Beautiful Work Boeing Financial Ratios

:max_bytes(150000):strip_icc()/ba_one_year_return-6469e46393e745b1ab95ca8211a90699.png)

Boeing Financial Ratios for Analysis 2005-2021 BA.

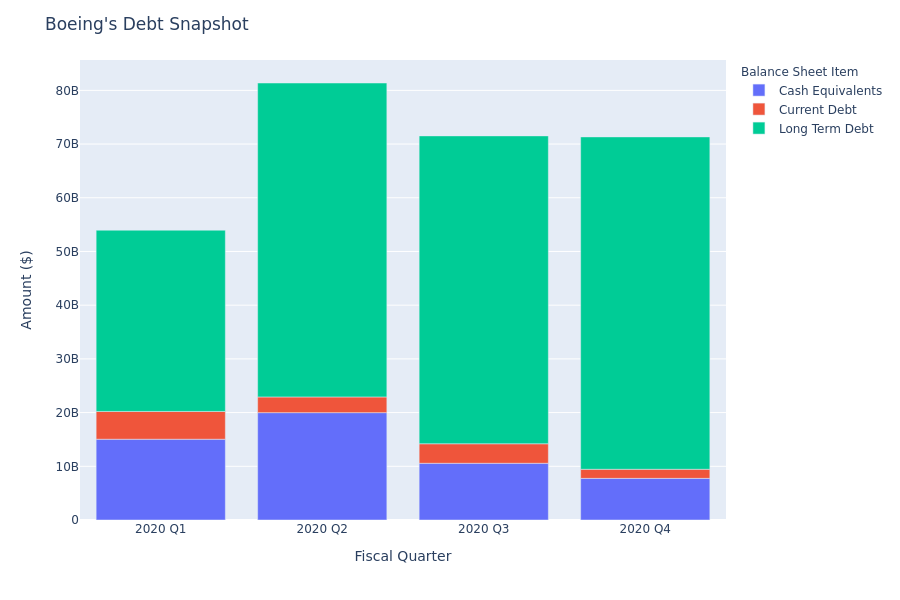

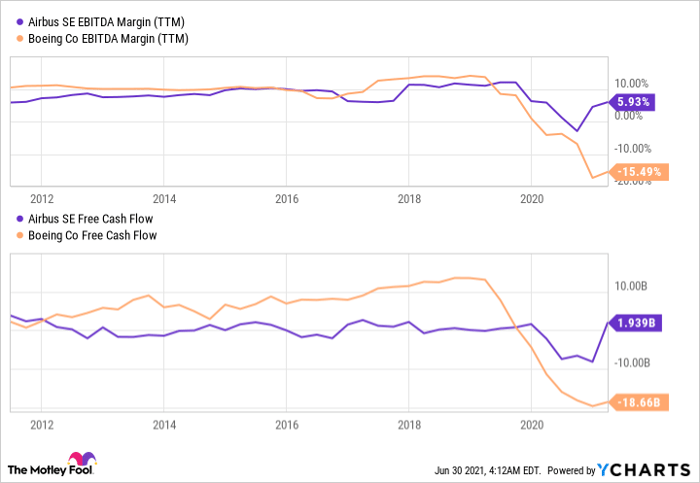

Boeing financial ratios. 9911 Net Gearing excl. The EVEBITDA NTM ratio of The Boeing Company is significantly higher than its historical 5-year average. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile.

The Boeing Company 2019 Annual Report. THE BOEING COMPANY. Interest Cover Ratio Year 2012 2013 2014 Earnings Before Interest And Taxes 6352 6618 7470 Interest Expense 442 386 333 Interest Cover Ratio 1437 1715 2243 Interest cover ratio of Boeing is increasing every year which means Boeing can pay interest on outstanding debt easily.

PDF 266 KB 2019. According to these financial ratios The Boeing Companys valuation is way above the market valuation of its sector. -1 between the first and the second quartile.

In the next two years the return on assets would increase to 91 in 2017. Date Current Assets - Inventory Current Liabilities Quick Ratio. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio.

View BA financial statements in full. The EVEBITDA NTM ratio of The Boeing Company is significantly higher than its historical 5-year average. 1 between the second and the third quartile.

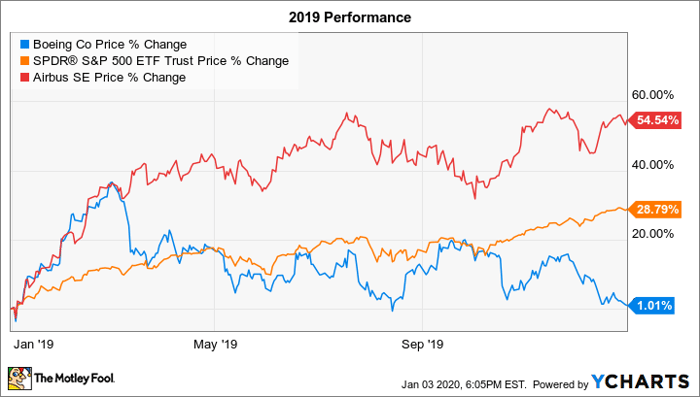

Balance sheet income statement cash flow earnings estimates ratio and margins. 22Investor Ratios Table 3 - Investor Ratio Boeing Airbus 2015 2014 2013 2015 2014 2013 PE Ratio 1853 1884 2283 1756 1734 3133 Earnings Per Share 748 738 596 342 299 185 Dividend Per Share 38 3 21 14 125 09 Dividend Yield 227 205 Source Authors Work inputs from financial times and ycharts PE PriceEarnings Ratio for Airbus has increased significantly in 2013 PE. Working Capital Per Revenue.

:max_bytes(150000):strip_icc()/ba_one_year_return-d7ebb8b614f447a8be6a2269308c2a48.png)