Simple Credit Balance In Profit And Loss Account Indicates

An amount not shown in parenthesesbrackets would indicate a profit has been made.

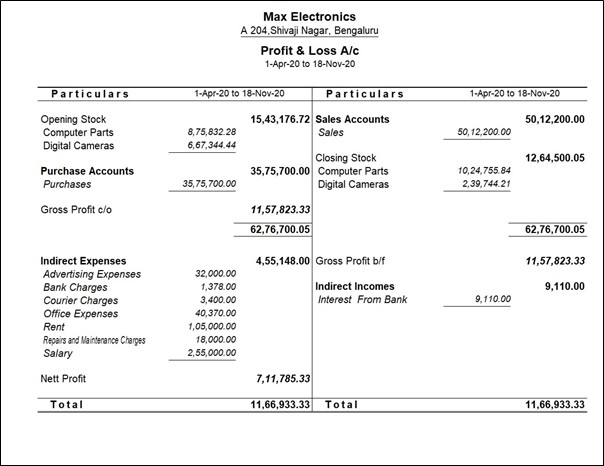

Credit balance in profit and loss account indicates. Accounts receivable is recorded as a current asset and describes the amount that is due for providing. FormatSpecimen of Profit and Loss Account. When the credit side is more than the debit side it denotes profit.

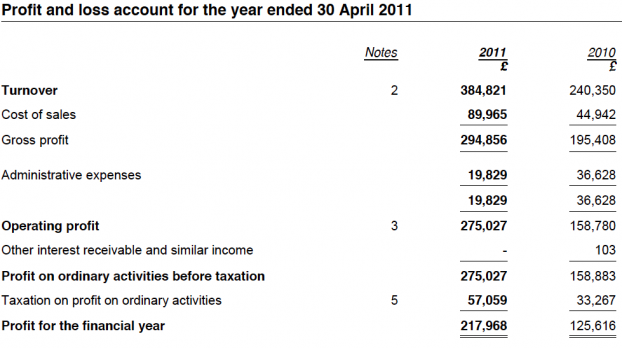

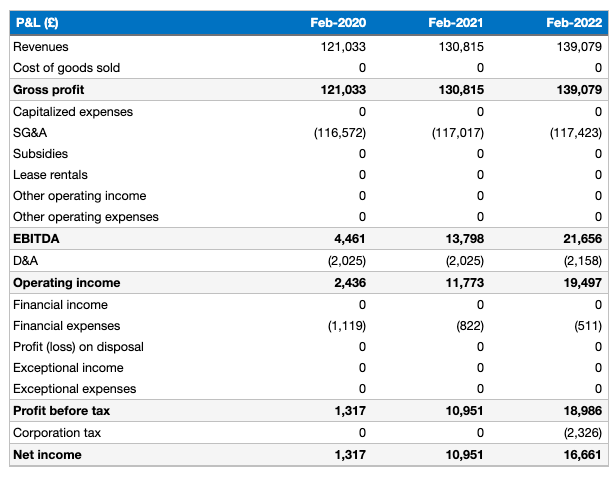

The PL statement shows a companys ability to generate sales manage expenses and create profits. Net profit is made when the total revenues exceed the total expenses. A profit and loss account records all the incomes and expenses that have taken place in the year.

It is prepared based on. In the example above the profit and loss account has a net credit balance of 12000 which indicates sales and other income are greater than the cost of goods sold and expenses and the business has made a net profit. A profit is indicated by a credit balance and a loss.

If the total of revenues is less than the total expenses the net loss is incurred. Profit and loss statement. All the indirect expense are debited and indirect income are credited to find out the net profit.

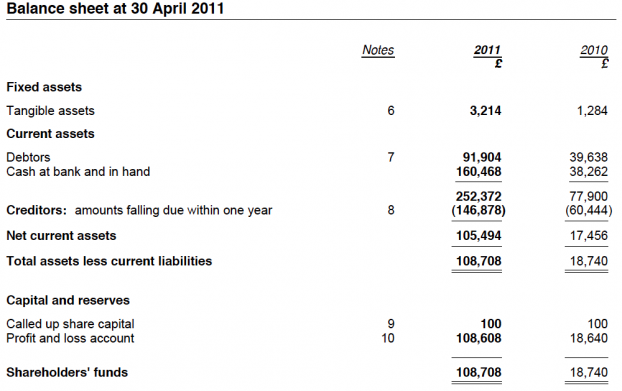

A On the credit side of profit and loss account b On the assets side of balance sheet asked Sep 15 2020 in Final Accounts of Sole Proprietors II by AbhijeetKumar 502k points final accounts of sole proprietors. Profit and loss account is prepared to know the profitability of the firm. In case of corporates the profit Loss of financial year is kept in P L acount in the BalanceSheet.

Excess of credit Income over debit Expense indicates net profit of the firm. Generally speaking the credit balance reported in the owners or stockholders equity section of the balance sheet reflects the owners investments in the company plus the profits earned minus the amounts distributed to the owners since the time that the company began. For example parentheses could indicate any of the following.