Formidable Income Tax Paid In Advance Cash Flow

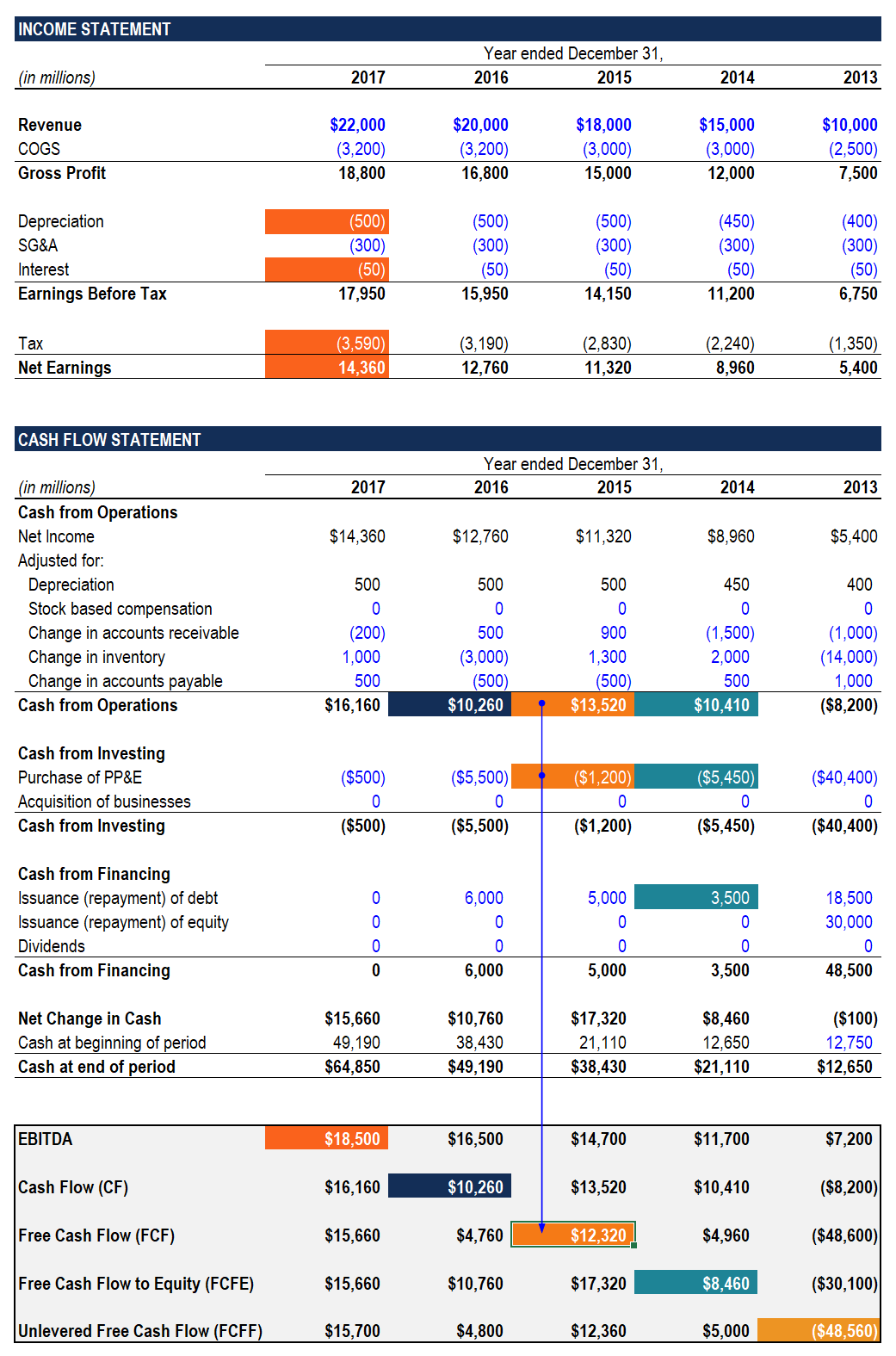

Proceeds from issuance of common stock.

Income tax paid in advance cash flow. Under IFRS there are two allowable ways of presenting interest expense in the cash flow statement. Hence this tax that we paid in advance is referred to as deferred tax asset and will be adjusted in later years by debiting the deferred tax income and crediting the current tax year expense. L Cash payments of income taxes unless they can be specifically identified with financing and investing activities.

IAS 12 implements a so-called comprehensive balance sheet method of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entitys assets and liabilities. Others treat interest received as investing cash flow and interest paid as a financing cash flow. In either case they represent Inventory specifically held for.

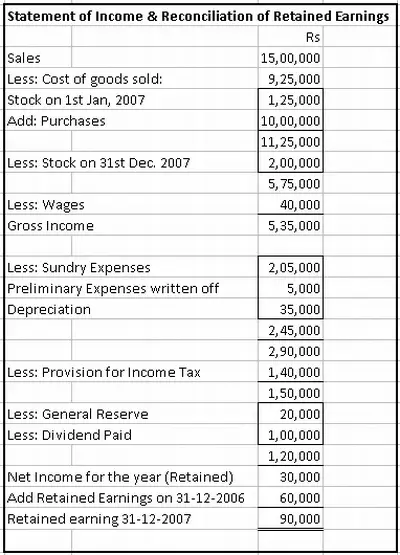

The method used is the choice of the finance director. Income Tax paid Op. 311 Cy Provision of Rs.

If you are preparing cash flow as per direct method then you need to show actual payment ie. Under the accrual-basis accounting rules used by most companies advance payments cant be counted as revenue because the company hasnt. 1372566 - Cl Provision net of advance Tax of Rs.

Many companies present both the interest received and interest paid as operating cash flows. Provision for Tax in Cash Flow Statement 1 If the provision for taxation account appears only in the balance sheet. It binds the Comptroller of Income Tax to apply the relevant provisions of the Income Tax Act in the manner that was set out in the ruling.

The beginning balance of Current Tax Payable of CU 14000 is increased by the current portion of income tax expense CU 27000. The net position is shown in case of operating cash flows. Advance tax tds as income tax paid and if you are preparing cash flow as per indirect method then you need to compare last years tax liability or asset as against last years tax liability or asset and show difference in income tax payment provided in balance sheet you are grouping tax paid against.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)