct a regular cash flow analysis. If your cash flow is low you may consider negotiating trade terms with some of your vendors or even tightening trade terms for clients so money comes in faster. The cash flow report is important because it informs the reader of the business cash position.

This is because the existence of many companies which although profitable have a significant shortage of liquidity and to support his work and make the necessary investments to increase efficiency resort to external sources of funding. Why is cash flow analysis important. Cash is also important because it later becomes the payment for things that make your business run.

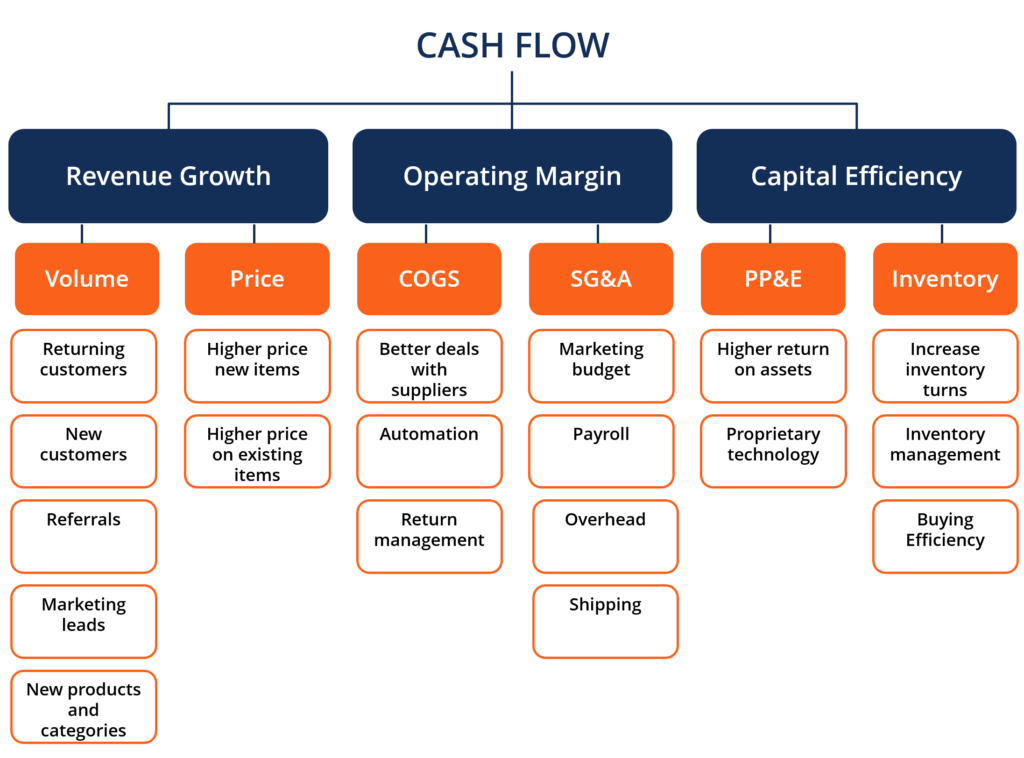

Important indicators in cash flow analysis include the operationsnet sales ratio free cash flow and comprehensive free cash flow coverage. Here are some of the most important ratios-1. Cash Flow Statement Importance.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)