Fantastic Gaap Accounting For Partnership Distributions

However revenue and expense and other results of partnership operations must be.

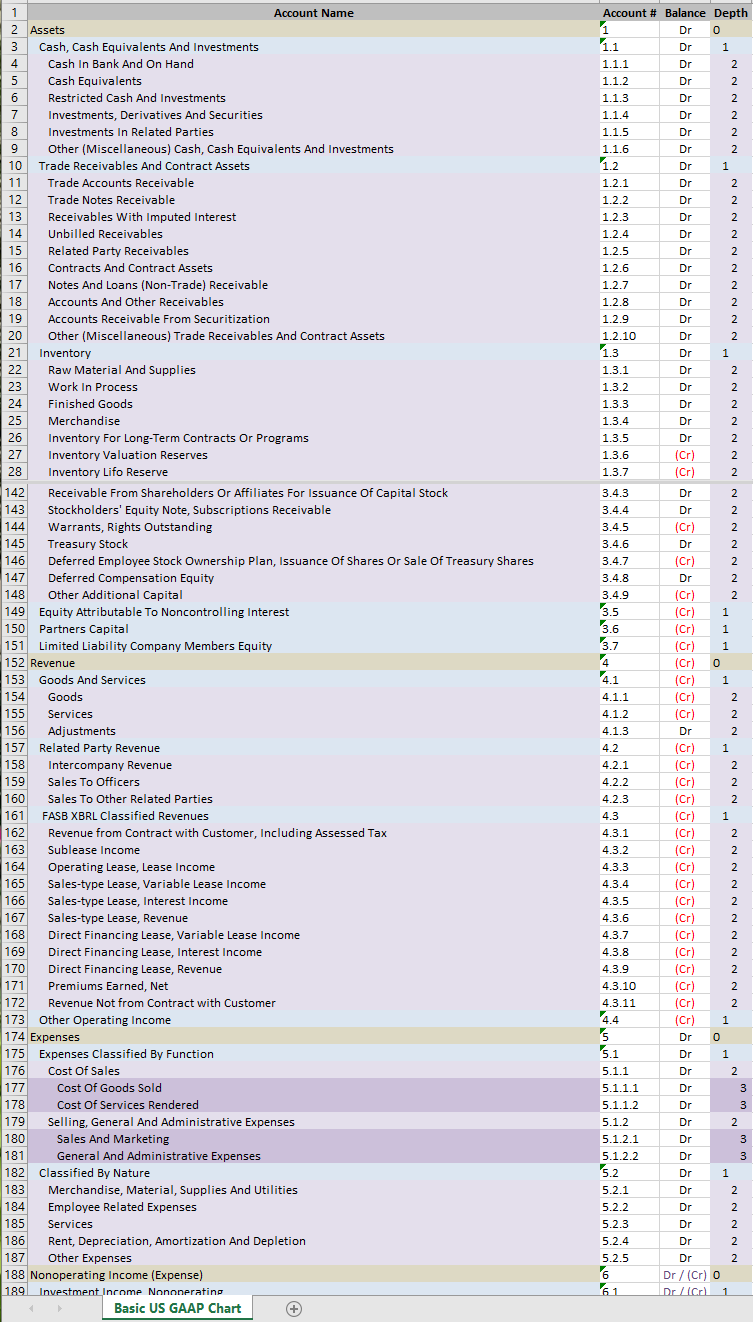

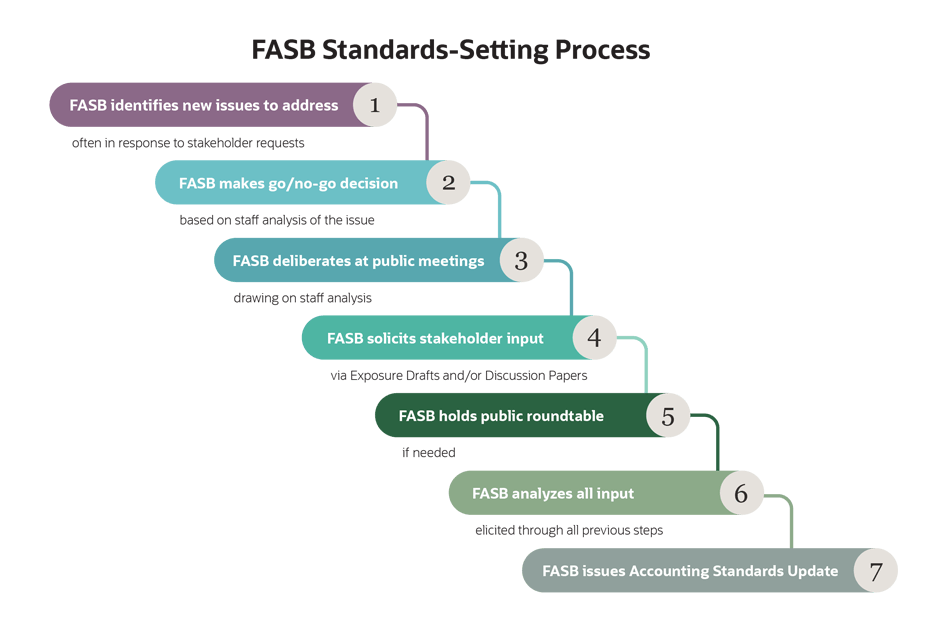

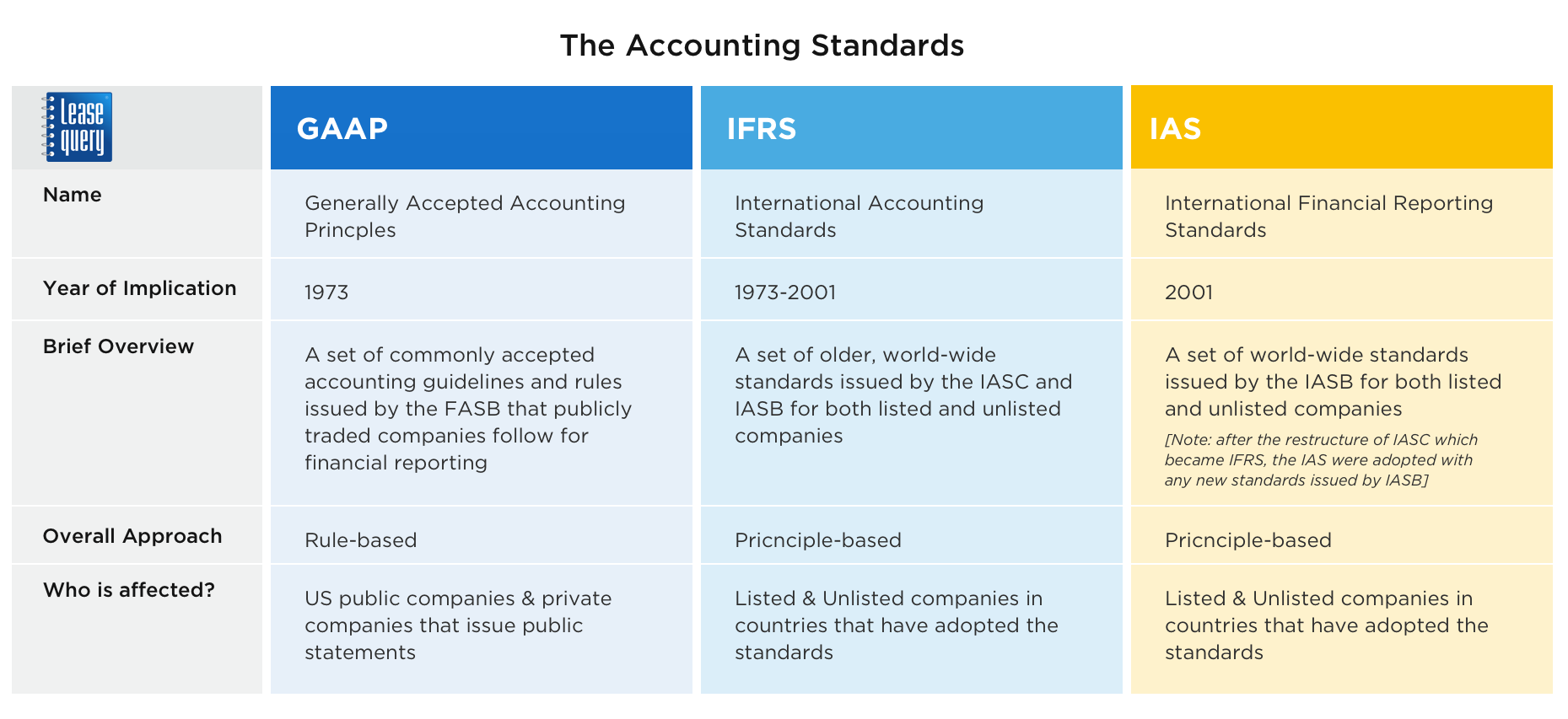

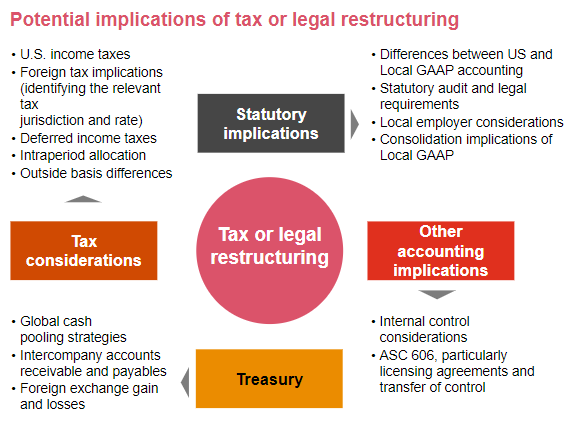

Gaap accounting for partnership distributions. You could also set up a fourth sub account for GAAP or book valuation nontax changes. The amendments in this Update clarify that the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a limit on the amount of cash that will be distributed is not a stock dividend for purposes of. Conformity With Generally Accepted Accounting Principles identifies AICPA Practice Bulletins as a source of established accounting principles generally accepted in the United States that an AICPA member should consider if the accounting treatment of a.

Generally Accepted Accounting Principles GAAP and Why Are They an Improvement. Each partner receives a previously agreed upon percentage. 520 Chapter 13 Accounting for Partnerships and Limited Liability Corporations A partnership like a proprietorship is a nontaxable entityand thus does not pay federal income taxes.

The partners can divide income or loss anyway they want but the 3 most common ways are. For instance a policy could be as simple as to accrue all unpaid return of earnings expected to be paid out in the following fiscal year. It contains the following types of transactions.

For example Sam Sun will get 60 and Ron Rain will get 40. When I account for partnerships I set up each deal with three sub accounts. GAAP 75 5132 Investee Has Elected a Private-Company Alternative 76 5133 Investee Applies Different Accounting Policies Under US.

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like Google Menlo Ventures and. If partners received a distribution in January to pay off tax liability due for estimated taxes of a preceding year - would you account for this distribution in taxcash GAAP books in a year a distribution was processed or in a year distribution used as a. Investments - Equity Method.

Similar to a proprietorship. One for capital contributions one for cumulative partnership distributions and one for cumulative income loss allocations. Profits and losses earned by the business and allocated.