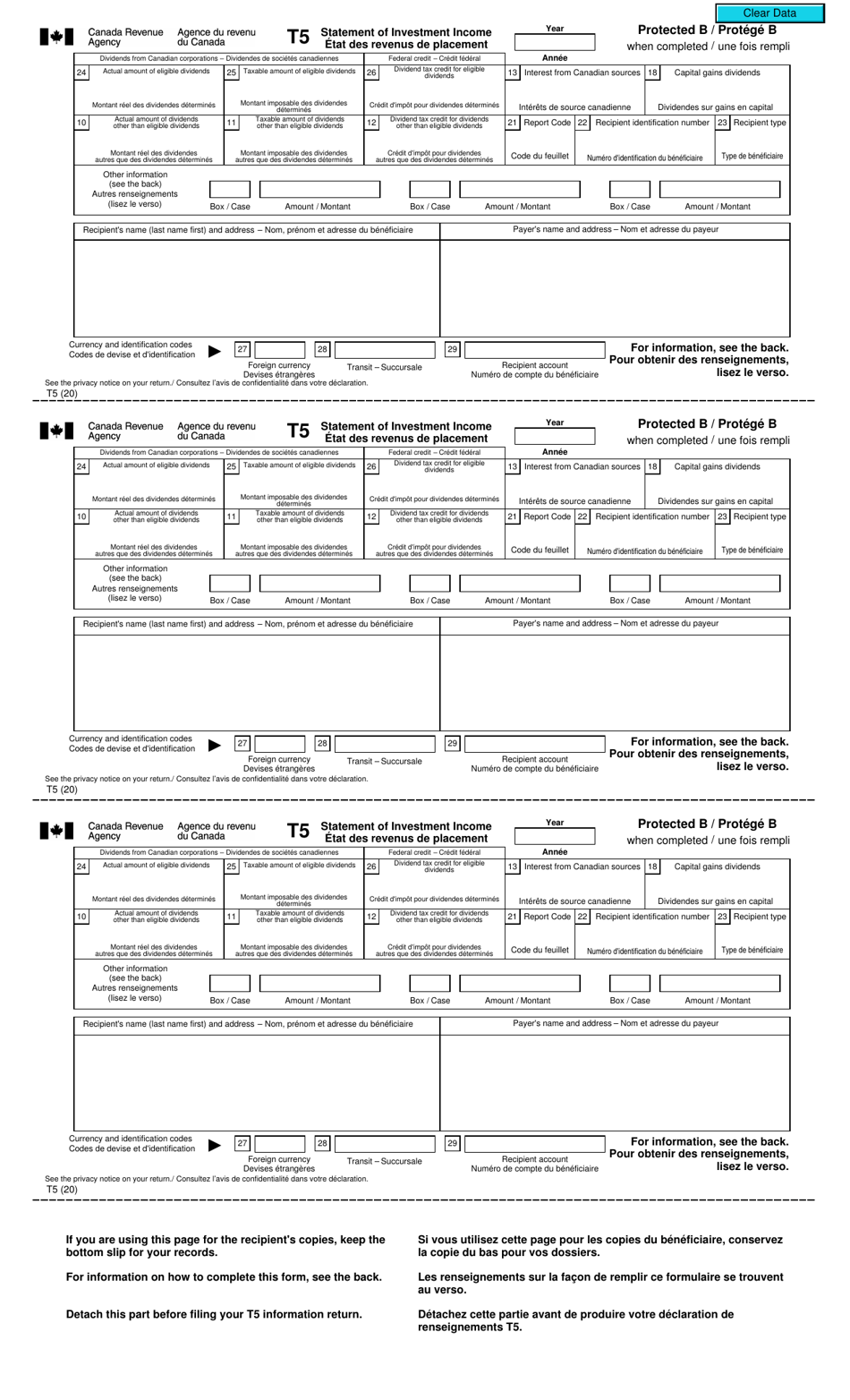

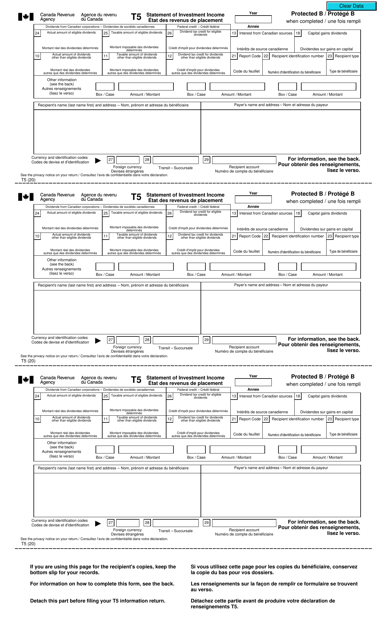

Ideal T5 Statement Of Investment Income

You received a T5 statement of investment income because you earned more than 50 in investment income during the year.

T5 statement of investment income. The financial institution where youve opened your investment account will generate a T5 for you but keep in mind that CRA wont tax income thats under 50 so most financial institutions wont issue T5 slips if your income is. T5 Statement of Investment Income Notice to the reader All information returns should be filed electronically to avoid the delays that may occur in processing paper returns. T5 slip image Boxes 10 11 and 12 - Dividends from.

Also known as the Statement of Investment Income a T5 slip is one of CRAs taxpayer slips Canadian residents file to report their income from various investments. While it may be used for amounts of less than 50 it is only a requirement if the amount is greater than 50. A T5 form is also known as a Statement of Investment Income form.

T5 slip identifies the various types of investment income that residents of Canada have to report on their income tax and benefit returns. This slip like your T5. Typically your interest and investment income will be shown on your.

Statement of investment income slip reports the interest dividends and certain sources of foreign income that you earned during the year. You received a T5 statement of investment income because you earned more than 50 in investment income during the year. These are intended to be used for laser or ink jet printers for typing or to be filled out by hand.

T5 Statement of Investment Income and Relevé 3 Additional Will be issued to report income earned on shares from Split Corporations. You will not receive a T5 slip for interest earned less than 5000 but it must be reported on your tax return. Before completing any T5 slip see Guide T4015 T5 Guide Return of Investment Income.

It is a Canadian tax form that is a record of investment income payments for amounts greater than 50. Statement of partnership income. If you used our fillable or blank slips last year save time and effort by using the Web Forms application to file up to 50 original additional amended or cancelled slips directly from the CRA.